TGIF, Agents of Impact! Today, we celebrate Juneteenth here in the U.S.

Impact Briefing. On this week’s podcast, co-host Monique Aiken chats with Amy Cortese about Brother Vellie’s Aurora James, the force behind the “15 Percent Pledge” and this week’s Agent of Impact. Jessica Pothering speaks with Candide Group’s Jasmine Rashid about her financial activist’s playbook for supporting Black lives. Plus, the headlines. Listen, share, and follow us on Apple, Spotify or wherever you get your podcasts.

Agents of Impact calls. Thanks to the hundreds of agents who showed up to 10x green infrastructure financing on yesterday’s Call No. 19. We’ll have a roundup and a replay of the lively discussion next week. Next week’s call (yes, they’re getting more frequent as well as bigger) is “Building impact investing portfolios for all stakeholders.” It’s time to bring new and unlikely allies into impact investing’s ecosystem to address racial injustice, income inequality and climate change. Rockefeller Philanthropy Advisors and Godeke Consulting have gathered the latest impact tools and best practices for the new Impact Investing Handbook: An Implementation Guide for Practitioners. Join co-authors Steven Godeke and Patrick Briaud, as well as Alabama Power Foundation’s Myla Calhoun, Ford Foundation’s Margot Brandenburg and Grove Foundation’s Rebekah Saul Butler on Agents of Impact Call No. 20, Thursday, June 25 at 10am PT / 1pm ET / 6pm London. RSVP today.

The Week’s Big 6

1. From bluster to action. Enough excuses. Amid COVID, the recession, the climate emergency and a mass movement against systemic racism, “how can we respond in any way other than by dialing up commitments?” writes Courageous Capital Advisors’ Laurie Spengler in a provocative guest post on ImpactAlpha. Spengler called out impact investing’s “familiar excuses for the delay and modesty of actions.” Step it up.

- Cool on COVID. The Global Impact Investing Network’s 10th investor survey estimates impact investing assets at $715 billion, up from $504 billion last year. But in a time of crisis, only 18 of 122 respondents said they are likely to commit more capital than planned this year, while more actually plan to cut back. Reality bites.

- Weigh in. Tell us how impact investors can, or are, rising to meet the moment. Join the conversation in our #Agents-of-Impact Slack channel or email us at [email protected] (or reply to this email).

