ImpactAlpha, Mar. 23 – When Shaun Abrahamson and Stonly Blue of Urban Us began investing in building electrification and other improvements for city life almost a decade ago, cleantech was still a dirty word among venture capitalists.

“People forget that it was all still cleantech hangover,” Abrahamson told ImpactAlpha. “Showing up and saying, ‘We want to do climate and hardware and related industries’ – people just patted you on the head and said, ‘Good luck.’”

Instead, the duo centered their climate thesis on urbanism, inspired by the work of C40 Cities, the network of major population centers that are taking local climate action. And for “strategic reasons of not wanting to be laughed out of the room,” adds Blue.

Last year’s surge in climate tech venture capital changed all that. After deploying three funds and backing more than a hundred companies, Abrahamson and Blue have rebranded as Third Sphere, inspired by the third planet from the Sun. Shilpi Kumar, ex- of First Round, has joined Third Sphere as a partner.

A fourth fund is in the works built around what Abrahamson calls “natural innovation upgrades that can happen where you just have something that’s better, faster, cheaper.”

The New York-based fund manager has backed at least three climate unicorns and notched five exits. The firm’s stake in Future Motion, manufacturer of the popular OneWheel electric scooter, for example, has been marked up more than 80x since 2014, according to Third Sphere.

Bowery Farming, which Third Sphere first backed in 2015, last year raised $325 million in the largest-ever private fundraise for an indoor farming company. The latest round valued the company at $2.3 billion.

The VC firm also backed Atlanta-based Cove Tool, which has helped architects and engineers avoid 27 million metric tons of carbon dioxide by designing low emissions buildings (Tesla, by comparison, avoided 5.0 million metric tons of CO2e emissions in 2020).

“Our bias is towards opportunities where we are not asking anyone to believe anything or support anything – but where we get the byproducts in terms of climate action that we want,” says Abrahamson. “For us, the best climate investments sneak in the benefit.”

Electrify everything

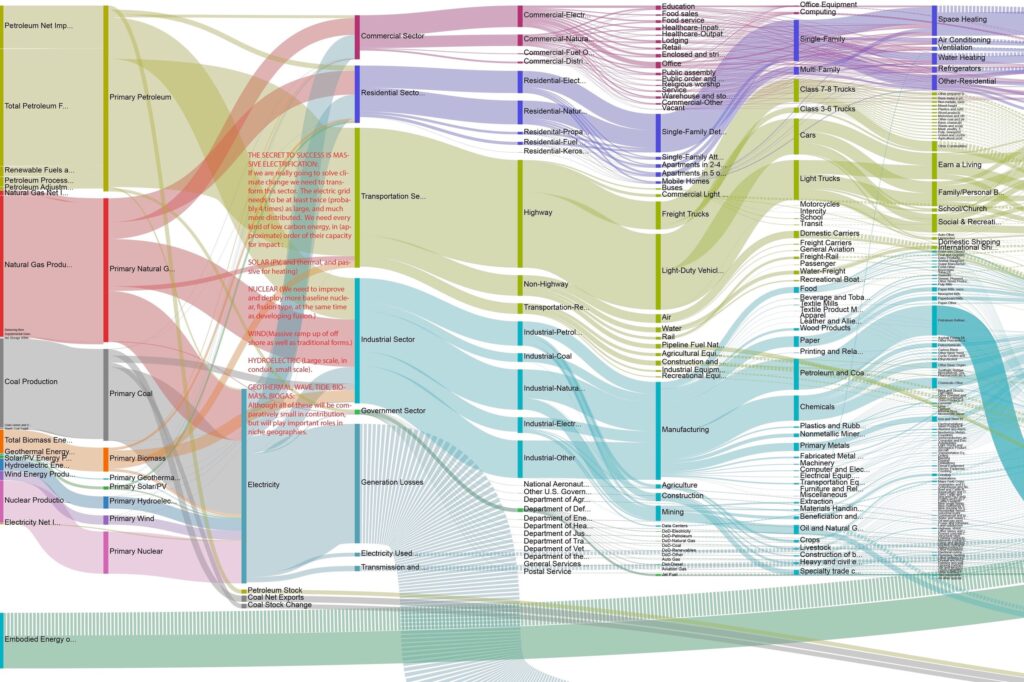

A few years ago, engineer and inventor Saul Griffith built a diagram of U.S. energy flows that identified at least a billion fuel-burning machines – from trucks and lawnmowers to space heaters and appliances – that need to be replaced with electric machines powered by renewable energy.

“These electric purchases need to be the lowest-cost option at every point-of-purchase decision, as soon as possible, in every zip code,” writes Griffith, author of Electrify: An Optimist’s Playbook for Our Clean Energy Future. “You don’t fix the climate unless every household participates and benefits from doing so.”

A focus on the deployment of existing climate technologies puts a stake in the ground on timeline – and impact, says Abrahamson. Fusion, for example, and other moonshot technologies, while necessary, could take decades to deliver results.

Third Sphere’s deployment focus has also meant an emphasis on hardware, particularly pre-product hardware, an area venture capital has historically avoided. A full 60% of the portfolio is in hardware.

To speed deployment, a new asset finance arm within Third Sphere led by Mark Paris and Zeev Kreiger and backed by Encina (KKR and Oaktree) provides collateralized, non-dilutive credit to portfolio companies. Abrahamson says more than half of the hardware companies in the portfolio also use credit. “It looks like a lot of the credit opportunities may be regional deployments where the VCs couldn’t get there on either growth rate or addressable market or competitive dynamics.”

Alongside deployment, Third Sphere emphasizes investments in resilience, which Abrahamson says changes the math and changes consumer thinking. “We’ve already locked in a certain amount of volatility.”

One Concern, for example, which Third Sphere backed in 2015, prices climate risk for physical structures in specific locations.

“We are looking through the lens of, if this works and scales, do you get emissions reduction? Or do you get increased resilience?” Abrahamson says. “Or ideally both.’”