Greetings, Agents of Impact!

Featured: Catalytic Capital

How foundations used pandemic-era bonds to catalyze capital for social infrastructure. Faced with 2020’s extraordinary set of crises, from a global pandemic to a racial-justice reckoning, most philanthropies went into self-preservation mode. In contrast, Ford, Rockefeller, MacArthur and at least six other foundations moved to increase giving to meet what Ford’s Darren Walker called “an existential challenge to the future of the nonprofit sector.” The foundations issued “social bonds” and other debt worth almost $3 billion and, in some cases, doubled their grant funding. Two years on, the eight foundations stand by the unprecedented decision, according to the Associated Press. “If we can’t swing for the fences at a time like this and use every aspect of our resources to try to make a difference in an existential moment, what are we here for?” Ford’s Hillary Pennington told the AP.

- Access to cash. Instead of dipping into their endowments, the move allowed foundations to tap global bond markets for cash at historically low interest rates. While countries and companies during the pandemic drove record issuances of social bonds to fund small business support, healthcare and public health solutions, and new technologies and medicines, the issuances were a first for philanthropic foundations. “It was a bonus that this also created an innovative and impactful product for #ESG and #impact investors,” Ford’s Margot Brandenburg wrote on LinkedIn.

- Flexible capital. Ford, which issued the largest bond at $1 billion, has spent more than $900 million of the funds raised. More than 70% of the grants have gone to organizations led by people of color and 87% of grants were marked for vital general support. Rockefeller, which issued $700 million in bonds, earmarked 10% for its own building renovations. The foundation put a “significant portion” of the balance into Rockefeller Foundation Catalytic Capital, a pooled fund that placed bets on an institute focused on preventing pandemics, a collaboration focused on the low-carbon transition, and other initiatives, according to the AP. With $300 million raised through bonds, California Endowment is supporting movement-building and healthcare infrastructure.

- Social bonds. Some of the bonds, including Ford’s, met the criteria for “social bonds” and were purchased by insurance companies like CNA Insurance and TIAA-CREF, investment firms like PIMCO, J.P. Morgan and BlackRock, and New York state’s public pension fund. The foundations will pay back the purchasers with interest over 30 and 50 years. Others, like those issued by Rockefeller, were issued without seeking certification as social bonds (disclosure: the Ford, MacArthur and Rockefeller foundations have been sponsors of ImpactAlpha). The added value has sparked new thinking about how to leverage capital markets for good. “People don’t actually imagine how much more we could do if we just thought a little bit more creatively,” said Pennington. “It just kind of shows you how much value we leave off the table.”

- Keep reading, “How foundations used pandemic-era bonds to catalyze capital for social infrastructure,” by Dennis Price on ImpactAlpha.

