TGIF, Agents of Impact!

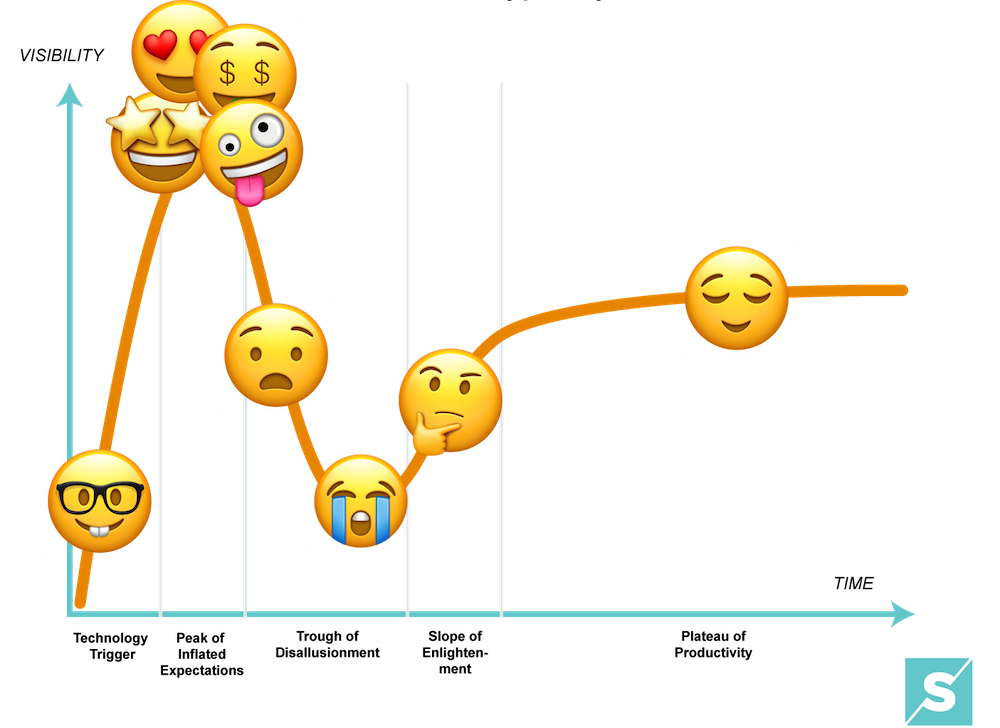

🗣 Slope of enlightenment. Students of tech’s “hype cycle” may recognize the same pattern in impact investing. From their Peaks of Inflated Expectations, impact strategies and tools like ESG, Opportunity Zones and carbon markets have often fallen into the Trough of Disillusionment. But as with tech, impact innovations can climb the Slope of Enlightenment as best-practices are hammered out and imposters shaken out. Contributing editor Imogen Rose-Smith and New America’s Scott Kalb engaged in such hammering over the Responsible Asset Allocator Initiative (and, by extension, other ESG ratings and rankings). Blueprint Local’s Ross Baird rebutted the recent despair over the efficacy of Opportunity Zone tax breaks with examples of equitable real estate projects boosted by the program’s long-term investment horizon. After trading flat on global markets for decades, the suddenly rising price of carbon is pushing corporations to internalize the costs of their carbon and other greenhouse gas emissions. Corporate spending drove financing for the low-carbon transition last year to nearly $1 trillion – still inadequate but a significant boost. We’ll dig into other real-world implications of $100-per-ton carbon on Tuesday’s Agents of Impact Call (RSVP now).

Speaking of hype, better measurement and management of impact outcomes is key to climbing out of the trough. Agents of Impact like Christina Leijonhufvud of BlueMark are building IMM benchmarks (see “Agent of Impact,” below) to enforce impact integrity. The broad market correction is spurring a shakeout. But far from waning, investor interest in solutions in water, food waste and all things climate is growing. “If you’ve been putting money into companies you think will create long-term value at fair valuations, nothing to worry about,” tweeted Fifty Years’ Seth Bannon, who this week invested in Zero Acre Farms to produce healthy oils and fats using fermentation rather than deforestation (see “Deal spotlight”). The Plateau of Productivity awaits impact investors who keep their eyes on the long-term horizon. – Dennis Price

🎧 Impact Briefing. Host Monique Aiken is joined by David Bank to preview next week’s Call on the real world effects of the rising price of carbon, and Dennis Price speaks with Kim Folsom of Founders First about flexible business financing to create jobs and wealth. Plus, the headlines.

- Listen to this week’s episode, and follow all of ImpactAlpha’s podcasts on Apple, Spotify or wherever you listen.

