Greetings Agents of Impact!

In today’s Brief:

- A secondaries strategy to provide liquidity for impact funds

- Pension fund co-investments in green steel

- Boosting grid reliability in Puerto Rico

- Talk of the town in Davos

Featured: LP / GP

Adding a dash of guaranteed liquidity to impact funds to attract more institutional LPs (video). Among the curses of impact investing is that the patient capital needed for many high-impact solutions is inherently more expensive – precisely because it is so patient. The lack of liquidity in a typical 10-year, closed-end fund means that, all else being equal, investors will expect higher returns compared to more liquid investments in which they can get their money back quickly. About 90% of all global assets under management are deployed into liquid strategies. The Octobre Liquidity Guarantee Facility, launching this year with support from the European Commission, aims to add liquidity to more impact funds by offering a commitment to buy out the stakes of impatient investors in less than 10 business days. “Octobre is a way to mobilize private capital for impact at very large scale,” Octobre’s Sylvain Goupille told ImpactAlpha in a video interview. “The idea is that if you can make this investment into an impact fund as liquid as listed equities or listed debt, suddenly you can increase by 10-fold or 100-fold the amount of capital that can flow into impact.” The added liquidity serves to lower return expectations as well. “And so, it’s breaking the curse,” Goupille said on the sidelines of the GIIN Impact Forum in Amsterdam.

- Impact secondaries. The development of a secondaries market for stakes in impact funds could also help unstick fundraising more broadly. Cash-strapped investors are showing a clear preference for lower risk, shorter-term and more liquid strategies (for background, see, “As private equity fundraising goes south, whither impact investing in 2025?”). Last week, Paris-based Ardian Capital, a spinout from the insurance giant AXA, raised $30 billion for its ninth private equity secondaries fund, one of the largest such funds ever. Minneapolis-based North Sky Capital in June closed a $250 impact secondaries fund, its second. “Market conditions are terrific for secondaries buyers right now, especially in impact sectors,” North Sky’s Tom Jorgensen said at the time. Last year, British International Investment sold its stakes in funds run by Aavishkaar, Novastar Ventures and Adenia Capital to Swiss impact investment firm Blue Earth Capital, which launched its impact secondaries fund in 2023.

- New capital. The Octobre Liquidity Guarantee Facility leverages the advantages of liquidity and secondaries across multiple funds. “The guarantee facility offers investors an opportunity to exit their participation in emerging market and impact funds under any circumstance, thereby incentivizing investors to enter the impact investing space,” the blended finance network Convergence wrote in a summary. For a small insurance premium, Octobre offers LPs a guarantee that they can exit their fund positions within 10 working days. The firm has initial underwriting capacity of about a half-billion euros. Goupille said the firm’s ambition is to mobilize €25 billion ($26 billion) in new capital for impact within five years. “We are obviously a financial instrument, a financial tool,” he said, “but it’s really a way to increase significantly the amount of private capital for impact. And that’s our impact.”

- Keep reading, and watch the video, “Adding a dash of guaranteed liquidity to impact funds to attract more institutional LPs,” by David Bank on ImpactAlpha.

