ImpactAlpha, January 24 — Summa Equity launched in 2016 to invest in companies working to solve the global challenges identified in the U.N. Sustainable Development Goals.

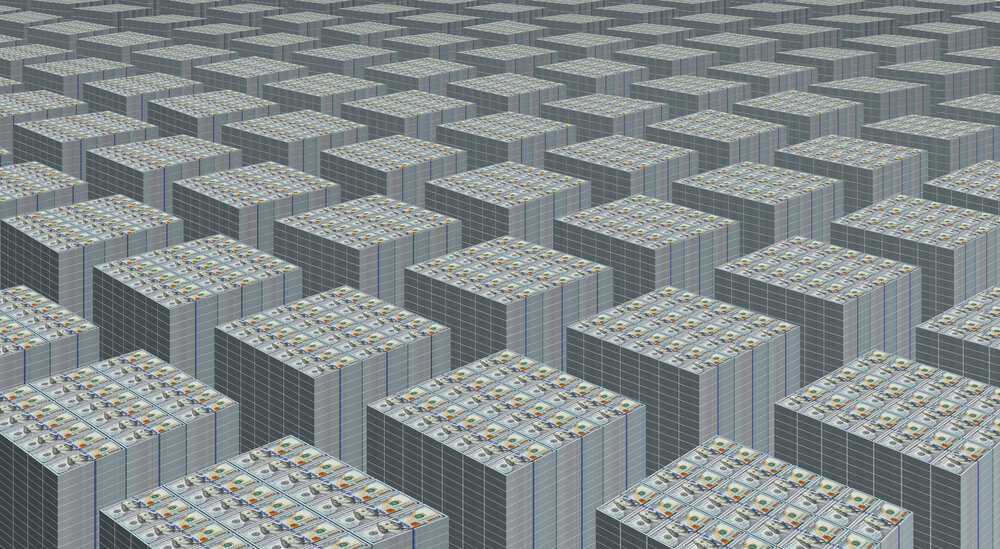

The Swedish private equity firm raised €470 million ($533.3 million) for its first fund in 2017 and €680 million ($771.6 million) for its second fund in 2019. Stockholm-based Summa has raised €540 million ($612.8 million) in co-investments, bringing its total raised to date to nearly €4 billion ($4.5 billion).

Like the earlier funds, Fund III will focus on megatrends such as aging populations, migration, resource scarcity, population growth, climate change and technological disruption, and will invest in companies “across the spectrum from young, high-growth companies to more mature firms,” said Summa’s Reynir Indahl.

Climate finance

Global pension funds, insurance companies, foundations and endowments, family offices and other financial institutions backed the fund. Summa said its fundraising was completely virtual and completed within four months.

Summa’s portfolio includes 22 companies, including ZeroAvia, which is aiming to decarbonize air travel with hydrogen-powered engines.