👋 Next Call: Carbon is $100 a ton. Now what? The price of carbon is finally getting interesting. Emmanuel Lagarrigue of General Atlantic’s BeyondNetZero, CDP’s Paula DiPerna, ReGen Networks’ Gregory Landua, Estabrook Carbon’s Edwin Datson, and Delton Chen of Global Carbon Reward will go beyond carbon credits to fund strategies, deal underwriting, corporate accounting, and the wild world of climate crypto. How and where is carbon pricing showing up in your deals and investment strategies? Share what you’re seeing and we’ll call you up on The Call.

- Answer the Call, Tuesday, Feb. 8, 10am PT / 1pm ET / 6pm London. RSVP today.

The Week’s Agent of Impact

Christina Leijonhufvud, BlueMark: Creating a benchmark for impact integrity. Of the nine “Operating Principles for Impact Management,” arguably the most important is the last one: “publicly disclose alignment and provide regular independent verification.” In the three years since the principles were launched, more than 150 impact fund managers have signed on; at least 110 have provided disclosures. Of the 85 independent verifications, more than two-thirds have been conducted by BlueMark, a spinoff of the consultancy Tideline. Last month, BlueMark closed on $2.3 million in seed financing (and $3.8 million in total) to build a business around impact verification. “We believe the Principles represent not just best practice for impact management, but over time will evolve into best practice investment management writ large,” Leijonhufvud, BlueMark’s CEO, said on an ImpactAlpha Agents of Impact call two years ago. Many assessments later, that process is well underway. Measuring fund managers against the benchmarks BlueMark has built on its growing data set is becoming a key aspect of due diligence for institutional investors and family offices looking for verifiable impact (disclosure: BlueMark is a sponsor of ImpactAlpha).

The creation of a baseline for impact integrity is something of a life’s work for Leijonhufvud. The daughter of UCLA economist Axel Leijonhufvud, she served as the World Bank’s country officer for Kazakhstan, Kyrgyzstan and Turkmenistan following the breakup of the Soviet Union. As a self-described “risk nerd,” she led teams at J.P. Morgan on sovereign risk, credit risk and emerging market risk before co-founding the bank’s social finance unit. That team’s 2010 report, “Impact Investments: An Emerging Asset Class,” provided mainstream validation for the nascent investment approach (although the “asset class” formulation quickly fell out of favor). With questions about impact investing’s potential for financial returns largely settled, attention has shifted to whether the impact is real. A new International Sustainability Standards Board is harmonizing ESG and impact reporting frameworks. BlueMark has started to assess asset managers under Europe’s new Sustainable Finance Disclosure Regulation, or SFDR. The real advance will come in the move from disclosure to performance. “Acting on impact data is not about tracking a handful of universal metrics,” Leijonhufvud and co-authors wrote recently on ImpactAlpha. The holy grail: knowing “how and which investment decisions can lead to better and longer-lasting outcomes for society and the planet.”

- Keep reading, “Christina Leijonhufvud, BlueMark: Creating a benchmark for impact integrity,” by David Bank on ImpactAlpha and share the story on Instagram.

The Week’s Dealflow

Deal spotlight: Enzyme and microbial tech. Microscopic, single-celled organisms like bacteria and fungi are being harnessed to help farmers protect and grow crops, treat wastewater and create healthier alternatives to daily staples, like vegetable oil. Biotech startups, such as Pivot Bio, Ginkgo Bioworks and Kula Bio are using microbes to give farmers sustainable alternatives to synthetic fertilizers.

- Beyond palm oil. Zero Acre Farms secured $37 million to make healthier and more sustainable cooking oils via microbe-based fermentation. Kula Bio raised $50 million this week to plant microbes in the ground to capture nitrogen from the atmosphere and convert it to nutrition for crops.

Impact tech. MRHB DeFi secured $5.5 million to build ethical and sustainable crypto options for the Muslim world… K-12 education software provider PowerSchool acquires Kinvolved, which helps reduce school absenteeism with school-communication and parent-engagement technology… Scaler Academy secures $55 million to upskill India’s tech workers… Colombia’s Melonn scores $20 million to help small businesses in Latin America sell and deliver goods to customers.

Returns on inclusion. Bank of America and the Roy and Patricia Disney Family Foundation invest in L.A.-based The 22 Fund… Citi partnered with five Black-owned firms to issue a $2.5 billion bond to preserve affordable housing… MaC Venture Capital, a Black-led VC firm, launches its second fund… Equity Alliance raises $28.6 million to invest in minority and female-led venture capital funds.

