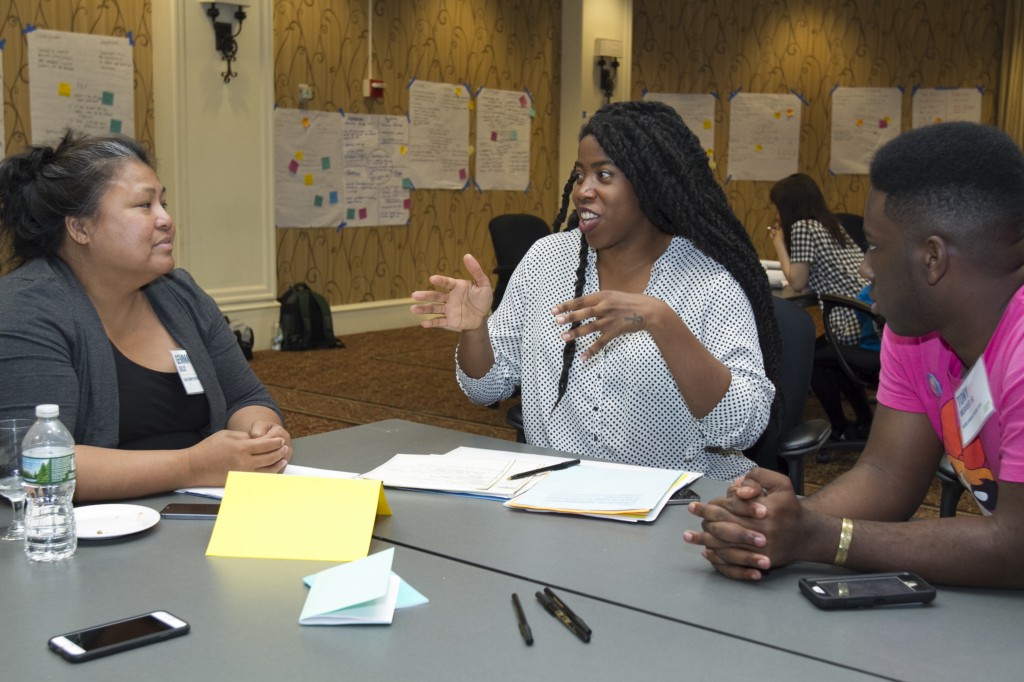

An impact investing merchant bank would arrange financing via share ownership instead of loans. The idea was floated at a recent workshop hosted by Echoing Green, the three-decade-old nonprofit fellowship program and accelerator.

A study of 49 Echoing Green fellows running for-profit and hybrid startups* found impact ventures continue to need investment readiness support at later stages, to scale their models. Particular areas of need include funding introductions, transactional support, and valuation assessment.

The study also spotlighted the fragmentation of the investment side of the impact sector, Echoing Green’s Min Pease told ImpactAlpha.

“If [an investor] in Silicon Valley tells someone no, they’ll recommend five other potential investors. We don’t have that in impact investing,” Pease says. “A lot of money went into building the venture capital industry infrastructure. There has not been that kind of investment in impact infrastructure yet.”

Enclude led the study, with support from the MacArthur and Kresge Foundations. The full findings are available online.

*Footnote: Echoing Green notes it has seen a surge in for-profit and hybrid social venture applicants in recent years.