Greetings, Agents of Impact!

Join the next ImpactAlpha Agents of Impact Call, “Optimizing muni bonds for racial equity,” with Public Finance Initiative’s Lourdes Germán, Robert Wood Johnson’s Kimberlee Cornett and other special guests, Wednesday, Nov. 16 at 10am PT / 1pm ET / 6pm London. RSVP today.

Featured: Policy Corner

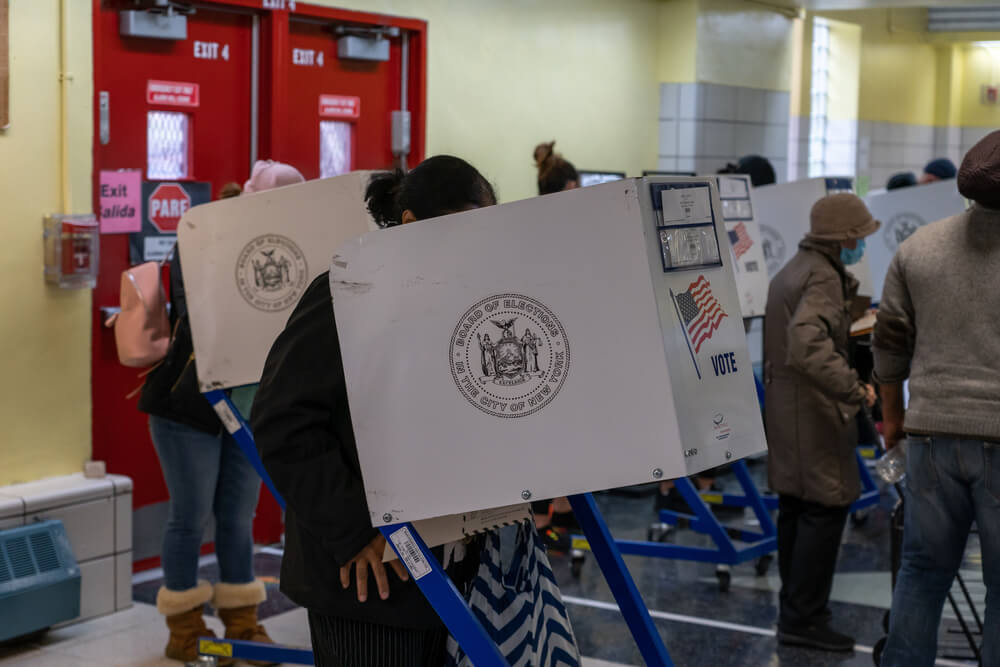

What’s at stake for climate, ESG and impact investors in the U.S. midterm elections. The annual global climate summit known as COP27, this year in Egypt, will coincide with next week’s midterm elections in the United States, putting in sharp relief the climate stakes for the U.S. – and the world. “Every election is now a climate election,” as Bloomberg Green’s Zahra Hirji and Akshat Rathi put it. The midterms could upend Democrats’ hard-won climate agenda. The Inflation Reduction Act is already turbocharging investment in electric vehicles, renewable energy and battery plants across the U.S., especially in Rust Belt cities. The Biden administration has promised to slash greenhouse gas emissions in half by 2030 and transition to carbon-free electricity by 2035. President Biden could still wield executive orders and, of course, veto power, if Republicans take back one or both houses of Congress. But Republicans plan to hold hearings, block appointments, target key agencies, and otherwise challenge his agenda. “The results of the midterm elections will dramatically shape the opportunities for business and investor communities to engage in building a sustainable future,” Fran Seegull of the U.S. Impact Investing Alliance tells ImpactAlpha. Here’s some of what’s at stake:

- ESG backlash. Banks and other financial firms already have been cowed by Republican attacks on ESG and what some politicians charge are anti-fossil fuel policies. The Global Financial Alliance for Net Zero, or GFANZ, formed with much fanfare at last year’s COP26 climate summit, has backpedaled on requiring its members to phase out fossil fuel financing in line with the U.N.’s Race to Net Zero initiative. Former Speaker of the House Paul Ryan says he tells corporate executives to play down ESG to avoid fights with politicians like Florida Governor Ron DeSantis. “This is going to escalate,” West Virginia’s Republican treasurer, Riley Moore, told Politico. “We are going full throttle once we get into 2023.”

