TGIF, Agents of Impact!

Distributed systems. Back in the 20th century, the Internet won out over legacy approaches because attributes like resource sharing, openness, scalability, transparency and fault tolerance were baked into its distributed network design. The power outages in Texas and elsewhere make clear the nation’s aging electric grids need their own distributed redesign to handle the demands of the 21st century (see No. 3, below). The same could be said for global health innovation, which needs an overhaul to ensure the affordable distribution of life-saving vaccines, drugs and devices to low-income countries and the people who need them most (No. 2). Markets can be a spur to distributed activity: widespread adoption of agricultural techniques to sequester carbon in soil had been mostly a non-starter when the price of a ton of stored carbon languished in the low single digits. At $20 a ton and going higher, ‘carbon farming’ is becoming a significant source of new revenues for farmers and ranchers (No. 1). And revamping a legacy financial system that generates inequality and injustice is as urgent as overhauling the power grid, as LISC’s Annie Donovan suggests (No. 7). Key to the redesign: equity for workers, customers, suppliers, communities, the environment and, yes, investors in a newly distributed system.

– David Bank

This week’s Impact Briefing. Host Brian Walsh is joined on the podcast by Amy Cortese to talk about the growing corporate demand for soil carbon (see No. 1). We hear from Macro’s Charles King, producer of Judas and the Black Messiah, and this week’s Agent of Impact. Plus, the headlines. Catch the latest episode, and follow us on Apple, Spotify or wherever you get your podcasts.

Next week’s Call: Opportunities at the intersection of gender and climate. Investments by, in and for women are generating tangible climate benefits – and returns across geographies and asset classes. Join Pax World Funds’ Julie Gorte, ANDE’s Richenda Van Leeuwen, WIC Capital’s Evelyne Dioh, GenderSmart’s Suzanne Biegel and Dolika Banda, former CEO of African Risk Capacity on ImpactAlpha’s Agents of Impact Call No. 27, Tuesday, Feb. 23, at 9am PT / 12pm ET / 5pm London / 8pm Nairobi. RSVP now.

The Week’s Big 7

1. Farming carbon. Farmers in Iowa and ranchers in Australia are selling more than soybeans and beef. The carbon they sequester in their soil with cover crops, no-till farming, rotational grazing and other sustainable-agriculture techniques is fetching $20 a ton. Prices look to go higher as corporations scramble to lock in still-low prices and make good on ‘net-zero’ pledges to phase out greenhouse gas emissions by 2050 or sooner. Dig in.

2. Making global health innovation accessible. Adjuvant Capital raised $300 million to commercialize late-stage medical solutions for neglected diseases such as malaria, shigella, hookworm, HIV and tuberculosis. The fund, anchored by $75 million from the Gates Foundation, will adopt the foundation’s “global access agreements” to ensure medical advances are affordable in low-income countries. Onward.

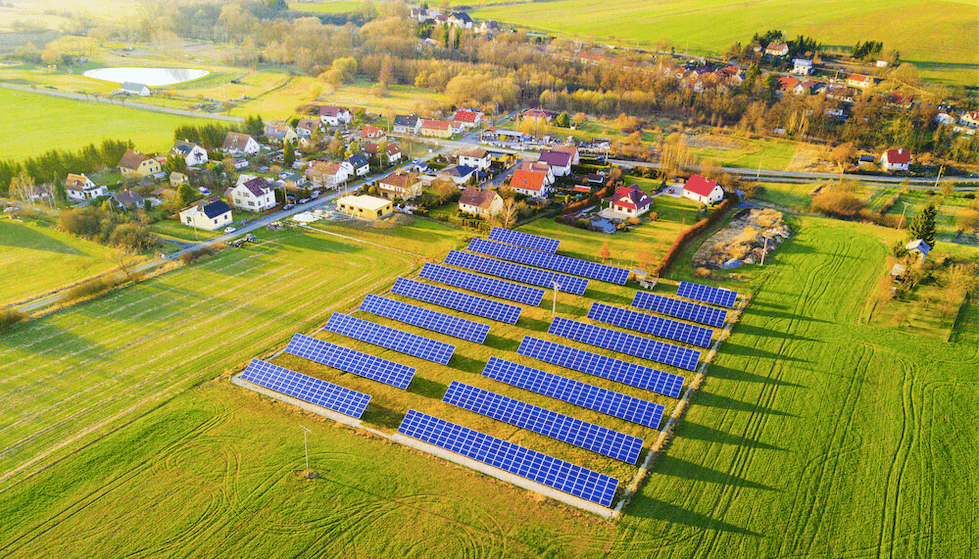

3. Building smart and resilient grids. The claim that frozen wind turbines caused Texas’ harrowing power outages? All hat, no cattle. Texas’ failure to build a smart and resilient grid highlights the nationwide need for 21st-century infrastructure. Electricity demand is expected to triple in the next 20 years. Investable solutions include microgrids, smart software, distributed storage and cheap and reliable renewable generation. Keep reading.

4. Caprock’s Nick Flores walks the talk. The personal assets of financial advisors like Caprock Group’s Nick Flores are generally much smaller than those of the clients they serve. “Like me, none of them had a +$10 million balance sheet,” says Flores. In the latest edition of Walking the Talk, an ImpactAlpha series with Confluence Philanthropy, Flores lays out how he has “tried to channel my passions and purpose into my portfolio.” Go deeper.

5. How President Biden can ‘pay for success.’ The pandemic has decimated state budgets and increased the demand for social services. ‘Pay for success’ contracts, also known as social impact bonds, “can be harnessed to free up government spending and build back better,” writes Ibrahim Rashid in a guest post on ImpactAlpha. More.

