Optimizing for Impact. Want to learn more about Optimizing Impact for the Sustainable Development Goals? Over the next few weeks, ImpactAlpha will offer a sampling of Cathy Clark’s favorite videos from the Coursera course, “Impact Measurement and Management for the SDGs,” developed by CASE at Duke and the U.N. Development Program – with commentary from Cathy.

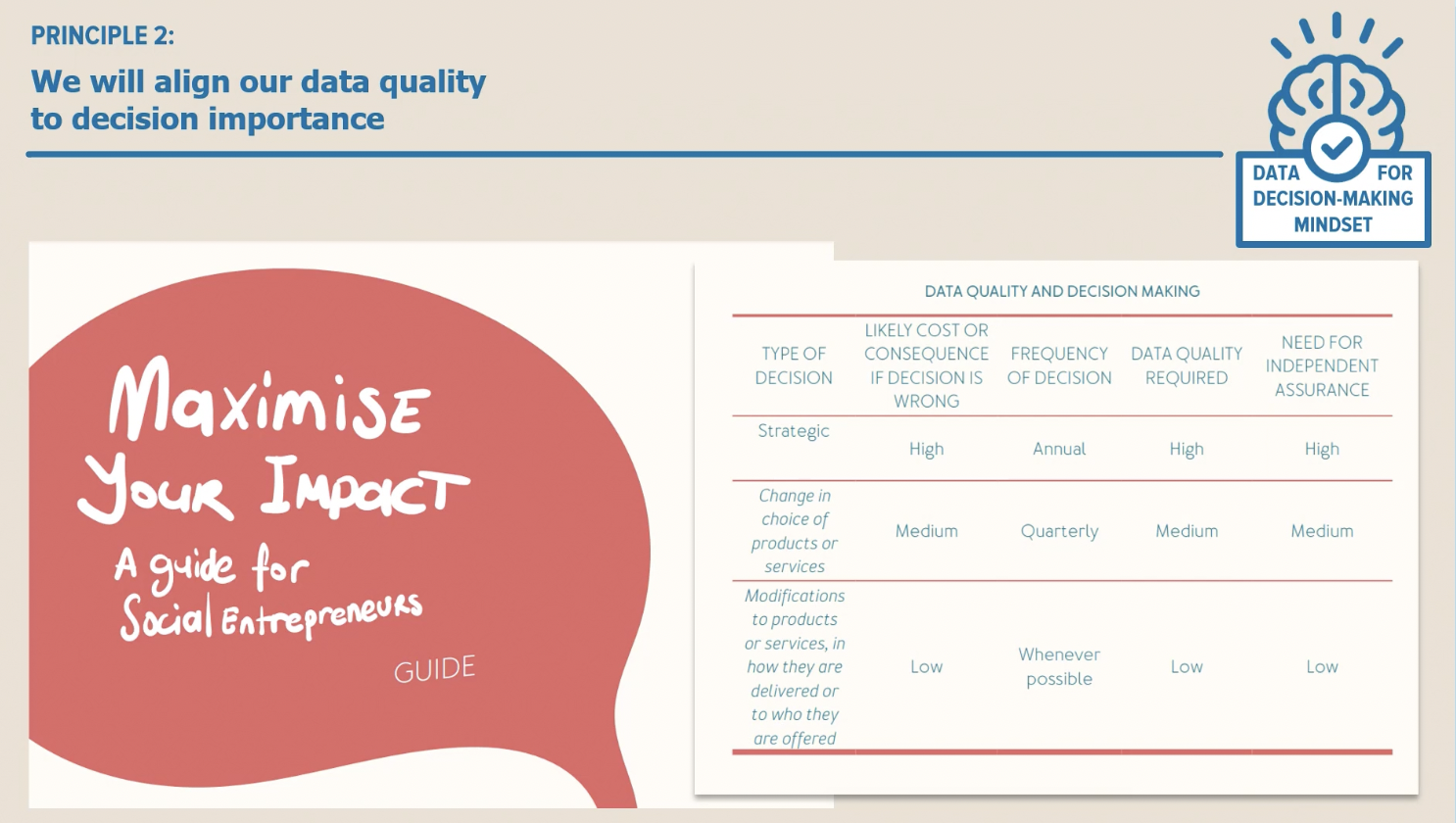

WHY I LIKE IT: The “data for decision-making” video is aimed at enterprise managers inside the course, but we have received a lot of positive feedback on it from investors that the video resonated with them as well. The key point is that the purpose of impact measurement and management is not counting, or reporting, or marketing – it’s better decision-making. Measuring and managing impact is about figuring out what you want to know more about so that the team managing the activity can adjust the organization’s actions to increase impact. This is a truly critical piece of optimizing for impact and is a key principle in the SDG Impact Standards.

The video details five principles that will help your organization embody a “data for decision-making” framework. The video also includes a sequence at the end that is one of my favorites in the entire series. The sequence demonstrates how analysis and decisions may change if you add more of the five dimensions of impact to your measurement practices. I must give full credit to Jeremy Nicholls (of Social Value International and now part of the SDG Impact team working on a new assurance framework for the standards) for the outstanding reports and lectures that inspired this part of the video.

HOW TO USE IT: Watch the video and ask yourself which of these principles you are living today, and if your investees are as well. How familiar are you with the most critical questions and hypotheses they might be making about optimizing impact right now? Are those questions and hypotheses coming up in board meetings or quarterly reports? If not, what can you do to jumpstart the kind of iterative decision-making that is talked about in the video? How does it apply to your own work and approach?

COMMON MISTAKES: The most common mistake (and I will admit to having made it myself!) is equating a nice impact report with good decision-making about how to optimize impact. The two are simply not correlated. The report is a slice-in-time document, usually produced under time and budget constraints, that often shows off the best of what was accomplished. But truly managing impact is an ongoing practice that requires asking good questions, evaluating data that is imperfect, and deciding what to do about it.

As an investor, I know you know good management when you see it. You know the difference between a board meeting where everything is polished up to look shiny and perfect and one where the management team really asks for help on the hard things. It’s a mistake to not expect to see the messiness and iteration of good impact management from your investees.

Ready to dig into the full training?

- Sign up free on Coursera for Impact Measurement and Management for the SDGs.

- Enter the Optimizing Impact Challenge – the first 100 people who post their course completion certificate on LinkedIn will receive a small gift from CASE as well as a mention by ImpactAlpha. Send an email to [email protected] with your LinkedIn profile or proof of completion certificate to enter.

- View prior posts in this series and the recap and replay of The Call: Optimizing for Impact.