- Corporate disclosure. Climate change poses a material risk to companies and a systemic risk to the planet. Under Gary Gensler, the Securities and Exchange Commission has been crafting rules for climate disclosure, including indirect, or “Scope 3,” emissions. The financial watchdog is also mulling new ESG fund labeling rules akin to those enacted in Europe. One option under consideration by Republicans if they win a majority of House seats: holding the rule-making hostage as part of the upcoming budget process.

- Racial equity. One of President Biden’s first acts was an executive order, known as Justice40, that aims for 40% of the benefits of federal investments in clean energy, housing, transit and other areas to flow to disadvantaged communities. The IRA, for example, earmarks $47 billion for marginalized communities (see “Pursuing environmental justice through the Inflation Reduction Act,” below). Republicans have attacked key parts of Justice40, including in a January letter to Biden from 16 Republican governors regarding the bipartisan infrastructure bill. “Excessive consideration of equity, union memberships or climate as lenses to view suitable projects would be counterproductive,” they wrote.

- Keep reading, “What’s at stake for climate, ESG and impact investors in the U.S. midterm elections,” by Amy Cortese on ImpactAlpha. Keep up with impact policy developments at Policy Corner, sponsored by the U.S. Impact Investing Alliance.

Sponsored by Tideline: Climate Impact

From climate investment to climate impact. What does it mean to be a climate impact investor? “Truth in Climate Impact,” a new guide from impact investing consultant Tideline, helps investors distinguish between climate strategies that consider climate-related factors and those that prioritize making a positive impact on the climate. By integrating intentionality, contribution and measurement in impact management, fund managers can earn the “impact” label. Climate-impact investors, for example, prioritize robust integration of climate objectives pre-investment, discipline in measuring real-world emissions, and the attribution of emissions reductions to a particular investment or action.

- Download the report and join the discussion, “Truth in climate impact: management and labeling best practices,” with Brookfield’s Kelly Goddard, British International Investment’s Nicola Mustetea, and Prime Coalitions’ Keri Browder, moderated by Tideline’s Jane Bieneman and Claudia Leon, Thursday, Nov. 3. RSVP today.

Dealflow: Inclusive Climate Finance

Satgana raises funds for climate tech startups in Africa and Europe. The Luxembourg-based venture capital fund has raised an undisclosed amount from 30 investors, including individual investors such as Back Market’s Thibaud Hug de Larauze, Eurazeo’s Fabrice de Gaudemar and Tiller Systems’ Josef Bovet. Satgana, which means “a good company” in Sanskrit, is looking to raise $30 million to invest in food and agriculture, energy, mobility, industry, buildings, carbon removal and the circular economy. “The climate and ecological crisis is the defining issue of our time,” said Satgana’s Romain Diaz. “There has never been a better time to build and invest in climate tech, [spurred] by an unprecedented flood of talent and capital into the space.” The fund will make investments of up to €500,000 in startups’ pre-seed and seed rounds.

- Gender lens. Satgana aims to qualify for the 2X Challenge, which incentivizes funds to emphasize women’s employment, entrepreneurship and leadership. Gender and diversity-lens investing are key to ensuring a just economic transition (see, “Gender lens + climate finance = broader reach”).

- Portfolio companies. Satgana has invested in Kenya’s Mazi Mobility, which is building a network of electric motorcycles and battery-swapping stations in East Africa; Germany’s Orbio Earth, which provides satellite data to energy companies to monitor and reduce their methane footprint; and France’s Yeast, which is using yeast to make sustainable alternative proteins.

- Check it out.