6. Ten-digit net-zero opportunities. Mark Carney and Jeffrey Ubben are raising multi-billion dollar funds to help companies transition operations to net-zero greenhouse gas emissions. Carney, former Bank of England chief, special climate envoy to the U.N. and vice chair of Brookfield Asset Management, has called the transition to a net-zero economy the “greatest commercial opportunity of our age.” Brookfield is looking to raise $7.5 billion for its Global Transition Fund. Inclusive Capital’s Ubben is aiming for $8 billion. Bulk up.

7. Fighting fallacies of legacy finance. Shareholder primacy, short-termism and obsolete notions of risk and reward must be retired to accelerate progress toward an inclusive economy, Annie Donovan of the Local Initiatives Support Corp. writes in a guest post on ImpactAlpha. “Impact investors,” she says, “should take creative approaches to capital, challenge outdated assumptions, and also support public policies that advance community investing.” Hear her out.

The Week’s Agent of Impact

Charles King, Macro. The former Hollywood super agent spotted a disconnect. Those green-lighting movies and TV didn’t represent the diverse audiences consuming them. “There was such a tremendous void of opportunity,” King said recently on Variety’s Strictly Business podcast. The producer and entrepreneur founded the film finance and production company Macro in 2015 to put voices and perspectives of persons of color in front of mass audiences. Macro’s latest film, Judas and the Black Messiah, depicts the betrayal of Fred Hampton, the leader of the Illinois chapter of the Black Panther Party in the late 1960s. Macro has achieved critical success with movies like Fences, Just Mercy, and Mudbound. Macro’s first two TV offerings, Raising Dion, one of the 10 most popular Netflix series of 2019, and Gentefied, have both been renewed. The slate is also financially outperforming. King says Macro has recouped or made a return on 80% of its projects – a rare feat in the media business.

To change the industry and its culture, King says he tapped investors who “saw the impact side, but most importantly, they saw the business opportunity” (see, “Investing in the impact of powerful new voices in film and video games”). He raised $150 million from Emerson Collective and the Ford, Kellogg and Libra foundations to produce a slate of films and TV shows (Emerson led the investment in Macro’s holding company as well). Getting authentic, high-impact stories seen by as many people as possible has meant working with superstars like Denzel Washington and Michael B. Jordan, as well as rising talent like Daniel Kaluuya and Lakeith Stanfield. For Judas, he teamed up with Black Panther producer Ryan Coogler to amplify the story of new writer and director Shaka King. He has co-financed films with Participant Media to drive impact, and with Warner Brothers for global distribution. That reach, including deals with HBO Max, Disney Plus, Amazon and Apple, as well as Netflix, is invaluable, he says. “To be able to do that in this environment, in six years, to become a go-to company for this space, authentically, you couldn’t put money on that.” – Dennis Price

The Week’s Dealflow

Low-carbon transition. Canada’s Eavor raises $40 million to commercialize geothermal power… Rheaply scores $8 million to help companies recycle and reduce waste… Energy Impact Partners backs EV infrastructure venture… SunCulture raises $11 million in debt to expand solar irrigation in Africa… HomeBiogas goes public in Israel.

Access to… DFC backs women’s health startup Kasha Global… Motley Fool Ventures backs women’s healthcare fund SteelSky Ventures… Reach Capital closes $165 million fund for edtech startups.

Impact debt. Carlyle Group secures ESG-linked credit tied to board diversity goals… Goldman Sachs issues $800 million sustainability bond… Tikehau Capital’s impact lending fund raises €100 million.

Agrifood investing. Protix raises capital to farm insects for protein… Redefine Meat raises $29 million for 3D-printed meatless steaks.

Responsible fintech. Alt-lender TomoCredit secures $7 million to help first-time borrowers… SoLo raises $10 million to provide an alternative to payday lending.

The Reconstruction. Thermo Fisher Scientific invests $25 million in lenders to Black businesses… Ariel Investments scores $200 million from JPMorgan to diversify supply chains.

The Week’s Talent

Nigeria’s Ngozi Okonjo-Iweala is appointed to lead the World Trade Organization (see, “Agent of Impact: Ngozi Okonjo-Iweala)… Tech banker Chris Buddin and industrial banker Fausto Monacelli will lead a new electric vehicle financing group from Goldman Sachs… Treasury Secretary Janet Yellen is considering Sarah Bloom Raskin, former chair of i(x) Investments, to lead the department’s climate efforts… Halcyon Angels’ Dahna Goldstein is appointed director of impact investing at Halcyon Incubator… Kate Byrne, ex- of SOCAP, joins Oslo-based Katapult.

Amir Kirkwood of Opportunity Finance Network, CJ Callen of Chan Zuckerberg Initiative, David McClean of DMA Consulting Group, and Lee Merkle-Raymond of Hercules Capital join the board of RSF Social Finance… B3am’s David Bosun-Arebuwa, Black’s Adam Taylor and Film3D’s Abdou Sarr join the inaugural cohort of Apple’s Entrepreneur Camp for Black Founders and Developers… Preeti Sinha is the new executive secretary of the United National Capital Development Fund, which facilitates financing for the world’s 46 least-developed countries.

The Week’s Jobs

Mission Investors Exchange is recruiting a chief operating officer in New York… Luminate is hiring an associate of partner support in Nairobi… Cartica Management seeks an ESG engagement manager in the Washington-Baltimore area… First Children’s Finance is recruiting a national director of lending.

That’s a wrap! Have a wonderful weekend.

– Feb. 19, 2020