ImpactAlpha, June 6 – Vox Capital, a São Paulo-based impact investment firm, has sold its stake in affordable healthcare network TEM, marking what Brazil’s financial media reported was the country’s first impact investment exit.

Vox, which invested 3 million real ($780,000) in TEM in 2015, said it made a 26% return when it sold its almost 30% stake in the firm to an undisclosed insurance company.

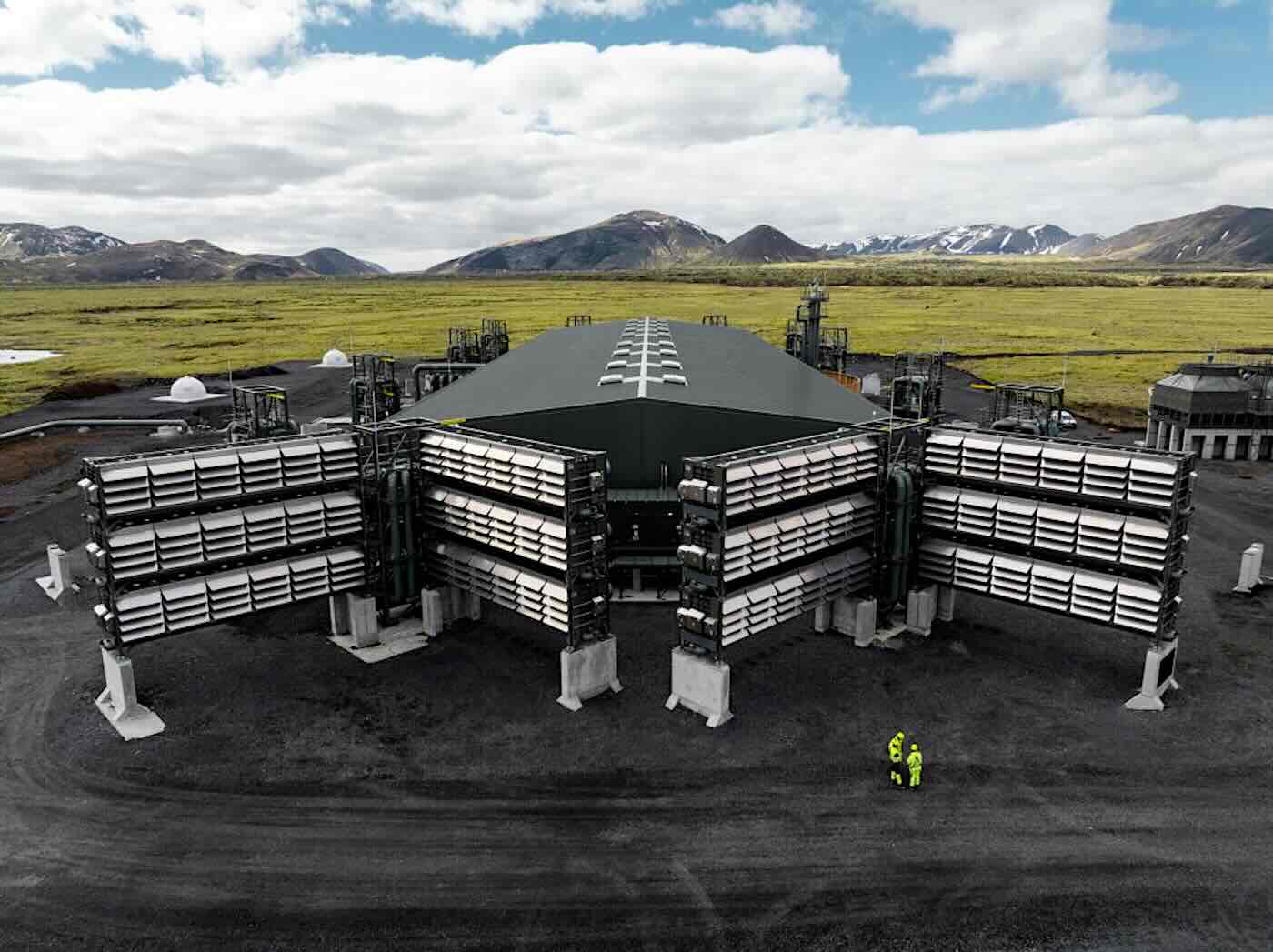

TEM launched in 2014 to provide an alternative to the public health system for low-income Brazilians. It administers prepaid cards that patients use to pay for healthcare at TEM’s network of more than 14,000 partner clinics and medical offices. More than 100,000 patients use providers in the network for basic checkups and exams that cost up to 70% less than private health facilities. TEM also offers 20% discounts on prescription drugs.

Seventy-five percent of Brazil’s population relies on public healthcare. The system “works quite well for some procedures but has a lot of bottlenecks, such as long wait lists for medical appointments with specialists and lab tests,” Vox’s Gilberto Ribeiro told ImpactAlpha.

“We believe that companies like TEM are paving the way for a new market, one more inclusive and fit for the Brazilian population, that offers an alternative to free (but sometimes low quality) public healthcare services and to highly expensive private health insurance,” Ribiero said.

Vox Capital was the first recognized socially-focused investment firm in Brazil when it launched in 2009. It has raised two funds since its founding: an 84.4 million-real fund in 2012 and a 120 million-real fund in 2016. Vox made ten investments from its first fund.

It has recently invested in another health-focused startup: Sanar, which provides online career guidance and resources for healthcare professionals around the country.