Orchard Street’s Social and Environmental Impact Partnership fund secures £90 million. U.K.-based commercial real estate investor Orchard Street is looking to raise £400 million ($459 million) to accelerate decarbonization for buildings in its portfolio and make the buildings healthier for tenants. The Social and Environmental Impact Partnership fund also aims to address social issues in local communities in the U.K. Emissions from occupiers in Orchard Street’s office, industrial and other buildings represent more than 90% of its annual carbon footprint.

- Impact management. Tideline’s BlueMark will provide independent impact reporting and verification services for the fund. Accenture’s Carbon Intelligence will monitor the fund’s ESG performance data. Orchard Street will reinvest 30% of the fund’s returns to achieve its impact objectives. “The fund will accelerate the property sector’s decarbonization, while maximizing the value of buildings as a tool to promote health and community investment,” Orchard’s Philip Gadsden said. The fund’s investors include U.K.-based pension fund Brunel Pension Partnership and members of Orchard Street’s senior executive team.

- Share this post.

Dealflow overflow. Other investment news crossing our desks:

- Ascend Elements raked in $300 million in equity and debt funding, led by Fifth Wall, to recycle lithium-ion batteries. The company also received $480 million in grants from the Department of Energy.

- Neev Fund invested $25 million in Hygenco for a pipeline of green hydrogen projects in India.

- The Netherlands’ RIFT snagged $2 million in an investment round led by Rubio Impact Ventures to supply businesses with iron fuel for low-carbon heat.

Impact Voices: Policy Corner

Pursuing environmental justice through the Inflation Reduction Act. The Biden administration’s climate law is an “ambitious, necessary, but incomplete step towards environmental justice,” write Dalberg’s Lauren Olosky, Mallory Byrd and Jeff Berger. The IRA devotes upwards of $47 billion to invest in marginalized communities that have faced underinvestment in essential services, borne the brunt of pollution, and suffered disproportionately from climate shocks. But the legislation undermines that effort by bundling renewable energy development with fossil fuel extraction. The public sector has an opportunity and a responsibility to ensure that funding reaches the communities that need it the most, and to offset and contain the impact of further investments in fossil fuels, say the Dalberg advisors.

- Catalytic capital. The law grants federal agencies and states discretion in designing and implementing programs. One strategy: crowding in private capital. “A surge in public spending can incentivize and de-risk investment in climate mitigation and adaptation in disadvantaged communities, creating more buy-in from the private sector,” write the advisors.

- Mitigating harms. Agencies like the Federal Energy Regulatory Commission, which oversees much of the nation’s energy infrastructure, have taken steps to incorporate racial justice and equity in energy policy. FERC found that there is no universal method for calculating such impacts. Olosky, Byrd and Berger call out the need “for a rigorous system to understand the climate and socioeconomic burdens imposed by fossil fuel extraction and industrial production.”

- Keep reading, “Pursuing environmental justice through the Inflation Reduction Act,” by Dalberg’s Lauren Olosky, Mallory Byrd and Jeff Berger.

Agents of Impact: Follow the Talent

Maggie Fried, ex- of New York-based nonprofit CREO, is joining Chicago-based S2G Ventures as vice president of corporate development in oceans and seafood… BerlinRosen is hiring a senior vice president of ESG, philanthropy and impact investing… BlackRock is looking for a vice president/director of corporate sustainability and an analyst on investment stewardship for Latin America… Neuberger Berman seeks an ESG and impact investing associate.

Bain Capital has an opening for an ESG manager of impact measurement and reporting… Tideline is hiring an impact investing analyst… Mill Cities Community Investments seeks a development and impact associate… BlueMark becomes a certified B Corp… Project Drawdown’s Jon Foley will discuss which actions will most effectively and swiftly tackle climate change in a webinar, Thursday, Nov. 3… Food Funded will bring together food entrepreneurs focused on justice, equity, diversity and inclusion, Thursday, Nov. 10.

Thank you for your impact!

– Nov. 2, 2022