Optimizing for Impact. Want to learn more about Optimizing Impact for the Sustainable Development Goals? Over the next few weeks, ImpactAlpha will offer a sampling of Cathy Clark’s favorite videos from the Coursera course, “Impact Measurement and Management for the SDGs,” developed by CASE at Duke and the U.N. Development Program – with commentary from Cathy.

WHY I LIKE IT: There’s so much in this one 20 minute video! I like it because we ended up creating a really concrete three-step process for investors to manage and optimize data. It’s so simple we broke it down into 3 questions: What happened? Why did it happen? And what will you do next? We delineate what you do with positive and negative deviations from your plan.

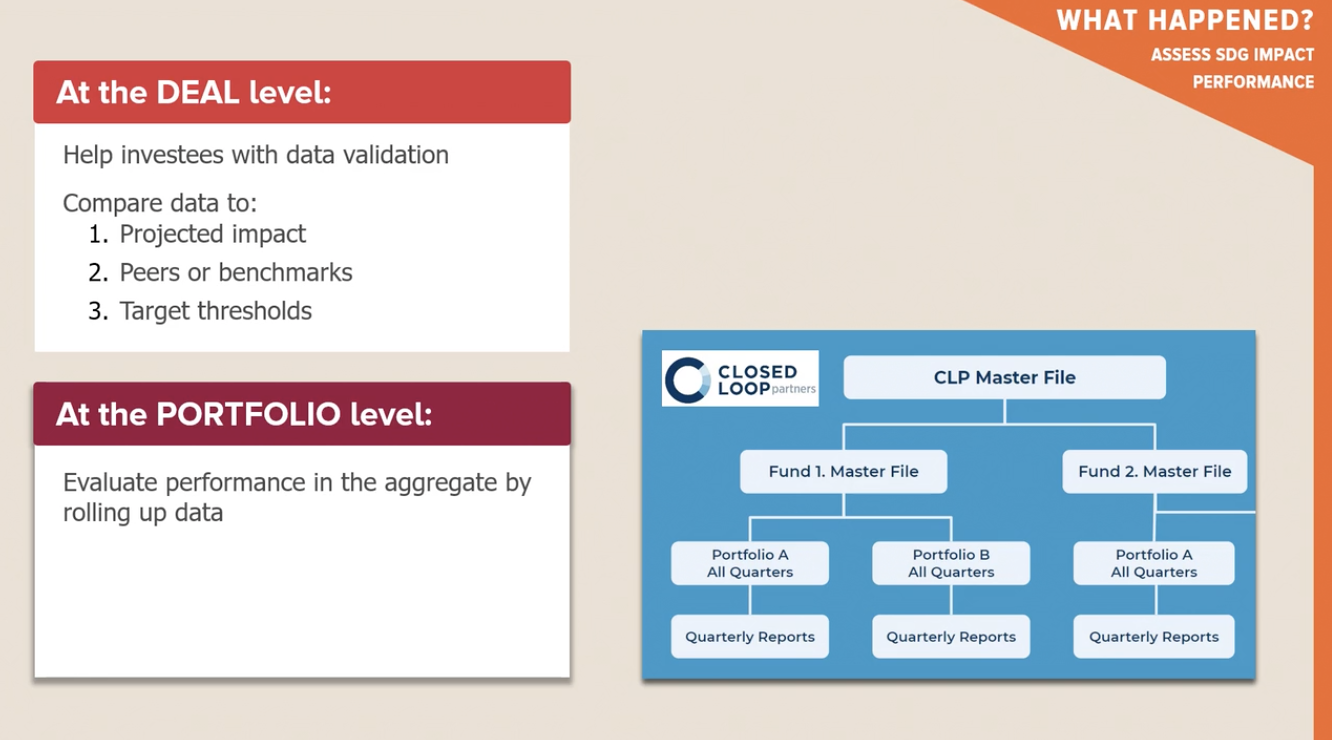

We also talk about the kinds of data comparisons you can make to create meaning out of performance. And the video contains examples of investors doing this in tangible ways, at both deal and portfolio levels. We also discuss monetization methods for assigning a dollar value to your impact results.

HOW TO USE IT: I’m not an investor, but I am an impact manager and I took these three steps into my own internal reporting a few months ago. It helped us move from static key performance indicator reporting like X% of students were satisfied with Y program last year. The problem with this is that our deans had little context to judge the data. To improve our practice, we reported what happened, but then asked why it happened and what it meant, looking for relevant comparisons, and explaining our best guesses at what it revealed. Asking better questions helped us see relationships among different data sources in entirely new ways.

We also surveyed our key stakeholders (our students), formulating possible solutions and choosing among them based on their feedback. Later when we presented our possible new actions for next year, I felt our deans completely understood our decision-making process. Indeed, they agreed with everything we proposed. I feel like this three-part structure could go into every management conversation about major impact goals and actions. I’m bringing it into my conversations on other boards as well.

COMMON MISTAKES: The most common mistake is sharing a set of key performance indicators with a decision-maker without context and without discussion of how they relate to decisions to be made about the future. How many impact reports today are doing just that? Here’s an example I’m seeing often: I went to a board meeting recently and the organization told me, “We surveyed our staff and 78% said we are doing better at diversity, equity, and inclusion, or DEI.” How do I as a board member make sense of that? Is it good, bad, or neutral? For context, how many people answered? How many were people of color? Did responses vary across identity groups?

For decision-making, do you think you are doing the right things, need to do new different things, need to stop some things? The goal is to serve up actionable decisions that represent good management of impacts based on the meaning you make of the data. My tip: add meaning to the discussion. The decision-maker might disagree with your interpretation or action steps but at least they can follow your process.

Ready to dig into the full training?

- Sign up free on Coursera for Impact Measurement and Management for the SDGs.

- Enter the Optimizing Impact Challenge – the first 100 people who post their course completion certificate on LinkedIn will receive a small gift from CASE as well as a mention by ImpactAlpha. Send an email to [email protected] with your LinkedIn profile or proof of completion certificate to enter.

- View prior posts in this series and the recap and replay of The Call: Optimizing for Impact.