Since the U.S. government’s $350 billion Paycheck Protection Program kicked in a week ago, Williams and his team have processed $42 million in loan applications. Working through last weekend, Southern Bancorp in Little Rock, Ark., processed loans as small as $8,000 for an African American-owned radio station and less than $2,000 for a photography studio.

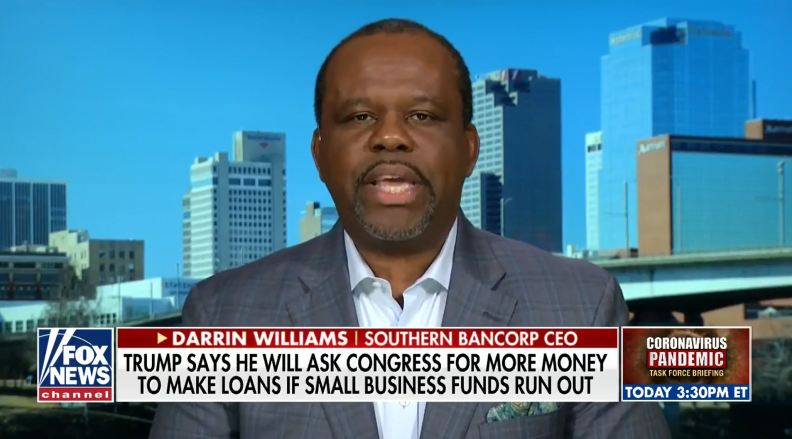

That effort got the attention of Fox News, and that got the attention of the White House, which invited Williams to represent community development financial institutions, or CDFIs, in a video conference with the president.

“Please consider a carveout for CDFIs,” in the next relief package,” Williams urged President Trump. “We have a proven track record of promoting economic stabilization, job preservation and job creation in some of the hardest hit rural, urban and immigrant communities.”

Williams, who served three terms in Arkansas’ House of Representatives, has led Southern Bancorp since 2013. Back then, the $1.5 billion bank was still working its way out of loans it had taken in the last recession.

Williams restructured the bank’s finances, established a quarterly dividend and employee stock ownership plan, and raised $34 million in common equity. That creates liquidity for investors in CDFIs, which are required to make 60% of their loans in low-income communities.

“Southern Bancorp is paving the way for a new kind of efficient capital raising for CDFIs.” Williams told ImpactAlpha. CDFIs will need that kind of stability to help underserved businesses and communities weather the COVID crash – and get access to federal relief.

Williams said businesses in the small towns of the Arkansas and Mississippi delta “haven’t had an opportunity like this before, in good times or bad times… The last thing that some of our small business customers need is more debt.”

“What makes this PPP so important is it’s 100% forgivable. It’s an infusion of capital in their business.”