Greetings, Agents of Impact!

👏 Agents of Impact Call No. 42: The rise of alternatives to venture capital. From revenue-based financing to crowdfunding (or community rounds, rather) the explosion of alternative startup financing structures is diversifying who and what gets funded. Join Kim Folsom of Founders First Capital, Wefunder’s Jonny Price and other Agents of Impact to explore how new funding structures are changing startup investing for good, Tuesday, May 10 at 10am PT / 1pm ET / 6pm London. RSVP today.

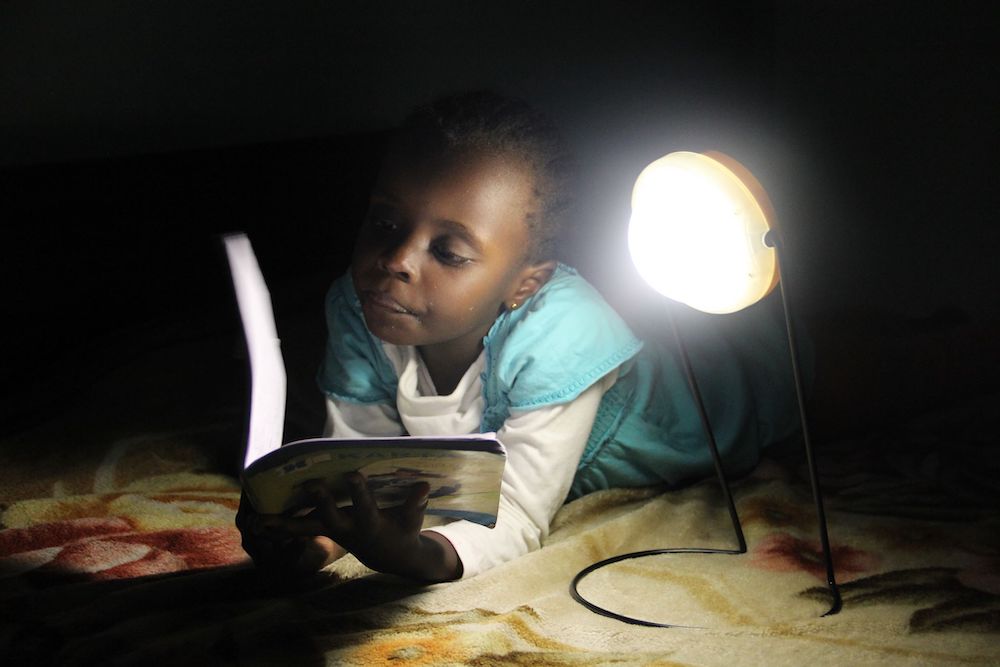

Featured: Energy Access

Can off-grid solar keep focus on energy access for the poor as commercial capital arrives? It’s one of the conundrums of the pandemic: commercial capital is pouring into off-grid electricity companies in Africa and elsewhere, but progress toward expanded access to energy has stalled. Investor confidence in makers of solar lanterns and small home systems reflects expectations that such systems will play a major role in providing energy access for the 770 million people around the world who still lack access to reliable electricity. But reductions in the number of people without electricity stalled during the COVID-19 pandemic, according to the International Energy Agency, after improving an average of 9% per year from 2015 to 2019. The number of people in Africa without access to energy went up in 2020 for the first time since 2013. In a roadmap released last year, U.N. Secretary General António Guterres called for investments in universal energy access of $35 billion a year in order to reach 500 million people by 2025. That sets up off-grid solar as a test case for impact investors who helped build the sector: Can their early focus on the poor survive the transition to commercial capital?

“We’ve seen some companies move upmarket because there’s more pressure on margins, and profit ratios need to be bigger, as you go to more commercial funding,” says 60 Decibel’s Kat Harrison. Last week, Sun King, which makes and sells small solar lanterns and home units in 40 markets, raised $260 million in equity, led by BeyondNetZero, General Atlantic’s climate investing arm. In March, Nairobi-based M-KOPA raised $75 million, led by Generation Investment Management. San Francisco-based Zola Electric raised $90 million in equity and debt last September. And BBOXX, which has raised close to $200 million in debt and equity, is in talks to acquire Ghana-based peer, PEG. “Off-grid solar is a tough and complicated business where companies need to excel on multiple fronts: product design, last mile distribution and consumer financing,” Bamboo Capital’s Christian Schattenmann told ImpactAlpha. “Only the most efficient companies are able to survive and become financially sustainable so that they can achieve social and environmental impact at scale.”