Dealflow: Future of Work

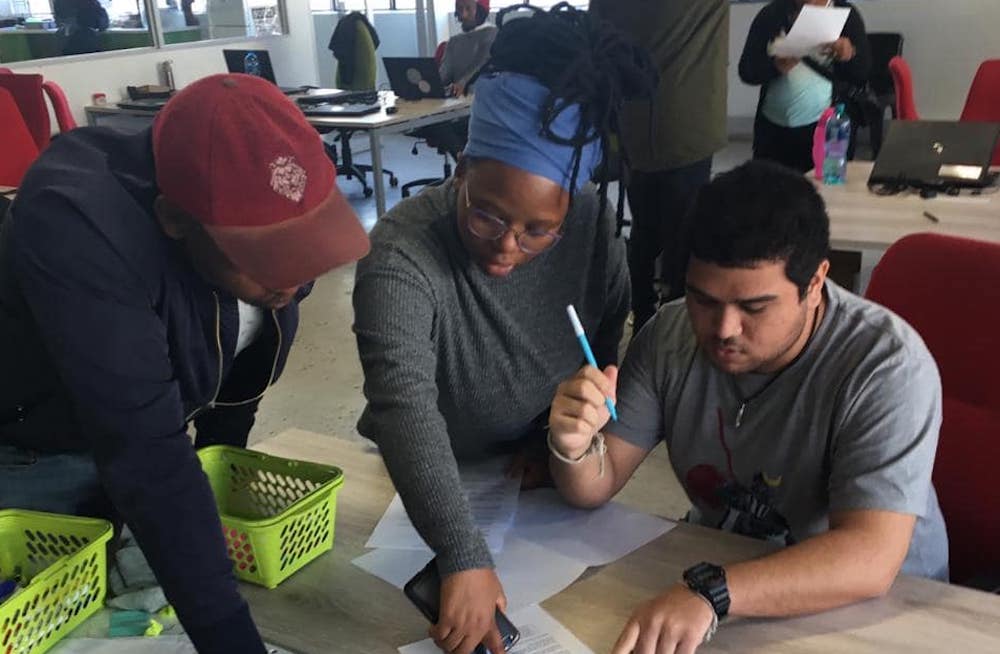

Village Capital and Moody’s accelerate 45 startups shaping the future of work in Africa. The median age in Africa is 19 years, making it by far the world’s youngest continent. At least 10 million young Africans enter the labor market each year. Village Capital and Moody’s second Future of Work Africa accelerator is supporting 45 startups boosting education and employment prospects for young people across the continent. Many are online job and gig platforms. “Meaningful employment for African youth is foundational to improving financial health and driving a strong economy,” said Village Capital’s Audrey Mate. “There’s a great need to strengthen models that bridge the skills gap, enhance employability, and prepare job candidates for the shifting job landscape.”

- Primary cohort. In South Africa, which has the highest unemployment rate in the world, Project CodeX offers programming training to under-resourced youth. Eloh App connects gig workers such as cleaners and beauticians to customers. Five startups are based in Kenya, including Onesha Technologies, which connects small businesses to skilled freelancers and creatives, and Kazi Remote, which helps young writers, translators and transcribers find clients. The full list.

- Virtual accelerator. Thirty of the startups are participating in a self-guided and virtual-only program. Ghana-based Prodigee provides skills training and online job-matching. OnLocum in Kenya connects healthcare workers with hospital shifts. Lagos-based Life Beyond Class offers online masterclasses focused on career development and soft skills.

- Learn more.

BlackRock acquires Akaysha to deploy $700 million for battery storage in Australia. Battery storage is “a fundamental requirement” to realize the $100 trillion opportunity presented by the transition to net zero, BlackRock’s Charlie Reid, told Australia’s Financial Review. Reid, co-head of BlackRock’s climate infrastructure strategy for Asia and the Pacific, led the acquisition of Akaysha Energy, a Melbourne-based developer with nine energy storage projects. BlackRock will invest more than A$1 billion (US$702 million) over the three to five years to help Akaysha develop one-gigawatt of battery storage capacity in Australia. Akaysha will also invest in energy storage in Taiwan and Japan.

- Clean-energy transition. The deal is BlackRock’s first for battery storage in the Asia-Pacific region. The region “is at the dawn of its energy transition from carbon-emitting fossil fuels to intermittent renewable resources,” said Akaysha’s Nick Carter. “A successful shift to a more sustainable energy future is dependent on the use of large-scale battery storage.” BlackRock last year invested in JOLT to accelerate electric vehicle adoption in Australia.

- Share this post.

Dealflow overflow. Other investment news crossing our desks:

- Gridserve secured £200 million ($242 million) from Infracapital, a subsidiary of M&G, to build a network of electric vehicle charging stations that operate on clean energy.

- CareHarmony raised $15 million in Series A funding to provide low-cost virtual healthcare services.

- Mexico City-based Atarraya secured $3.9 million for its sustainable shrimp farming tech.

- Canada-based Reusables, which provides reusable food packaging to reduce food waste, scored $100,000 from Sustainable Development Technology Canada.

- Verod-Kepple Africa Partners received an undisclosed investment from Toyota Tsusho Corp. to invest in startups focused on healthcare, consumer goods and carbon-neutrality in Africa.

Agents of Impact: Follow the Talent

San Francisco’s Department of the Environment seeks a racial equity senior coordinator… Galvanize Climate Solutions is hiring a vice president of science and technology in New York or San Francisco… The city of Asheville, N.C. is recruiting a sustainability coordinator… Nedbank is looking for a senior analyst of sustainability and ESG in Johannesburg… Ownership Works is hiring for several roles in New York, including a marketing analyst, a director of data and research, and a director of culture and employee engagement.

Morgridge Family Foundation is accepting applications for the Morgridge Acceleration Program Fellowship until Friday, Oct. 14… Convergence is accepting applications for its Design Funding program for early-stage blended finance solutions. The deadline for the Gender-Responsive Climate Finance program is Friday, Sept. 9. and for the Asia Natural Capital program is Friday, Sept. 30. Convergence is hosting Design Funding 101 webinars, Wednesday, Aug. 24 and Thursday, Aug. 25… Registration is now open for the Opportunity Finance Network’s annual conference, Oct. 18-21 in New York.

Thank you for your impact!

– Aug. 17, 2022