Hi there, Agents of Impact! Welcome back to ImpactAlpha Open, our free weekly newsletter read by 20,000 impact investing and sustainable finance professionals.

Two quick action items:

✅ Go deeper, and daily. Upgrade to an annual, all-access ImpactAlpha subscription to get our daily brief, unlimited articles on ImpactAlpha.com, and exposure to career building opportunities through calls, events and Slack channels. Take 50% off.

👋 Last chance to RSVP for tomorrow’s Call: Year of the ‘S.’ Human capital. Worker ownership. Community resiliency. Social factors are at the top of this year’s impact policy agenda. Special guests Cambria Allen Ratzlaff of JUST Capital, Jesse Van Tol of the National Community Reinvestment Coalition, and Jack Moriarty of Ownership America join Fran Seegull and David Bank, tomorrow, Feb. 22 at 10am PT / 1pm ET / 6pm London. RSVP today (this call is open to all courtesy of the U.S. Impact Investing Alliance).

In this week’s newsletter:

- Private equity touts impact;

- Unlocking the ownership economy;

- Rihanna’s star power; and

- Blue-collar tech jobs.

I crafted this week’s newsletter to a melodic Fisher playlist. What music boosts your productivity? Let’s jump in.

– Dennis Price

Must-reads on ImpactAlpha

- Private equity touts impact. “There’s a seismic change,” TPG’s Jon Winkelried told analysts this week. “If you thought of a landscape of sectors you might want to be involved in, they overlap the impact investing marketplace very strongly.”

- Impact alpha. Other publicly listed private equity giants like Brookfield, KKR and Apollo likewise touted their climate and impact performance (and fundraising), Amy Cortese reported.

- Returns on inclusion. Ariel Alternatives raised $1.5 billion from major corporate buyers to buy up supplier companies and diversify their management. “We are applying typical traditional private equity elements,” Ariel’s Leslie Brun told Amy Cortese, Jessica Pothering and Roodgally Senatus in a Q&A. “We’re just doing those things and employing Black and Brown talent that we know exists within corporate America that’s often overlooked.”

- Ownership economy. Social Capital Partners’ Jonathan Shell and Bill Young are seeking to demonstrate companies and funds that facilitate broader ownership of homes and businesses through their $2 million Ownership Fund.

- Catalytic continuum. Ceniarth’s Greg Neichin shares hard-won lessons for deploying catalytic capital as part of ImpactAlpha’s “Scaling Impact” series with the Catalytic Capital Consortium.

- Reimagining Capitalism. Dalberg’s Kusi Hornberger lays out a half-dozen overdue financial paradigm shifts.

Get impact ready. Get ImpactAlpha.

⚡ Seize the day. The vibe has shifted. If “impact” a few years ago connoted concessionary returns, it has increasingly come to mean alpha outperformance. Get impact ready, get impact alpha. Get an all-access subscription.

Agents of Impact

🌟 Rihanna: Shining star power on inclusion in music and business

Barbados-born Robyn “Rihanna” Fenty leads with representation. Fenty Beauty, the $2.8 billion cosmetics business the megastar founded with luxury goods brand LVMH, opened new markets with 40 shades of foundation. “Suddenly beauty houses – niche, establishment and those in between – began extending their shade ranges to accommodate a wider variety of skin tones,” Unmi Fetto wrote in British Vogue.

- Keep reading, “Rihanna: Shining star power on inclusion in music and business,” on ImpactAlpha and share the story on Instagram.

🏃🏿♀️ On the move

- David Malpass, the embattled president of the World Bank, will step down by June.

- Casey Gunkel, ex- of General Atlantic, will join Sidewalk Infrastructure Partners, an Alphabet spinoff, as head of communications.

- Valerie Red-Horse Mohl, ex- of East Bay Community Foundation, was named president of Known Holdings.

Impact Briefing

🎧 On the podcast

Project Equity’s Alison Lingane talks with ImpactAlpha’s David Bank about the growing popularity of employee ownership as a strategy for generating wealth and democratizing the economy. Host Monique Aiken has the headlines.

- Listen to the latest episode, and follow all of ImpactAlpha’s podcasts on Apple, Spotify or wherever you listen.

