ImpactAlpha, Feb. 1 – Venture investments in climate tech grab the headlines. Spending for energy transition deployment by corporations, government and households is driving a greater share of total climate finance.

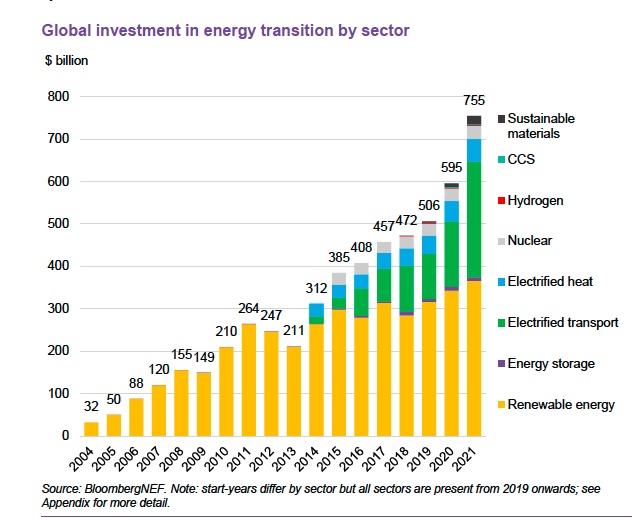

Purchases of renewable energy, storage, electric vehicles and heat pumps and other clean technologies jumped 30% last year to $755 billion. Investment in climate tech added another $165 billion to the pot. Together, spending and investments brought total 2021 climate finance to $920 billion – a figure BloombergNEF, which crunched the numbers, calls conservative. Not included, for example: energy efficiency and grid investment.

Net-zero pledges, increased government action around COP26, and a rising price on carbon are driving a rapid increase in climate spending. Last year’s increase in climate spending is all the more impressive given the commodity shortages and supply chain issues that have driven up costs for batteries, solar panels and other clean tech.

Yet even record funding levels are not enough to stave off catastrophic global warming. Energy transition investment needs to triple to more than $2 billion a year between now and 2025 to achieve net zero, and then double to an average of more than $4 billion over the next decade, warns BNEF. (McKinsey pegs the price tag at an even higher $9 trillion a year).

“Governments will need to mobilize much more finance in the next few years if we are to get on track for net zero by 2050,” said BNEF’s Matthias Kimmel.

Growth markets

Solar, wind, biofuels and other renewable energy made up the largest chunk of deployment spending, at $366 billion. But electric vehicles and charging infrastructure, at $273 billion, grew at the breakneck pace of 77% over 2020, compared to 6.5% for renewables.

At that rate, the EV sector will overtake energy renewable energy this year.

Consumer demand

Consumers snapped up EVs, heat pumps and solar modules, while businesses sunk money into renewable power, charging infrastructure, hydrogen production, recycling, carbon capture and other projects. Consumer purchases of heat pumps, for example, grew 11% to nearly $53 billion.

Together, these end users spent $400 billion on low-carbon purchases in 2021, surpassing for the first time spending by “supply side” energy producers.

Corporations, led by Amazon, Microsoft and other tech giants, also locked in more than 31 gigawatts of clean power through long-term contracts, representing 10% of all the renewable energy capacity added globally last year, according to a separate BNEF report.

Innovation investing

Venture investment, which BNEF calculates separately from commercial deployment, hit $54 billion last year. The biggest private hauls: Swedish battery maker Northvolt $2.8 billion raise, Commonwealth Fusion Systems ($1.8 billion), and Chinese battery producer SVOLT ($1.6 billion). Nearly two-dozen climate tech companies raised raised $500 million or more in venture or private equity funding.

Another $111 billion was raised by climate tech companies via SPACs, IPOs and other public offerings. The energy sector attracted the most action in the public markets, pulling in $54 billion – as much as all climate tech venture deals combined.

The most underfunded sector: building decarbonization startups, which raised a combined $1.3 billion.

