ImpactAlpha, February 16 — Investments to help businesses and communities adapt to climate change have long taken a back seat to financing to mitigate global warming.

Many mitigation solutions, such as in renewable energy or decarbonization technology, have demonstrated a clear path to profitability. Perhaps from a kind of denial, or simply a lack of awareness, investments have lagged in the kind of tools and technologies needed to manage the climate changes already upon us.

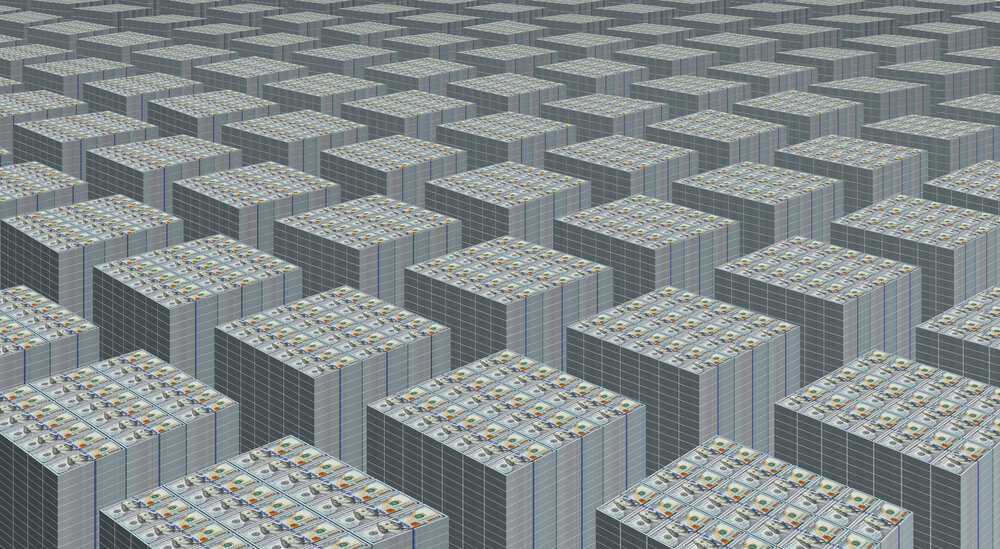

U.N. Secretary-General António Guterres has called for half of all climate-related investing to go to adaptation. The current figure is about 8%, and nearly all of that comes from public investors. Climate change adaptation has attracted less than $500 million per year in private investment, according to the Climate Policy Initiative.

“Private sector participation is essential in order to close the adaptation gap,” CPI wrote in its latest climate finance report.

The Lightsmith Climate Resilience fund, believed to be the first private-equity growth capital fund focused on climate resilience, has raised an initial $186 million to invest in water management, resilient food systems, agricultural and supply chain analytics, satellites and sensors, and catastrophe risk modeling.

“Customers, companies, communities and governments are spending lots of money looking for these solutions, and are not aware that there are companies out there that have these solutions,” Lightsmith’s Sanjay Wagle told ImpactAlpha. “Our jobs as investors is to help point these companies that are already out in the market for the customers that are looking for their solutions.”

One of Lightsmith’s first investments is in SOURCE Global, based in Scottsdale, Ariz., which makes solar hydropanels that extracts drinking water from water vapor in the air. Another is Waycool, which works with smallholder farmers in India to cut out middlemen, reduce waste, deliver goods to customers and raise incomes. As much as 35% of food produced in India is lost in the supply chain.

“We are aiming for technologies that can get us through this challenging set of conditions to a better set of outcomes for more people and we think that’s good for people and very valuable for investors,” says Lightsmith’s Jay Koh, who founded the fund with Wagle.

Lightsmith is working with Village Capital to support two dozen small- and medium-sized enterprises developing climate adaptation solutions in Africa, Asia, Latin America and the Caribbean. Lightsmith expects to make about half its investments in developing countries.

“Climate impacts are happening now, and the solutions are out there,” Wagle said. “It’s not about hunkering down behind bigger sea walls, but about using these technologies to be smarter about how businesses and communities plan, how they invest, how they operate.”

Catalytic capital

Koh and Wagle have worked for years to, er, acclimatize investors to the opportunities in climate adaptation and resilience.

A key piece fell into place last month, when the U.N.’s Green Climate Fund put up an initial $46 million in first-loss capital to backstop commercial investors in the fund. The Green Climate Fund authorized as much as $100 million in such catalytic capital.

The Rockefeller Foundation, through its Zero Gap Fund, along with the Nordic Development Fund and the government of Luxembourg also provided first-loss capital.

“We are uncompromising on behalf of our commercial and other investors in targeting commercial returns in the investments that we’re making,” Koh said. “That being said, at the beginning of any area of risk or investment transition, there is a lot of perceived risk. There’s unfamiliarity with adaptation and resilience as a theme or strategy.”

That first-loss cushion helped attract private investors including PNC Insurance Group, Kinneret Group, European Investment Bank, Asian Infrastructure Investment Bank and Caprock Group, a multifamily office with about $5 billion in assets under management.

“This is one of these situations where government entities and development finance institutions got it right,” said Caprock’s Mark Berryman. “They’re providing catalytic, first loss capital for private investors to come in and be a part of this incredibly important strategy.”

Caprock invested in the commercial tranche alongside some of its climate-focused clients. “There are so many decarbonization growth equity funds right now, and climate resiliency and adaptation is critical and complementary to decarbonization,” Berryman said.

The fund is based on a strategy, known as CRAFT (for Climate Resilience and Adaptation Finance and Technology), developed with support from the Global Innovation Lab for Climate Finance.

“We invest in growth-stage technology companies that have proven technologies, proven business models, proven customer uptake,” Wagle said. “We can apply those technologies to address and manage the risks and impact of climate change in different sectors — in agriculture, water, energy, transportation, infrastructure – every sector is being impacted today.”

Investing in those companies should enable them to scale up much faster, Koh adds. “And that would be good for investors and everybody else, because in five or 10 years we’ll have multi-billion-dollar solutions companies to a multi-trillion-dollar problem.”