Concerns about the resiliency of the food supply chain went from conceptual to concrete when the COVID crisis shut down railroads and stranded ships.

“It was no longer a theoretical issue. Borders were shut,” Equilibrium Capital’s Dave Chen says in the latest podcast in ImpactAlpha’s Institutional Shift series.

Chen was speaking from Singapore, where he’s working with officials on ways to realize the island nation’s “30 by 30” plan to meet 30% of its food needs locally by 2030, from less than 10% today.

COVID has accelerated investor interest in high-tech greenhouses that already were positioned as solutions to climate-induced changes in agriculture. Today, Credit Suisse Asset Management announced it is making Equilibrium’s ‘controlled environment’ agriculture and other sustainability strategies available to its clients.

“It speaks to the growing institutional demand for these kind of products,” Chen says. “We’re all trying to find categories that are big enough to scale, big enough to make a difference.”

Productivity curve

Modern greenhouses that control not only light, but light-spectrum, as well as carbon dioxide, temperature and humidity have put agriculture on the technology productivity curve.

“Who would use terms like ‘Moore’s law’ or ‘adaptive systems’ in regards to a thousand-acre field of lettuce?” Chen asks. “That’s changing the mentality of what agriculture is.”

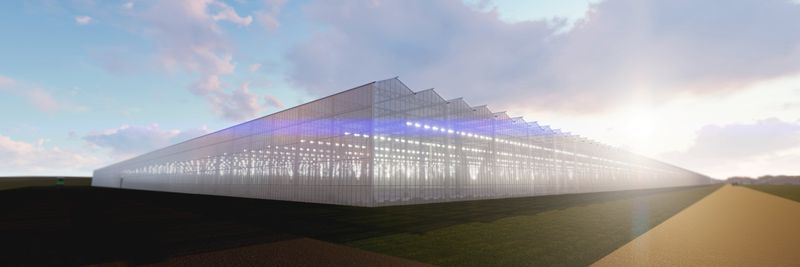

Equilibrium is the owner of the 2.6 million square-foot greenhouse under construction in Kentucky by AppHarvest, which last month agreed to go public through a merger with a special purpose acquisition company, or SPAC, as well as an investor in the company.

Life imitates art as hedge fund manager Jeff Ubben launches public-market impact fund

Equilibrium also led last month’s $68 million financing for Minnesota-based Revol Greens, which is building its third greenhouse in Texas.

Public policy to increase food security, along with the large amount of capital required makes the buildout of such facilities attractive to sovereign wealth funds in the Middle East and China, as well as Singapore.

“This is food infrastructure,” Chen says. “The effects of climate change are now measureale and agriculture is ground zero.”