TGIF, Agents of Impact!

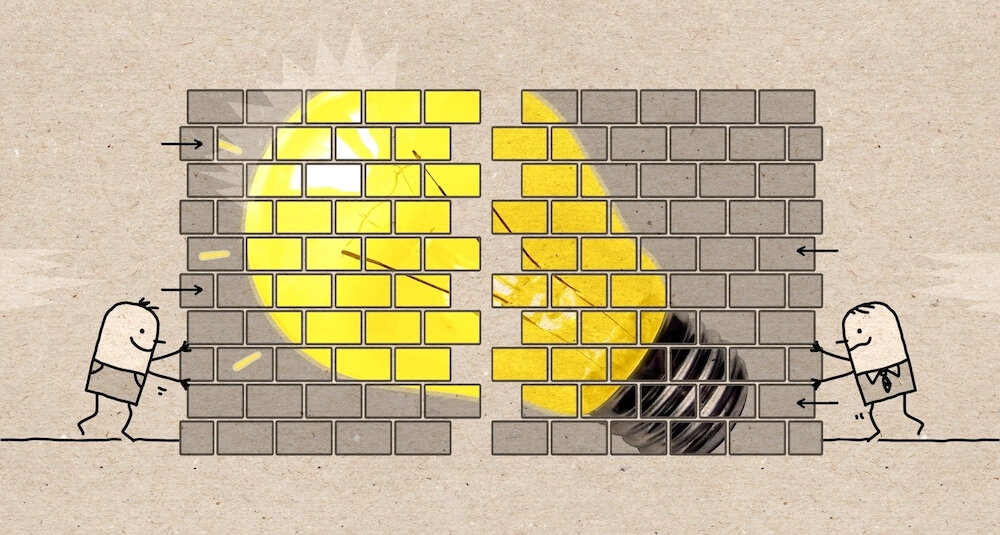

🗣 Time to build. Silicon Valley has long been mocked for building solutions to problems of the privileged. Taxis on demand. Instant food delivery. The next new gadget. The crypto crash and wipeout of so many publicly traded tech stocks (and so much wealth) puts a finer point on the critique. Seth Bannon of Fifty Years couldn’t resist needling Marc Andreessen this week after Andreessen Horowitz said it raised a $600 million “Games Fund One.” That followed news the Sand Hill Road firm is raising $4.5 billion for a new set of crypto funds. A few years ago Andreessen penned an ambitious essay, “It’s Time to Build,” in which he took Western institutions to task for their collective “failure of action, and specifically our widespread inability to build.” Bannon wondered why Andreessen wasn’t championing vaccines, therapeutics, housing, connectivity, bio-manufacturing, industrial infrastructure and sustainable transportation. “If you want to join a firm that backs the kind of things you wrote about in your wonderful essay,” tweeted Bannon, “Fifty Years is hiring.” Fifty Years’ latest investment, in HealthLeap, helps hospitals deliver the right nutrient mix to malnourished patients.

Agents of Impact have been building. The busy grocery store on Buffalo’s east side that was the scene of last weekend’s horrific mass shooting was the result of a decade-long push by local residents to build a pillar of community health in what had been a food desert. With VC Include, Bahiyah Robinson is building the next generation of diverse climate fund managers (see Impact Briefing, below). In Chicago, financiers and developers have a plan to build affordable housing by coordinating public and private capital from the American Rescue Plan and Opportunity Zones, respectively. Investors, including private-equity giant KKR, are building – and sharing – wealth with worker-ownership strategies that turn earners into owners. German startup Yapu is helping smallholder farmers build resilience to a changing climate with financing to adapt to changes in weather, water and other conditions. To weather the booms and busts, ImpactAlpha’s Amy Cortese said at this week’s Total Impact conference in Philadelphia that we need to shift our mindset from “rescue to resilience.” That means shifting power to leaders close to the problems and giving them the capital, Cortese says, “to build inclusive, sustainable and resilient local economies.” – Dennis Price

The Week’s Podcast

🎧 Impact Briefing: Building the next generation of diverse climate fund managers. “My question when I’m really quiet, or even when I’m talking to close friends and colleagues, is one word: Why? Why does this continue to happen?” On this week’s podcast, VC Include’s Bahiyah Yasmeen Robinson (right, above) shares with host Monique Aiken her feelings in the wake of the racist attack in Buffalo. “Why does our community continue to be and has for so many hundreds of years been targeted, particularly with all the contributions we’ve made to this country, and to its building and its maintaining and its innovation?”

Robinson and her Include Ventures partner, Taj Eldridge, are raising $250 million for a fund of funds led by climate-focused managers of color – part of their strategy to increase the number of diverse-led climate funds ten-fold by 2030. VC Include’s climate-justice initiative last month seeded that effort with $1 million in operational grants to 10 emerging climate managers in the U.S. and Europe. “When allocators ask, ‘How can we support investments in climate solutions, particularly in communities of color?’ – this is one of the most powerful ways that you can do that,” Robinson says. “And we wanted to show that and not just talk about it.”

