ImpactAlpha, Feb. 14 – Brookfield Asset Management made waves last June when it closed fundraising for its $15 billion energy transition fund, the largest such fund raised to date. Less than a year later, the Canadian firm is looking to raise a successor climate fund that could be double that size and to launch additional products to capitalize on the transition to a net-zero economy.

Private equity firms have been raising big funds and writing big checks for renewable energy, climate tech and industrial decarbonization. They’re just getting warmed up.

Publicly listed investment firms such as Brookfield, KKR, Apollo and TPG have dropped details of their strategy in public filings and quarterly earnings calls. Over the past week, one private-equity executive after another has singled out the low-carbon transition as a key opportunity for raising and deploying capital.

Brookfield’s Bruce Flatt told investors last week the firm’s transition business could scale to over $200 billion in the next decade, “thanks to significant macro tailwinds for the strategy and strong initial deployment.” He pegged the total net-zero transition opportunity at $150 trillion between now and 2050.

Apollo Global Management has committed or deployed more than $6 billion to sustainable investments. It will begin raising capital for a new clean transition and other “opportunistic vehicles” in the second half of the year, Apollo’s Jim Zelter told analysts on a conference call. Apollo this month is adding a dedicated team to find climate and infrastructure deals.

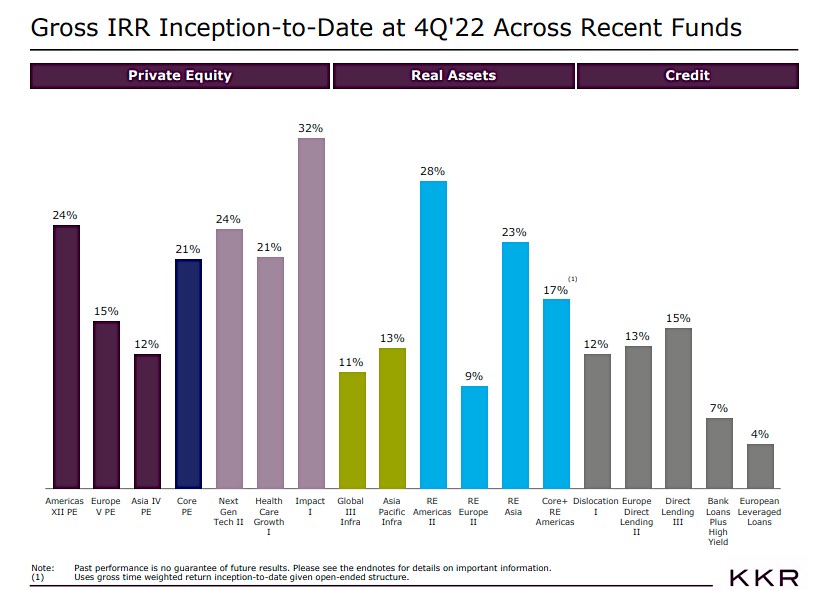

KKR’s impact fund leads the firm’s 17 other funds with a 32% internal rate of return, according to the firm. In October, it invested $300 million for a 13% stake in Advanta Enterprises, a Mumbai-based sustainable ag and seed company. KKR has closed on at least $1.9 billion for a successor Global Impact Fund.

KKR is staffing up for a dedicated climate fund. It has brought on Emmanuel Lagarrigue, a former Schneider Electric executive who helped establish General Atlantic’s BeyondNetZero fund, and Goldman Sachs partner Charlie Gailliot to co-lead the new fund. KKR declined to comment on fundraising.

Privately held Generation Investment Management, led by Al Gore and David Blood, is nearing completion of a $1 billion dedicated climate fund, Just Climate.

Concentrated capital

The PE fundraising is buoyed by broad-based trends. PE firms, many of which have tapped public markets, have the capacity to inject large sums of capital into ambitious opportunities. At the same time, institutional investors are increasingly concentrating their allocations with big players that can invest across a wide range of asset classes and strategies.

TPG, which through its TPG Growth unit has raised $7.3 billion for its own climate fund, as well as two Rise impact funds, will report its 2022 results Wednesday. In November, TPG’s Jim Coulter called climate tech “one of the real bright spots” in a complicated investment landscape.

It’s biggest bet: A $1 billion investment, with Abu Dhabi’s ADQ, in an electric vehicle spin-off of India’s Tata Motors. TPG has also invested hundreds of millions of dollars to assemble a carbon credit origination and trading platform. TPG is looking to raise $3 billion for its third Rise fund, and a follow-on climate fund next year.

Worker ownership

KKR’s impact strategy, launched in 2018, invests globally across climate action, sustainable living, lifelong learning and inclusive growth solutions with measurable impact. A key focus: extending equity ownership of portfolio companies to rank-and-file employees. More than 45,000 employees across 25 portfolio companies have been awarded equity. KKR helped stand up a nonprofit, OwnershipWorks, to advance broad-based employee ownership.

Energy transition

Brookfield’s earnings call was its first since spinning off 25% of the company to the public, under the ticker BAM. Brookfield global transition fund’s portfolio includes hydroelectric, green hydrogen, wind, solar and storage facilities around the globe. It acquired a 51% stake last October in Westinghouse, which has been doing a brisk business replacing aging Soviet-era nuclear power plants with more modern technology.

“We are willing to go where the emissions are,” said Flatt. He pointed to opportunities to buy power companies with the goal of helping them decarbonize, and to partner with industrial corporations to speed their transitions to low carbon products and solutions. It has also invested in climate tech solutions such as carbon capture, battery storage, or recycling and in U.S.-based companies that stand to benefit from a gusher of federal climate funding.

Brookfield Renewable Partners, a publicly traded entity with $75 billion in assets under management, has 135,000 megawatts of capacity in the works, making it among the largest global renewable energy companies.