New funds

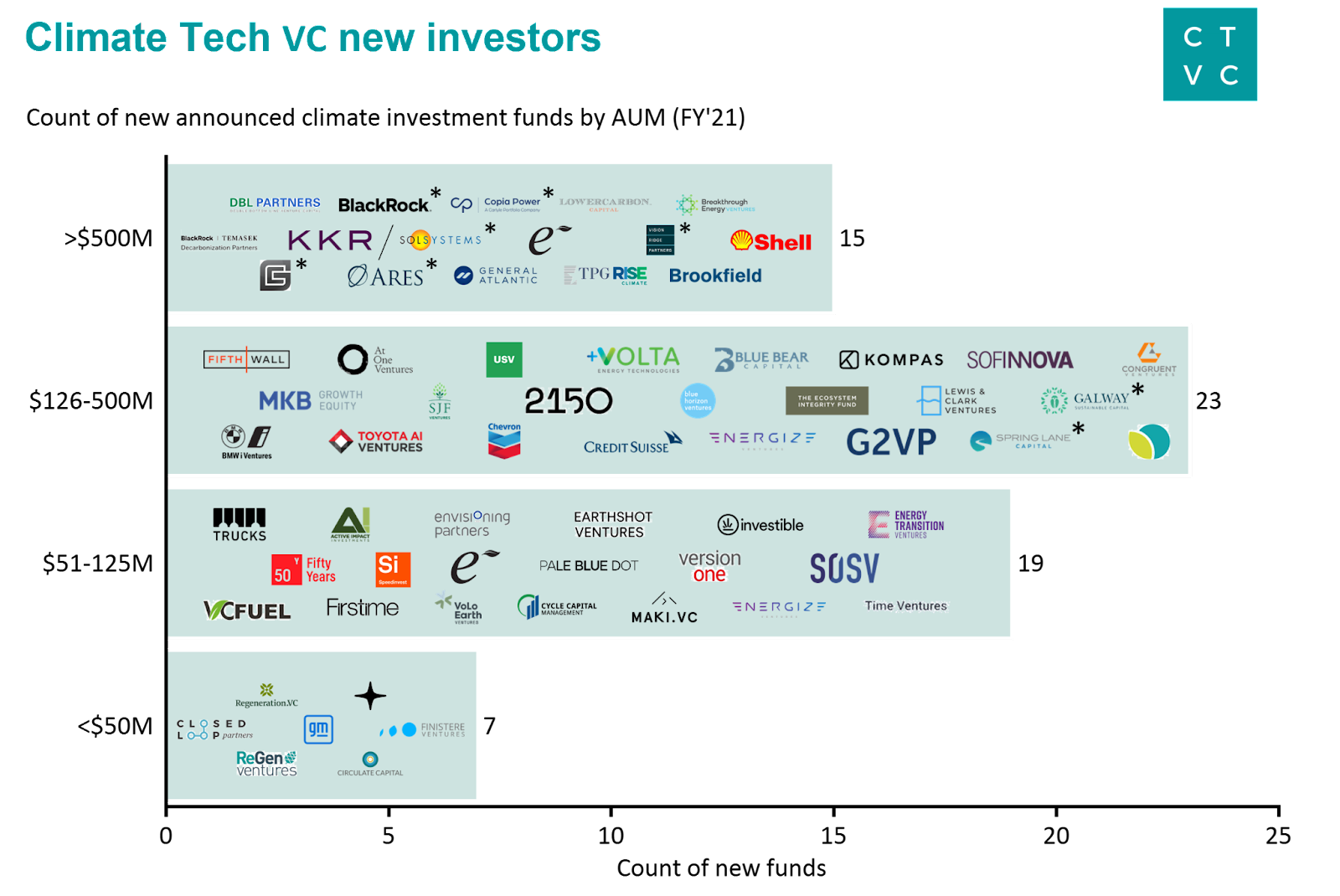

BloombergNEF’s report complements other recent tallies of climate investment. In its own 2021 investment recap, Climate Tech VC counted 64 new climate funds launched in 2021 with a collective $37 billion in fresh powder. The lion’s share of the new climate cash, or $30 billion, comes from 15 new megafunds of $500 million or more.