Dealflow: Energy Transition

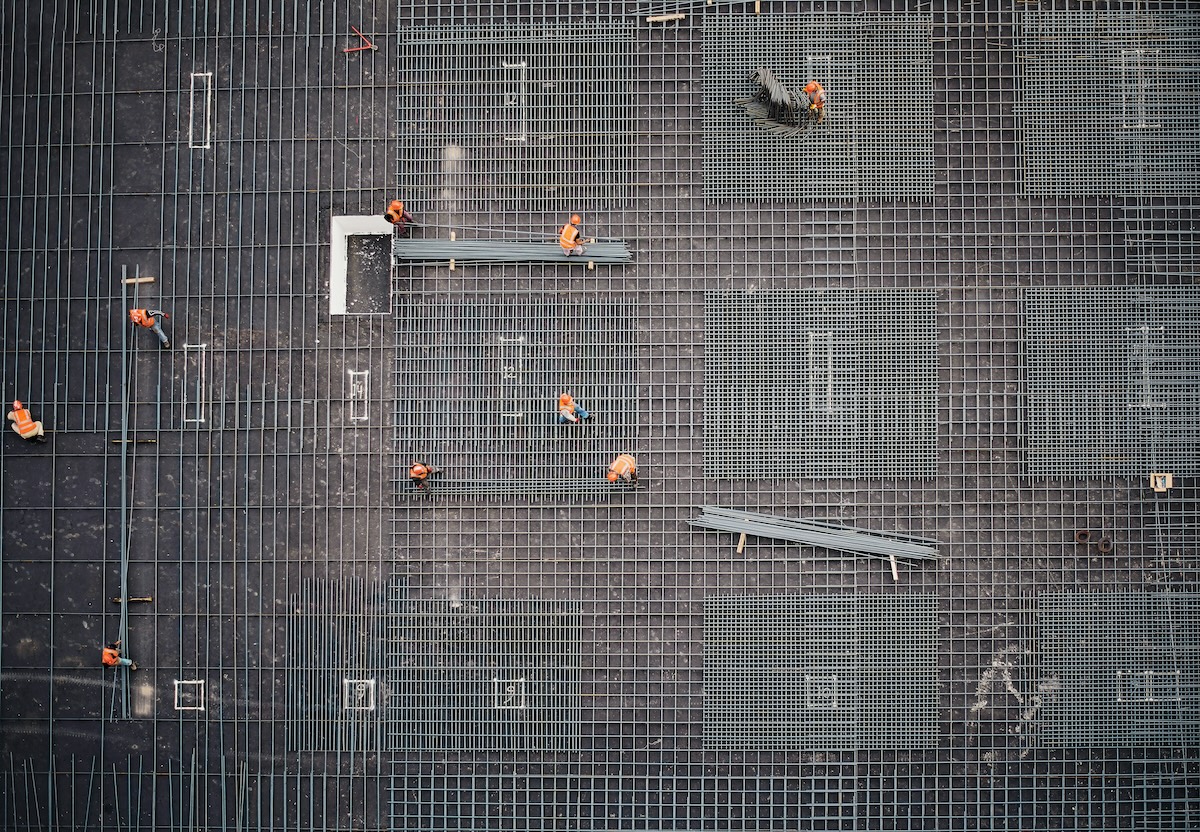

Generate Capital finances green steel, with co-investment from CalSTRS and HESTA. Sustainable infrastructure investor Generate Capital extended a $200 million secured loan to Pacific Steel Group to construct the first green steel mill in California. PSG’s mill, on the western edge of the Mojave desert, will use a renewable energy-powered electric arc furnace and locally sourced scrap metal to produce low-carbon, high quality rebar. Those practices, along with carbon capture and storage, are expected to cut steel production emissions by 85% compared to traditional methods. Steel is critical for building and infrastructure, but is responsible for 7% of global emissions and almost 30% of industrial emissions.

- Co-investment. The California State Teachers’ Retirement System, or CalSTRS, and Australian pension fund HESTA – both investors in Generate – co-invested alongside Generate’s strategic credit initiative. The deal showcases a growing trend for co-investment strategies. “We’re seeing private institutional capital increasingly coalesce to meet insatiable demand for climate investments amid global macro tailwinds,” Generate’s Bill Sonneborn told ImpactAlpha. Institutional investors have faced barriers to entry relating to risk and check sizes, he said. “As an early investor and operator of sustainable infrastructure, Generate brings the knowledge and expertise to unlock the value that institutional investors have traditionally struggled to realize in clean infrastructure.”

- Share this.

DOE’s Loan Programs Office injects $1.2 billion for clean energy in Puerto Rico. In a final heave-ho, the Department of Energy’s Loan Programs Office pushed out loan guarantees for three utility-scale solar generation and battery energy storage projects in Puerto Rico. The $1.2 billion low-cost debt financing package was LPO’s last commitment before the Biden administration handed over the keys to the White House. LPO, which got a big boost under the Inflation Reduction Act, is a key target of President Donald Trump, who has promised to claw back unspent funds from the climate legislation (see, “Jigar Shah’s $30 billion final clean tech push”). The loan guarantees include $584.5 million to subsidiaries of Convergent Energy and Power to finance over 200,000 megawatts of solar and battery storage in Coamo, Cuaguas, Penuelas and Ponce. The projects are expected to enhance Puerto Rico’s grid reliability, adding generation and energy storage capacity near load centers. Convergent says the projects will create roughly 540 construction jobs and 20 green jobs when the systems come online.

