ImpactAlpha, May 30 – Impact investing is a wedge issue.

That’s not to say it’s a hot-button – yet! – that pols will press in this year’s mid-terms. Nor does it split us neatly into blue or red, left or right.

Rather, the act of driving capital toward explicit, accountable social and environmental value-creation starts companies and investors down a trail of logic that may well scramble alliances and split constituencies.

I mean split in a good way. Global corporations. Too-big-to-fail banks. Huge pension and sovereign wealth funds. Billionaires and their families. Cities and whole countries. All are being called to account for their impact, negative or positive.

The strategy for Agents of Impact, then, would seem to be: work the angles, bet on trends, move some money, drive the data and…wait for the right moment.

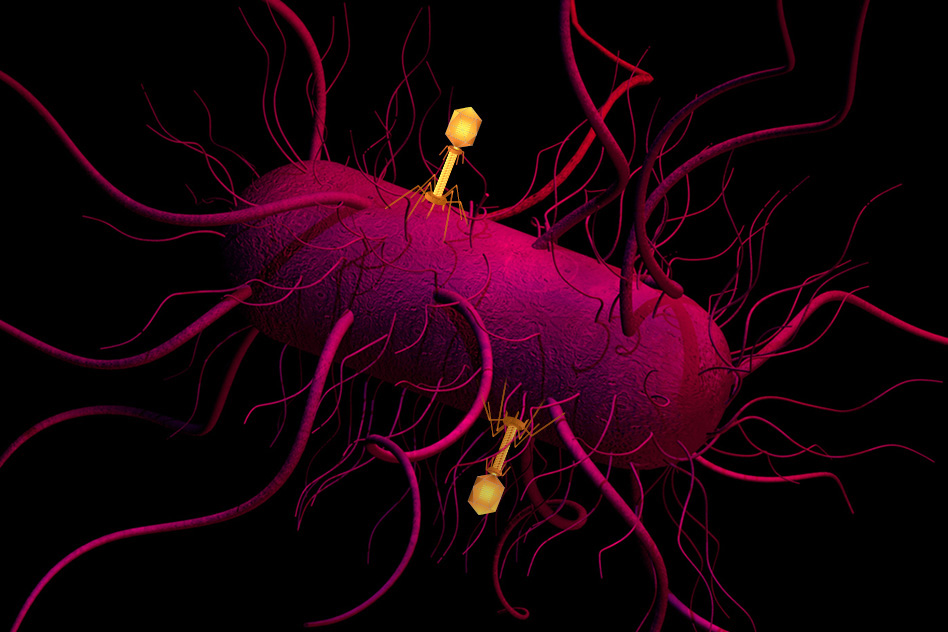

Infectious logic

In last week’s column, I wrote, “As the still-underappreciated value of social and environmental regeneration worms its way through the machinery, the markets will shift.” Arjuna Capital’s Farnum Brown put it more succinctly in a Facebook response: “I’ve long maintained that the project is and always has been one of infecting the host.”

Corporate venture capital may already be infected. As my ImpactAlpha colleagues Dennis Price and Jessica Pothering have been reporting, corporate venture capitalists, or CVCs, are increasingly becoming corporate impact investors as they scout startups that advance technology or open markets.

CVCs are running straight into impact as they assess corporate risks. The top 10 risks, in terms of impact, according to the World Economic Forum’s latest survey: extreme weather events, failure of climate-change mitigation and adaptation, water crises, food crises, biodiversity loss and ecosystem collapse, large-scale involuntary migration and the spread of infectious diseases.

Impact investing can mitigate such risks. And so Cargill, the giant animal feed supplier, and Tyson, the king of chickens, through their venture arms, have been investing in lab-grown meat companies like Future Meat, SuperMeat (Tyson) and Memphis Meats (Tyson and Cargill). Tyson has funded plant-protein company Beyond Meat. Cargill has backed Calysta’s process for producing animal feed from microbes.

Tyson’s Justin Whitmore says meat is still king, but the company believes in “exploring additional opportunities for growth that give consumers more choices.” Cargill’s corporate web page splashes its sustainability bona fides and its goal to reduce carbon emissions 10% by 2025 (compared to 2017). The company touts its partnership with The Nature Conservancy to develop a climate-change strategy aligned with the Paris climate agreement and the Sustainable Development Goals.

BP Ventures, the venture arm of British oil giant BP, has invested in StoreDot, a Tel Aviv-based venture that is building electric vehicle batteries that can fully charge in five minutes. Earlier this year, BP Ventures backed FreeWire, a separate fast-charging battery company. Shell late last year bought NewMotion, a European electric car-charging network, and enlisted Ionity to put fast, high-powered electric car chargers in 80 busy highway service stations in 10 countries.

With the shift to green energy, BP’s Lamar McKay told analysts, “Our industry is changing faster than any of us can remember, certainly in my career.”

Tipping point

To be sure, the multinationals still are only hedging their bets. But the new initiatives create internal and external constituencies and build corporate support for alternative approaches. Such alternatives will come in handy when the disruptive waves crash hard.

As they say, sh*t happens. Was it only last summer that leading U.S. corporate CEOs collectively decided to “condemn and disband” the White House’s corporate advisory council over President Trump’s comments after the Charlottesville white-supremacist march? At the time, ImpactAlpha asked, “Was the mass resignation of the country’s top CEOs from the Trump Administration a momentary reflex? Or the catalyst for collective and purposeful social leadership from business on the grand challenges of our time?”

A better question might have been, have enough companies already decided there’s a more compelling alternative? The fabled “tipping point” comes not when a majority is in hand, but earlier, when the disruptive insurgents’ growing share of market- and mind-share can no longer be ignored.

Take major institutional asset-owners, the huge pension and sovereign-wealth funds loaded with hundreds of billions of dollars. A squadron of such financial supertankers already appears to be breaking off from the main fleet to chart a new course toward “responsible” investing. The Bretton Woods II project at New America Foundation identified 25 such leaders, representing $4.9 trillion in assets, which behave quite differently than the laggards. That’s a big enough fraction to produce performance data and establish a career track for this generation’s most fired-up finance talent.

Last month, New York State’s $201 billion Common Retirement Fund doubled (to $4 billion) its allocation to a low-carbon index fund. In 2015, the fund had commissioned a study that showed assets were at risk under a 2-degree climate-change scenario. The pension fund put $2 billion into a low-carbon index (leaving much of the rest of the portfolio presumably at risk).

Norway’s trillion-dollar sovereign wealth fund last fall proposed dropping oil and gas companies from its index and its portfolio. Norway’s move was largely to diversity from the oil economy that supplies most of the country’s wealth. But it was nevertheless a signal to world markets to hedge against the “risk” of a low-carbon future.

The logic worms its way into the machine, the virus infects the host. The pro-sustainability, pro-inclusion, pro-innovation minority faction within today’s corporations and asset-owners may have more in common with environmental and social activists around the world than they do with retrograde pols hustling retrenchment and division. As its influence grows, the “positive impact” faction has the opportunity to perform a radical makeover of capitalism, not only in image but in strategy.

There already is an agenda, of course, for a long-term global investment strategy to lay the foundation for a century of shared, sustainable prosperity. That agenda is officially still the world’s consensus strategy, encapsulated in the Sustainable Development Goals and the Paris climate agreement, which remains in force and to which the U.S. is still a party.

So it’s time to split the corporate and financial leaders from the laggards. Explicit, accountable social and environmental value-creation is contagious and spreading. From within and without, bottom up and the top down, agents of impact are infecting their hosts.

This is the latest column in David Bank’s weekly series, The Impact Alpha. Catch up on all of David’s columns here.