Hi there, Agents of Impact!Welcome to the latest ImpactAlpha Open, your weekly roundup of news, trends and actionable opportunities in impact investing. Two quick invitations:

📞 Heading for Change. 2X Global’s Suzanne Biegel will share details about the Heading for Change donor-advised climate + gender fund on a Zoom call co-hosted by ImpactAssets and ImpactAlpha, today, April 25 (RSVP).

📞 Good green jobs. Join ImpactAlpha and Jobs for the Future on LinkedIn Live to kickoff JFF’s Quality Green Jobs Regional Challenge and a new funding opportunity to support green jobs. JFF’s Taj Ahmad Eldridge will interview JFF’s Sara Vander Zanden and Lucy Fernandez, Thursday, April 27. (RSVP)

In this week’s newsletter:

- Human rights in VC

- Mapping climate investments

- Impact exits in Asia

- The trillion dollar bank

Ok, on to the good stuff. – Dennis Price

Must-reads on ImpactAlpha

- Global financial inclusion. Catalytic capital from Mastercard’s Center for Inclusive Growth has de-risked and primed models of inclusive finance, including an initiative by Accion around “embedded” finance, reports ImpactAlpha’s Jessica Pothering.

- In China, climate and ESG investing is catching on, even as the country’s fledgling impact investing sector lags, reports contributing editor Dan Keeler.

- Worker solutions. In the US, Lafayette Square is bridging a gap in financing for middle market companies that can uplift low- to moderate-income people and communities, ImpactAlpha’s Amy Cortese and David Bank report.

- In a guest post, Lafayette Square’s Damien Dwin urges more investment in often-forgotten places and workers.

- Mapping climate investments. A network of catalytic investors has helped climate investment remain remarkably resilient compared to other tech sectors, data ecologist Eric Berlow writes in a guest post on ImpactAlpha.

- The Climate Co-Investor Tracker, co-developed by Vibrant Data Labs and SecondMuse and launched on ImpactAlpha, shows these patterns of co-investment.

- Human rights in VC. Artificial intelligence ethics. Labor rights for gig workers. Client protection in fintech. Venture capitalists are finding it harder to ignore human rights risks in their portfolios, argue Joanne Azem and Johannes Lenhard of VentureESG, which released tools to help VCs integrate human rights in their due diligence.

- Policy corner. Recent U.S. legislation signals a step-change in US industrial policy. But public money alone can’t achieve the policy goals without strategy, institutional capacity and accountability mechanisms, Aaron Cantrell of Future Nexus, David Wood of the Harvard Kennedy School, and Melanie Brusseler of climate think-tank E3G write in a guest post.

Take 50% off an all-access subscription

⚡ Stay ahead of the curve

Enjoying ImpactAlpha Open? Sample an all-access ImpactAlpha subscription with 50% off your first month. Ready to commit? Grab 50% off a one-year. For the biggest savings, lock in a two-year subscription for just $399.

Agents of Impact

📈 Lourdes Germán, Public Finance Initiative: Tilting the $4 trillion muni market toward racial equity

Attorney and academic Lourdes Germán recognized early the power of public finance. Public Finance Initiative, her new nonprofit, helps market stakeholders prioritize values that include racial equity and environmental justice while steering capital toward schools, water systems and other determinants of health and well-being. The nonprofit is leading a wide-ranging effort to nudge the $4 trillion municipal bond markets to address systemic inequities.

- Keep reading my profile of Lourdes Germán and “like” the story on Instagram.

🏃🏿♀️ On the move

- Nick Hurd will succeed Ronald Cohen as chair of the Global Steering Group for Impact Investment. Cohen will become non-executive president and continue to serve on GSG’s board.

- Rebekah Saul Butler, ex- of The Grove Foundation, joined Gratitude Railroad as managing partner and co-CEO.

- Ravtegh Aurora, ex of World Bank, joined Impact Capital Managers as an analyst.

Impact Briefing

🎧 On the podcast

For Earth Day, Dianne Dillon-Ridgley joins host Monique Aiken to reflect on four decades of working at the intersection of finance, the environment and human rights. Dillon-Ridgley is chair of the Intentional Endowments Network, a network of more than 200 asset owners and managers. Plus, the headlines.