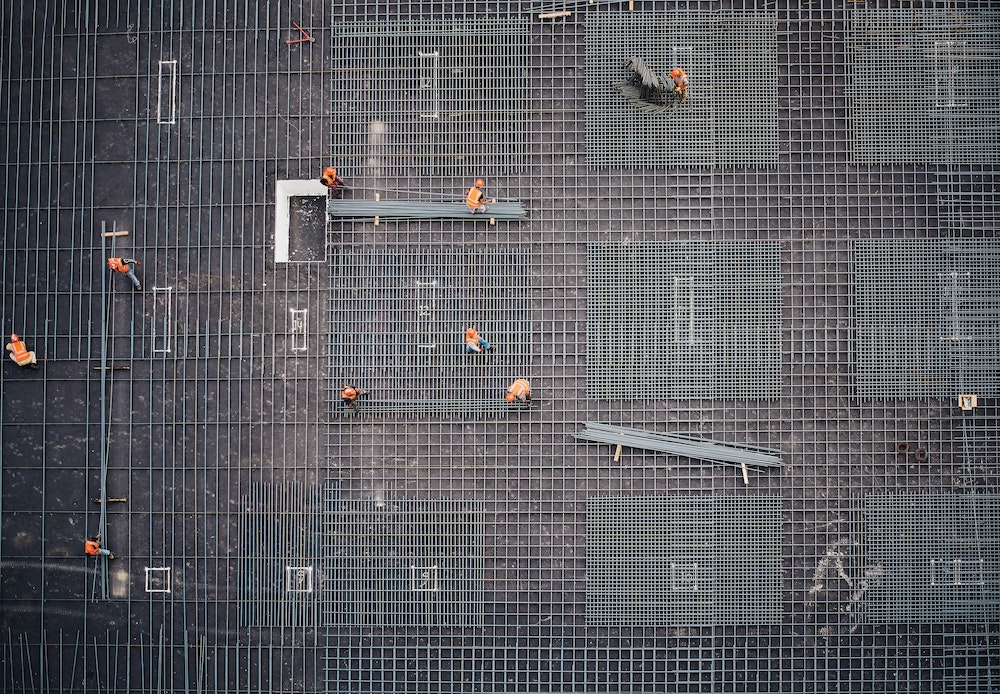

2. No ‘shutdown’ for green infrastructure. Falling costs for green power are accelerating climate and clean-energy investments. Copenhagen Infrastructure Partners’ €1.5 billion ($1.7 billion) first close for its latest renewable energy fund is just the most recent data point among many. By the numbers.

- Climate capital steps up… Chris Sacca’s Lowercarbon Capital backs 20+ climate tech deals… Prime Impact Fund raises $52 million to jumpstart the climate tech pipeline… Pale Blue Dot raises €53 million for climate-focused startups… Clean energy incubator Greentown Labs expands to Houston… Vizcab raises seed funding to cut carbon in construction.

- …as Big Oil writes down fossil fuel assets. Oil major BP will write off assets of up to $17 billion in the second quarter – its largest write-off since the Deepwater Horizon disaster in 2010. Drill down.

3. LeapFrog Investments seeks growth through the crisis (podcast). LeapFrog’s Andy Kuper criticized what he called a lack of ambition in some parts of the impact investing ecosystem. “Impact investing has to be the lever that’s long enough to move this world,” he said on ImpactAlpha’s Returns on Investment podcast. “And this world has four billion low-income people in it. So we really need to focus on companies that are going to serve tens of millions of people with quality, affordable products and make sure they get the support they need.” Loud and clear.

4. Bridging the banking gap. Google parent company Alphabet has carved out $170 million – mostly from its corporate balance sheet – to improve access to COVID recovery capital for women and minority-owned businesses. Community development financial institutions, or CDFIs, are “really vital to bridging the gap,” said Alphabet’s CFO Ruth Porat at a forum hosted by Opportunity Finance Network. Dive in.

5. Cornerstone’s Erika Karp walks the talk. In the latest installment in ImpactAlpha’s Walking the Talk series, the founder and CEO of Cornerstone Capital shares how she applies the alternative path she’s carved out throughout her career as a banker, day trader, investor and entrepreneur to her personal investment portfolio. “While I may not be the average investor, I do have my discipline,” she writes. “And I often take the road less traveled.” Get the full story.

- Catch up on the Walking the Talk series, with contributions from Beth Bafford, Matthew Weatherley-White and Brent Kessel.

6. Democratizing finance. The winners in impact investing remain a privileged few. “If we don’t address inequity in decision-making and wealth accumulation, we will perpetuate unequal systems,” Intelligent Impact’s Aunnie Patton Power writes in a guest post on ImpactAlpha. Jump in.

The Week’s Agent of Impact

Aurora James, Brother Vellies. The designer and entrepreneur wasn’t satisfied with corporate statements of solidarity for Black lives after street protests over the killing of George Floyd and deep-seated racial injustice. Solidarity should be more structural. “So many of your businesses are built on Black spending power,” James, founder of Brooklyn-based luxury accessories brand Brother Vellies, posted to Instagram. Her simple call to action for retailers: “We represent 15% of the population and we need to represent 15% of your shelf space.” The post, which called out big retailers like Whole Foods, Walmart, Saks Fifth Avenue, Home Depot and Target, went viral and the #15PercentPledge was born (and became a full-fledged nonprofit with a website). The pledge asks retailers to take stock of their shelf space for Black-owned businesses and publish a plan to increase the share of Black brands to a minimum of 15%.

