Was the mass resignation of the country’s top CEOs from the Trump Administration a momentary reflex? Or the catalyst for collective and purposeful social leadership from business on the grand challenges of our time?

The president’s contortions over neo-Nazis and white supremacists may have been the final straw, but there were already major loads on the camel’s back of corporate support. CEO defections began early, with protests over Trump’s immigration and refugee bans. Others balked when the White House renounced U.S. leadership in the global climate-change battle.

Now, the exodus is nearly complete. In the heat of the post-Charlotteville moment, the newly liberated CEOs want not to slink off, but to take a stand. But for what?

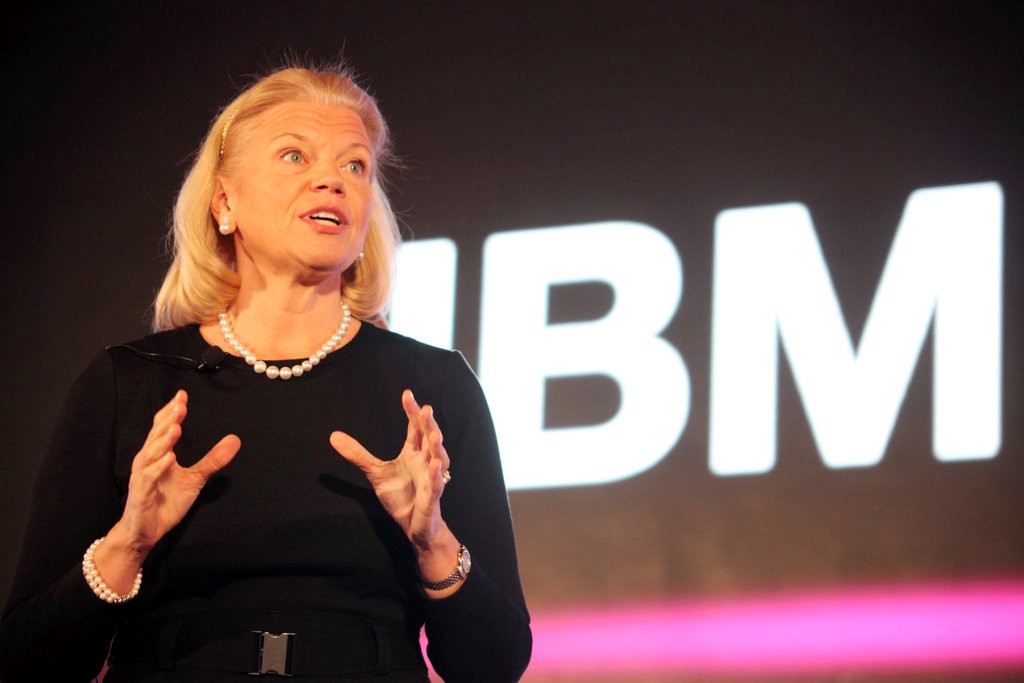

The spur for collective CEO action came from an urgent series of conversations between Pepsi’s CEO Indra Nooyi, GM’s Mary Barra, IBM’s Virginia Rometty and Boston Consulting Group’s Rich Lesser. (That the CEO revolt was led by women was not lost on observers of the women-effect on leadership and decision-making.) According to the New York Times, two “old boys,” ex-Boeing CEO Jim McNerney and former GE legend Jack Welch wanted to “condemn and remain.” IBM’s Rometty advocated for “condemn and disband.” She argued, “In the past week, we have seen and heard of public events and statements that run counter to our values as a country and a company.” When Larry Fink, the CEO of BlackRock, signaled his exit, the gig was up.

There is an alternative center of gravity that CEOs can rally around. The innovative and inclusive agenda for sustainable prosperity is the consensus strategy, at least officially, for most world leaders and global organizations. It is best encapsulated in the 17 Sustainable Development Goals, which were ratified by 193 nations, including the United States. The Paris climate agreement entered into force last year and now has the endorsement of 158 countries and 68% of global emissions; next year, countries will ratchet up their nationally determined contributions to tackling climate change. Along with the often overlooked Addis Ababa Action Agenda for financing development, adopted in July 2015, the three agreements set an architecture for the 21st century economy as much as the agreements at Bretton Woods in 1944 set up the second half of the 20th century.

