ImpactAlpha, May 19 — Generation Investment Management has raised $1.7 billion for its fourth Sustainable Solutions Fund. The private equity fund is Generation’s largest to date and the latest in the billion-dollar impact and sustainability fund club.

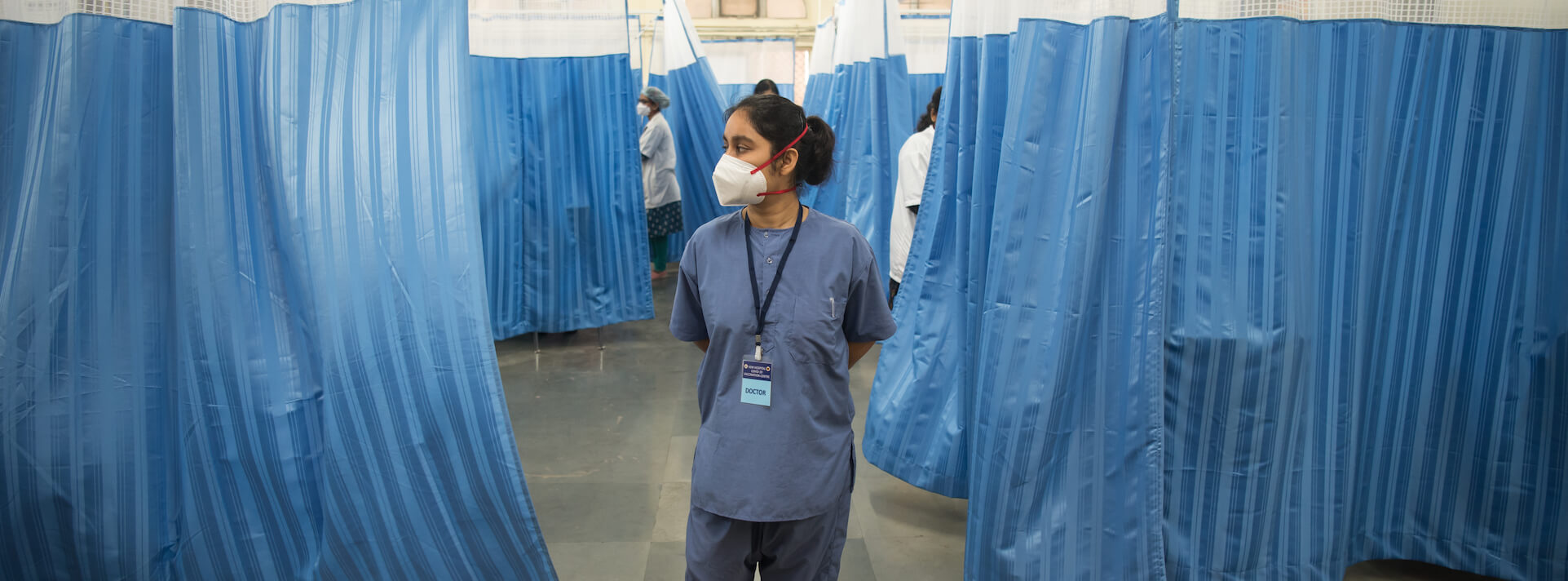

The $36 billion manager’s sustainable solutions fund will follow strategies similar to its predecessor, which raised $1 billion for global low-carbon and climate solutions, human health, financial inclusion and the future of work. Deal sizes will range from $50 to $150 million.

Limited partners include pension funds, endowments and high-net-worth individuals; more than half of the investors are from the U.K., Australia, New Zealand and the rest of Europe.

Sustainable portfolio

Generation’s private equity funds have deployed $2 billion since 2008. Portfolio companies include Kenyan pay-as-you-go finance company M-KOPA, sustainable nitrogen biofertilizer producer Pivot Bio, home healthcare platform AlayaCare, Taiwanese electric scooter maker Gogoro, tech upskilling company Andela and others.