Within a matter of days, Rent the Runway and some smaller retail sites signed on. Last week, cosmetics powerhouse Sephora got on board. Of the 290 brands Sephora carries, just nine are Black-owned. That will increase nearly five-fold under the pledge, which pushes companies beyond statements and donations to build real revenue streams for Black-owned businesses that have had limited access to coveted retail shelf space. James, who started Brother Vellies with $3,500 from her savings account, built a customer base at a Lower East Side flea market. The Toronto-native works with artisans in Africa and elsewhere to craft luxe and often whimsical shoes and accessories that have gained a celebrity following. In the pandemic, Brother Vellies’ Springbok bags have been an afterthought for most consumers; to keep artisans employed, James started a home-goods line. “Coming this far myself and knowing what a huge difference it can make to have meaningful support and a big purchase order from one of these companies, there are no words for that,” James told Vanity Fair. Getting a small brand picked up at Sephora, and around the world, “that is a dream come true, a game changer.” – Amy Cortese

The Week’s Dealflow

Inclusive fintech. Chipper Cash clinches $13.8 million for its no-fee cross-border payments app… Home financing startup Haus raises $15.8 million for housing “co-investment”… Origin secures $12 million to build employees’ financial health.

Returns on inclusion. Worker-owned Obran Cooperative acquires Appalachian Field Services… Rockefeller Foundation pledges $10 million for inclusive growth in 10 cities.

Affordable housing. Legal & General commits £100 million to expand U.K. affordable housing… Impact fund of funds Zamo backs social housing investor SSC.

Future of work. Gig-worker platform Steady secures $15 million to expand pandemic support… Degreed raises $32 million to offer free skills training to employees.

Impact tech. GreenLight Biosciences raises $102 million to develop vaccines… BIOMILQ secures $3.5 million for “alt-breast milk,” grown in a lab.

Frontier finance. VestedWorld makes early-stage investments in Vanu and GET IT.

Racial justice. Ava DuVernay launches Law Enforcement Accountability Project.

The Week’s Talent

Future Positive Capital’s (and Agent of Impact) Sofia Hmich, Quona Capital’s Varun Malhotra, and Flourish Ventures’ Sarah Morgenstern are among 61 Kauffman Fellows. Marlon Nichols of MaC Venture Capital, Melissa Richlen of MacArthur Foundation, and Allen Taylor of Endeavor were named to the Kauffman Fellows board.

Michelle Kathryn Essomé steps down as CEO of the African Private Equity and Venture Capital Association… Boston Ujima Project names Johnny Charles, ex- of Dorchester Bay Economic Development Corp., as managing director of the Ujima Fund and James Vamboi, ex- of Health Leads, as chief of staff, community and culture… Sonya Childress becomes a senior fellow at Perspective Fund, an impact-focused film fund in New York.

The Week’s Jobs

New Media Ventures seeks a head of investments in New York or the San Francisco Bay Area… Nia Impact Capital is hiring a financial analyst and client services/operations team member… Open Society Foundations is looking for an investment associate for its economic justice program in London… BTG Pactual’s Timberland Investment Group is recruiting an analyst of natural climate solutions in Seattle… Boston Impact Initiative is hiring an investment director in Boston.

Veris Wealth Partners is looking for a research analyst in New York… Harlem Capital Partners has openings for part-time interns starting in September… OpenInvest seeks an ESG analyst in San Francisco… Roots of Impact is looking for an operations manager… The Cartier Women’s Initiative wants funding proposals from women impact entrepreneurs.

New Island Capital Management is looking for a managing director of private credit in San Francisco… Fidelity Investments is hiring a director of philanthropic strategies in New York… Arctaris Impact Investors seeks a senior fund accountant/controller in Boston… Y Analytics is recruiting an impact solutions associate in Washington, D.C.

Thank you for reading.

— June 19, 2020