- Plus, the headlines. Listen to this week’s episode, and follow all of ImpactAlpha’s podcasts on Apple, Spotify or wherever you listen.

The Week’s Dealflow

Deal spotlight: Clean energy abundance. Clean energy efforts in Bangladesh, Brazil, Colombia, Kenya, Mozambique, Nigeria, Pakistan, South Africa, Turkey and Vietnam will get $242 million in support from Bloomberg Philanthropies. Bloomberg will work with ClimateWorks Foundation and Sustainable Energy for All to expand access to renewables and phase out coal.

- Cleantech. Infinitum Electric raised $80 million to commercialize electric motors… Soluna scored $35 million from Spring Lane Capital to use wasted clean energy for crypto mining… Optivolt scored $8.2 million in a seed round backed by Social Impact Capital to produce solar power, even in shaded environments, for electric vehicles, IoT devices and more… UtilityAPI raised $10 million in Series A funding, led by Aligned Climate Capital, to build data exchange tools for clean energy companies and utilities… Ambient Photonics raised $31 million in Series A funding to develop self-charging battery chips for smart home devices and consumer electronics.

Agrifood investing. Robert Downey Jr.’s FootPrint Coalition Ventures backed Motif FoodWorks to develop new types of plant-based food… Sencrop secured $18 million to help farmers manage “ultra-local” weather risks… AXA, Unilever and Tikehau Capital seed regenerative agriculture fund with €300 million… Funds managed by Verdane and Pioneer Point Partners acquired Norway’s Scanbio Marine to build an aquaculture waste management business.

Climate finance. La Banque Postale Asset Management secured €270 million for a planned €700 million impact climate infrastructure debt fund… The OPEC Fund for International Development extended a $25 million loan to CIFI to finance energy, water and sanitation, transportation and other projects in Latin America and the Caribbean… Sustain.Life secured $16 million to help small businesses take climate action.

Economic inclusion. ABC Fund invested in Ghana’s Success for People and in Benin’s PEBCo to provide microloans to thousands of smallholder farmers… Germany’s Bliq raised $13.5 million in a Series A round to build an app that helps gig economy workers manage workflow… Qoala secured $65 million to make insurance affordable and accessible in Southeast Asia… British International Investment provided a $100 million guarantee for supply-chain financing in Africa.

Investing in health. Elemeno Health raised $7 million in a Series A round led by SJF Ventures to help nurses execute day-to-day tasks to improve patient care… Mahmee, a woman-led maternal health startup for new mothers, raised $9.2 million… Pharos Capital Group invested in Sanderling Renal Services to provide telemedicine services for kidney patients in underserved communities.

Energy transition. Global Infrastructure Partners acquired the clean energy business Atlas Renewable Energy from Actis in a deal valued at nearly $2 billion… KKR agreed to purchase U.K.-based clean energy producer ContourGlobal for nearly $2.2 billion.

Sustainable solutions. Generation Investment Management raised a $1.7 billion sustainable solutions fund… HowGood secured $12.5 million, led by Titan Grove, to build a product sustainability database for food and personal care brands and retailers.

Returns on inclusion. Black Tech Nation, a Black-owned venture fund, secured $2.5 million in equity financing from FNB Corp. to invest in Black-led technology firms and startups.

The Week’s Talent

Troy Spence, ex- of PwC, joins Reinvestment Fund as managing director of risk and compliance… Victor van Hoorn steps down as executive director of Eurosif this summer… Nuveen’s Nadir Settles is appointed to lead Nuveen Real Estate’s new impact investing strategy. Pamela West, managing director of Nuveen’s affordable housing portfolio, becomes impact investing senior portfolio manager.

The Week’s Jobs

Eurosif is recruiting an executive director… PCV is hiring a research analyst in its Good Jobs Innovation Lab and a senior credit underwriter, among other roles… Fish Choice seeks a fishery improvement project analyst… Windward Fund’s Sunrise Project seeks an auto supply chain senior strategist… Steans Family Foundation is looking for a director of operations in Chicago… Candide Group is hiring a principal and a senior associate for its climate justice fund in Oakland.

Carbon Tracker is hiring a head of stewardship and a company research analyst of oil, gas and mining in North America… Toucan Protocol seeks a policy and impact lead… Quantified Ventures seeks a client senior associate and an associate director and senior associate of health and human services… LeapFrog Investments is recruiting a strategy manager in Sydney… On Purpose has opened applications for its October associates program.

Ben Franklin Technology Partners of Southeastern Pennsylvania seeks an impact analyst… World Wildlife Fund U.S. is hiring a finance director for its nature-based solutions origination platform in Washington, D.C… Palladium Impact Capital is looking for a director in New York or London… Reinvestment Fund has multiple openings in Atlanta and Philadelphia… Village Capital has an opening for an investment analyst in the U.S.

That’s a wrap. Have a wonderful weekend.

– May 20, 2022