Agrifood investing. EDFI AgriFI loans East Africa Fruits $1.5 million to connect Tanzania’s small farmers and retailers… India’s B2B agri-trading platform Bijak raises $19.4 million from Bertelsmann, Omidyar Network India, Better Capital, Sequoia Capital India and others… Vox Capital and Lever VC invest $5 million in Brazil’s carbon-neutral oat milk producer Nude.

Electric vehicles. BlackRock partnership commits $650 million to charging infrastructure for electric trucks… Zeta Energy raises $23 million to develop and commercialize sulfur-based lithium batteries… E-scooter ride-sharing app Superpedestrian raises $125 million in debt and equity funding.

Low-carbon transition. HSBC joins Breakthrough Energy Catalyst with a $100 million investment… Moss.Earth raises $10 million to put carbon credits on blockchain… Energy Impact Partners’ Deep Decarbonization Frontier Fund secures $2.5 million from FirstEnergy Corp… Australia’s Plato Investment Management launches a fund to short stocks of carbon-intensive companies.

Financial inclusion. Floatpays raises $4 million to give South African workers access to earned wages… Fintech venture Esusu raises $130 million to help U.S.-based minorities and immigrants build credit profiles.

Fund news. Stockholm-based Norrsken Foundation raises $110 million for Norrsken22, a growth fund for African tech ventures… Africa-focused venture capital firm TLcom Capital scores $70 million for the first close of its second fund.

Health and wellbeing. Brazil’s Nilo Saude secures $10 million for software that streamlines data and communications for primary healthcare providers… Impact Engine backs The Helper Bees to keep seniors out of nursing homes.

Impact acquisitions. Impact pioneer responsAbility gets acquired by investment manager M&G.

The Week’s Talent

General Atlantic hires Cornelia Gomez, ex- of PAI Partners, as head of ESG and sustainability… Rally Assets promotes Kelly Gauthier to president… Sue Lloyd, ex- of the International Accounting Standards Board, is named vice-chair of the International Sustainability Standards Board. Value Reporting Foundation’s Janine Guillot will be a special advisor to ISSB chair Emmanuel Faber… U.N. climate and finance envoy Mark Carney joins Macro Advisory Partners as senior counselor… Anne Schankin, ex- of CME Group, joins Catholic Impact Investing Collaborative as director.

Beneficial State Bank appoints Surjit Chana to its board of directors… Atle Eide is appointed group chairman at Lake Harvest Group… Rohit Aggarwala, former sustainability advisor to Michael Bloomberg, is appointed New York City’s chief climate officer and commissioner of the Department of Environmental Protection… Mission Driven Finance brings on Catherine Rotchford, ex- of Gemini Finance Corp., and promotes Andrew Moncada, Laura Olivas and Crystal Sevilla.

SK Capital Partners hires Anne Kolton as its first chief sustainability officer… Elevar Equity promotes Amie Patel and Shobha Venkataraman to partners… Peter Seligmann, chairman of Conservation International and CEO of Nia Tero, joins Engine No. 1 as a senior advisor… Kwabena Asante-Poku, ex- of PwC, joins CDC Group as its Ghana coverage director… LAVCA appoints Elevar Equity’s Johanna Posada, Vinci Partners’ Bruno Zaremba and CPP Investments’ Tania Chocolat to its board.

Bjorn Sorenson, ex- of Blue Dot Advocates, joins RPCK Rastegar Panchal as senior counsel and head of learning, development and impact assessment. Sebastian Martinez-Villalba, ex- of DigitalBridge, joins the law firm as senior associate… Shari Davis of Democracy Cohort, Valeria Fernández of Altavoz Lab, and Justin Hendrix of Tech Policy Press are among the Democracy Cohort of Emerson Collective Fellows.

The Week’s Jobs

Sorenson Impact Foundation seeks a managing director in Salt Lake City… Airbnb seeks a carbon markets lead in San Francisco… Open Road Alliance is hiring a portfolio associate in Washington, D.C… Impact Engine is looking for a senior associate of economic opportunity in Chicago… Lafayette Square is recruiting an executive director of the Lafayette Square Foundation in New York… Engine No. 1 is hiring an equity analyst intern in San Francisco… LAVCA is seeking an executive director.

Anthem is hiring a sustainability and ESG analyst… Acumen America seeks an investment manager in San Francisco… Conduit Capital is looking for a director of impact in London… CalSTRS seeks an investment officer for its sustainable investment and stewardship strategies unit… Zevin Asset Management is hiring an equity analyst in Boston… MCE Social Capital has openings for a portfolio manager, analyst and intern.

That’s a wrap. Have a wonderful weekend.

– Feb 4, 2022