- Keep reading, “Can off-grid solar keep focus on energy access for the poor as commercial capital arrives?” by Jessica Pothering on ImpactAlpha.

Dealflow: Climate Tech

Sealed snags $30 million for energy retrofits for homeowners. The New York-based company offers energy retrofits for homeowners at no up-front cost and works with contractors, technology providers and utilities to simplify the experience. Insulation, air sealing, smart thermostats and heat pumps can save customers up to 50% on energy costs. Sealed gets paid based on those monthly savings. The company grew 350% last year, buoyed by a five-fold increase in heat pump installations. “We try to make it easy and affordable,” Sealed’s Lauren Salz told ImpactAlpha. “Our biggest competition is people doing nothing.”

- Room to grow. Home energy use accounts for 20% of total U.S. carbon emissions. The $29.5 million Series B round was led by Fifth Wall Climate Tech with participation from Robert Downey Jr.’s FootPrint Coalition, CityRock Venture Partners and other investors. Sealed will expand from its base in the Northeast U.S. and double its staff, said Salz.

- Get pumped.

$55 million pours in for Brimstone to decarbonize cement. At least 8% of global emissions are generated by concrete, a key building material for everything from buildings to bridges. Oakland-based Brimstone Energy was founded by two Caltech scientists to decarbonize Portland cement, a key ingredient in concrete. The company uses calcium silicate instead of limestone, because limestone releases its embedded carbon when heated. A byproduct of Brimstone’s process – magnesium – absorbs carbon from the air. The Series A round was co-led by Breakthrough Energy Ventures and DCVC. Fifth Wall and Amazon’s Climate Pledge Fund also backed the round. Brimstone will use the funds to build a pilot plant in Nevada.

- Building blocks. Startups working on ways to green cement include Alberta, Canada-based Carbon Upcycling Technologies, which recently raised $6 million to produce carbon-enhanced additives for the concrete industry. CarbonCure Technologies and CarbonBuilt each won $7.5 million last year for a carbon reuse XPRIZE.

- Share this.

Dealflow overflow. Other investment news crossing our desks:

- Tanzania’s NMB Bank floated a “gender bond” on the Dar es Salaam Stock Exchange, the first-ever to list on an African exchange. The bond is backed by FSD Africa.

- KKR launched Aster Renewable Energy to develop and operate solar, wind and energy storage projects in Taiwan, Vietnam and other Asian markets.

- Ruth Health raises $2.4 million in a round led by Giant Ventures to scale its pre- and postnatal telehealth platform.

- BlueOrchard’s InsuResilience Investment Fund will acquire a minority stake in Phnom Penh-based Forte Insurance Group.

Agents of Impact: Follow the Talent

Alex Nisichenko, ex- of Blackstone, joins TowerBrook Capital as managing director to build the firm’s impact investing activities in North America… Apollo Global Management is hiring a head of ESG data strategy in New York… Bridges Fund Management is looking for an associate of impact management in London… The Packard Foundation is recruiting a mission investing operations manager… SVX seeks a project manager for Colombia in Bogota.

World Wildlife Fund is looking for a finance director for its nature-based solutions origination platform in Washington, D.C… Reinvestment Fund seeks a director of diversity, equity and inclusion in Philadelphia… The Impact Investing Institute is hiring a non-executive director and international development expert in the U.K… Invest for Better seeks a part-time marketing and outreach manager.

ImpactPHL is convening “Total Impact: Investing for New Economies,” in Philadelphia, May 16-17. ImpactAlpha subscribers get $300 off with code IMPACTALPHA… Clara Miller is keynoting “Money and Mission: Creating 21st Century Capital Markets for Better Social Outcomes,” at the Federal Reserve Bank of New York on May 17.

Thank you for your impact!

– May 2, 2022