- Listen to the latest episode, and follow all of ImpactAlpha’s podcasts on Apple, Spotify or wherever you listen.

Deal Spotlight

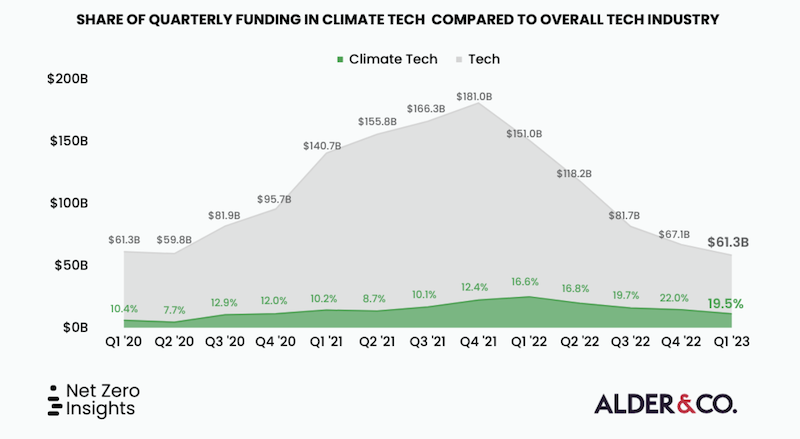

💸 The new, uncomfortable reality for climate tech VC

Last year, climate tech investing was a bright spot in an otherwise challenging fundraising market. The talk among startups at San Francisco Climate Week made clear the bright spot has dimmed. Data from Net Zero Insights shows climate funding suffered an even steeper drop than overall tech funding in the first quarter of 2023. “Venture capital is going through a bloodbath, and it will affect some climate investments,” acknowledged Abe Yokell of early-stage climate tech investor Congruent Ventures, which closed its $300 million “continuity fund” for follow-on investments into its portfolio of 60 companies.

- Read the full spotlight.

Six Signals

🚀 Impact exits. Bangalore-based Unitus Capital, which backs ventures serving low-income populations in Asia, has helped investors exit 53 investment from 30 companies with a 43% median internal rate of turn and cash-on-cash return of 4.4x (Unitus Capital).

🎥 Investing in the creator economy. The $100 billion “creator” economy of platforms, products and services for independent content creators is ripe for impact investment to ensure the related economic benefits are shared equitably and sustainably. (Upstart Co-Lab)

💲 The trillion dollar bank. To meet goals for global poverty reduction and climate action, The International Bank for Reconstruction and Development, the lending arm of the World Bank, should triple its sustainable annual lending to around $100 billion per year, with a total loan exposure of $1 trillion by 2030. (Brookings Institution)

⚡ IRA after eight months. Since the policy became law last August, companies and investors have announced 41 major new projects, more than $44 billion in capital investment and an estimated 32,000 new jobs. In March: Ford announced a 500,000 per year EV target for Blue Oval, Tenn. In Ohio, Lordstown and Foxconn resumed pilot production. (Jay Turner / Charged)

🦠 Virus hunters. A new coalition, CLIMADE, brings together some of the biggest names in public health to address climate-amplified diseases in Africa and Latin America. (Bloomberg)

🌱 Scaling biodiversity credit markets. Natural capital accounting, nature-related risk disclosure and tax incentives for setting nature targets are among policy options needed to give supply- and demand-side market actors the confidence to scale their investments in biodiversity. (Taskforce on Nature Markets)

Get in the Game

💼 Step up

- Blue Dot Capital is recruiting an ESG research and integration senior associate in New York.

- Common Future seeks a vice president of finance.

- University of Pennsylvania is looking for a research specialist for an ESG initiative.

Check out the full list of the week’s impact jobs on ImpactAlpha.com.

🤝 Meet up

- May 1-2: ImpactPHL’s Total Impact in Philadelphia (use code IMPACTALPHA for $500 off)

- May 1-5: AVCA Annual Conference (Cairo)

- May 16-18: ReFED Food Waste Solutions Summit (St. Louis)

📬 Get ImpactAlpha Open in your inbox each Tuesday

Don’t be a stranger. Connect with us. Tell us who you are and what you’re up to. Share your news, tips, data points, introductions and high-impact ideas, to [email protected].

‘Til next Tuesday!