Deal Spotlight

💸 Old-fashioned IPOs with a climate twist

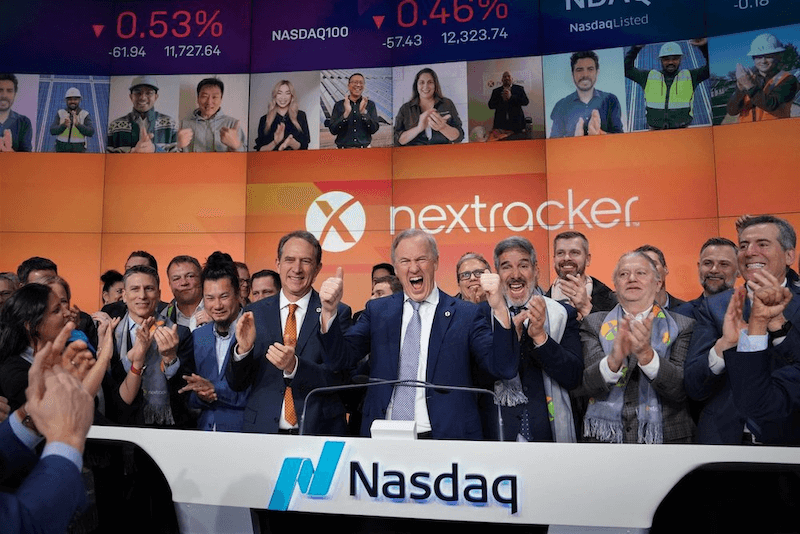

A climate tech company has scored the biggest IPO so far in 2023. Fremont, Calif.-based Nextracker, which optimizes solar panels as the sun moves, listed on Nasdaq last week, raising $638 million – almost 20% more than the company’s target. The deal underscores investors’ appetite for climate tech and energy-transition solutions, a bright spot in the slump in venture capital and public listings.

- Read the full spotlight.

Six Signals

👩🏾🔬 Blue-collar tech jobs. The central Ohio region around Columbus – site of the first new fabrication plant spurred by the CHIPS Act – is one place to look for ideas on how to deliver on the promise of accessible semiconductor manufacturing jobs. (Brookings Institution)

📣 Backlash to the ESG backlash. Americans overwhelmingly want companies to speak out on issues that are important to their employees and customers and try to have a positive impact on their communities. (Global Strategy Group)

⚡ Supplying Lithium. The race is on for countries to secure stable and resilient lithium supplies to meet demand for batteries in electric vehicles, energy storage systems and other devices and appliances.

- The discovery of a major deposit of lithium pushes India into the world’s top five national lithium reserves. (Quartz)

- With public and private investment, the U.S. could double annual lithium battery revenues to $33 billion and provide 100,000 jobs by 2030. (Li-Bridge)

- How do lithium-ion batteries work? An explainer. (Energy.gov)

🇪🇺 Rapid-response energy shift. Europe turned an energy crisis into a green energy sprint with the potential to knock a full decade off the continent’s decarbonization timeline. (New York Times)

🌳 Forest intelligence. Purdue launches a new AI-based global forest mapping project. (Purdue University)

🌱 Climate career toolkit. Track, research, apply, and land the climate job of your dreams. (Climb)

Get in the Game

💼 Step up

- Mission Driven Finance has an opening for a director of real estate asset management.

- The International Finance Corp. seeks an investment officer for disruptive tech and venture capital in Europe.

- Sarona Asset Management is looking for an investment analyst in Singapore.

🤝 Meet up

- The 7th annual Impact Investing Symposium will take place Friday, Feb. 24 at Washington University in St. Louis.

- Overture is hosting a virtual conversation with Ben Rhodes, former deputy national security advisor in the Obama White House, about climate change, foreign policy, and national security, Monday, Feb. 27.

- New Ventures is hosting the Latin America Impact Investing Forum, or “FLII”, February 28 to March 2 in Mérida, Mexico. Get 35% off with code IMPACTALPHA35.

📬 Get ImpactAlpha Open in your inbox.

Sign up FREE on impactalpha.com.

Don’t be a stranger. Connect with us. Tell us who you are and what you’re up to. Share your news, tips, data points, introductions and high-impact ideas, to [email protected].

See you back here next Tuesday!