That agenda for sustainable development is still the consensus of the G-7 and the G-20, which have pledged to move the agenda forward (see “Transcending Trump in Taormina”). The elements of the agenda include the “Bari Policy Agenda on Growth and Inequalities,” which recognizes that inequality is a systemic risk; the “G-7 Roadmap for a Gender-Responsive Economic Environment,” which promotes women’s entrepreneurship and increasing women’s access to capital, networks and markets; and the G-7 plan for skills and labor, which seeks to drive the Next Product Revolution through a rebirth of small-scale and local manufacturing.

The tougher challenge, even if momentum and financing can be maintained, is that the global agenda is, well, so global. The optics of a global elite that includes Wall Street and CEOs, Europe and the United Nations, dictating a social and economic agenda — that’s beyond-easy to target for Breitbart and Fox and the tweeter-in-chief at 1600 Pennsylvania Avenue. “Sustainable, inclusive global prosperity” does not have the same ring of talk-radio populism as, say, “Make America great again.”

But why the hell not? The challenges of Scranton or Milwaukee or Youngstown can be met with smart investments in good jobs, healthy communities and vibrant ecosystems just as surely as can the challenges in Africa, Asia and Latin America. Now that corporate CEOs, Wall Street, global leaders and two-thirds of the American people are ready for something new, the positive alternative has the opportunity to harness the capital, the talent and the super-majority of public support for the transformational work at hand.

American renaissance

What will that bottom-up renaissance in America look like? It will look like it already does in cities and towns across the country that are reviving and prospering by leveraging their assets and their talent. James and Deborah Fallows found dozens of such “city makers,” in their excellent series in The Atlantic. Forbes has a good list of cities leading the revival of American manufacturing, which has created a million jobs in a the last half-dozen years.

It will look like small business. Investors such as Village Capital’s Ross Baird and AOL founder Steve Case are finding gritty and determined entrepreneurs solving local problems in cities far from the coastal elites. One example: Fin Gourmet, a Kentucky startup that hires disadvantaged workers to turn invasive Asian carp into tasty boneless filets. Bloomberg columnist Noah Smith this month listed more than a dozen practical ideas for raising American living standards.

It will look like cities that welcome immigrants and embrace diversity. In regions with high immigration, wages go up for all workers. A one percent increase in the population’s share of migrants, both low- and high-skilled, leads to a two percent increase in GDP per capita in the long run, according to the International Monetary Fund.

It will look like companies that like the oft-maligned Walmart, are deciding they can do better by paying their workers more. It will look like Texas, where more than 700 businesses came together recently to defeat the “bathroom bill” that would have infringed on the privacy of transgender people.

“What if we could create good jobs, educate our kids, fix our electrical grids and sewers and roads, address climate change, and in so doing all of that, we could also jet-propel the economy, too?” wrote Nancy Pfund of DBL Partners and Fran Seegull, now head of the U.S. Impact Investing Alliance, ahead of last year’s election. “What if we could develop powerful new technologies that fuel prosperity here at home and then go on to share that innovation and prosperity with the rest of the world?”

Corporate cash

Corporate giants can take the lead, both in their production and purchasing and their political influence. Apple’s CEO Tim Cook, who spoke up after Trump’s Charlottesville comments, recently told the New York Times’ Andrew Ross Sorkin, “The reality is that government, for a long period of time, has for whatever set of reasons become less functional and isn’t working at the speed that it once was. And so it does fall, I think, not just on business but on all other areas of society to step up.”

A key number to watch is the $2.7 trillion in corporate cash held overseas, particularly by tech giants and led by Apple, which has an astonishing $250 billion parked abroad. Together, Apple, Microsoft, Cisco Systems, Alphabet (Google) and Oracle hold more than $500 billion overseas, awaiting the tax break for repatriated profits that Trump has promised in his tax plan. The Brookings Institution has proposed that, in return for the tax break, at least some of that money be used to capitalize a national infrastructure bank.

Corporate leaders could also advocate for a carbon tax, as some Republican elders and even companies like ExxonMobil have proposed. Such a tax could raise $200 to $300 billion a year, send a signal to the financial markets and, if some of the proceeds were distributed back to citizens in the form of a carbon dividend, create a powerful constituency for the low-carbon transition.

There are plenty of other ideas for catalyzing the capital required for the regeneration. Responses to income inequality may be more diffuse and less organized than those to combat climate change, and some proposals are more fully baked than others. Some will approach, or cross, the line of traditional corporate behavior. But as Darren Walker, president of the Ford Foundation (and a member of Pepsi’s board of directors) said in a different context, “If we are going to transform finance, we are going to have to get uncomfortable.”

American CEOs took collective action to reject the Trump project. Now it’s time for them to make sustainable, inclusive prosperity their common cause, at home and abroad.