- Clean power producers. The other two loan guarantees are conditional commitments, including $133.6 million to Yabucoa Solar, a subsidiary of renewable energy provider Infinigen, for nearly 100 megawatts of solar and battery storage on the island’s eastern coast. Yabucoa Solar will provide about 70,000 megawatt-hours of clean energy yearly. The other is a guarantee of up to $489.4 million to a subsidiary of San Francisco-based clean energy developer Pattern Energy Group for three standalone battery storage projects in Arecibo and Santa Isabel. The projects are projected to deliver roughly 165,000 megawatt-hours of clean energy annually in Puerto Rico. LPO’s Jigar Shah says LPO invested close to $61 billion for 25 loans and guarantees under the Biden administration. Another $147 billion in conditional commitments for 28 projects have not yet been finalized.

- Check it out.

Dealflow overflow. Investment news crossing our desks:

- Inua Capital, a Kampala-based impact fund manager that provides equity to Uganda’s small businesses, invested in Flow Uganda to extend credit to micro-enterprises. (Africa Private Equity News)

- London-based BeZero Carbon raised $32 million in a funding round led by Temasek’s GenZero decarbonization investment group to build out its carbon credits platform. (ESGtoday)

- Infinity Real Estate Partners scored a $18.7 million equity investment from American South Real Estate Partners to acquire and renovate over 1,000 affordable housing units in the Carolinas. (American South Capital Partners)

- Origen Power clinched $13 million in Series A financing, backed by Barclays Climate Ventures, Shell Ventures and Elemental Impact, for its direct air capture systems that use limestone to absorb carbon dioxide from the atmosphere. (Origen Power)

Signals: World Economic Forum Watch

Without even going to Davos, Trump is the talk of the town. It’s the best of times and the worst of times for the global elite flocking to the World Economic Forum in Davos, Switzerland. The wealth of the billionaire class grew by $2 trillion last year, according to Oxfam, with four new billionaires minted each week (for context, see “What if they threw an elite global forum in a Swiss ski resort and no one cared?”). Yet “the Davos consensus” is being tested by shifting geopolitics and the return of bomb-thrower-in-chief Donald Trump, who is making the gathering’s theme, “Collaboration in the Intelligent Age,” seem like wishful thinking. Among Trump’s first executive orders upon being sworn in Monday were to start the US’s withdrawal from the Paris climate agreement and the World Health Organization. Corporate chiefs have been ditching social and climate pledges. Trump – who juiced his own net worth by tens of billions of dollars with the release of a Trump memecoin just before his inauguration – will address the Davos crowd via video Thursday, after his corporate cash-fueled inauguration festivities wind down. Also on the Davos agenda:

- Mental health solutions. A shortage of care providers and funding for mental health is exacerbating a growing crisis. Mental Health Day, hosted by The Real Mental Health Foundation and Convergence Partners tomorrow outside the main WEF proceedings, will address those obstacles. Shawn Lesser, a co-founder of Big Path Capital, launched The Real in 2023 after battling depression (see, “The REAL: A new path for men’s mental health”). Lesser is seeking to raise a $200 million fund of funds and mobilize $10 billion in mental health solutions by 2030. “We’re looking to put mental health on the global stage,” he told ImpactAlpha. A session focused on fresh solutions for youth mental health will feature Second Muse’s Todd Khozein, Sabrina Gracias of Ortus Foundation, Katherine Hay of Kids Help Phone and Vooha Vellanki of Mantra Health.

- Latin America rising. Latin America is well represented at Davos, including by heads of state from Argentina, Peru and Panama, as well as by Chilean environment minister Maisa Rojas Corradi, Mexico’s environment and natural resources secretary Alicia Bárcena, Ilan Goldfajn of the Inter-American Development Bank, Rio de Janeiro’s mayor Eduardo Paes, and other officials shaping sustainable growth in the region. Brazil’s president Luiz Inácio Lula da Silva is not going, but his country is in the spotlight as host of the COP30 climate summit later this year. Pro Mujer’s Carmen Correa will join Claudia Romo Edelman of We Are All Human, Asha Makana of Nairobi Hub, Amitabh Behar of Oxfam International, and Kate Fitz-Gibbon, a professor at Monash University, to discuss progress on gender equality.

- Safeguarding the planet. Trump’s withdrawal from the Paris accord comes after yet another record-hot year, where average global temperature breached the critical threshold of 1.5 degrees Celsius above pre-industrial levels. “Withdrawing the US from the Paris Agreement is a shortsighted abdication of leadership that will only serve to put our nation at a disadvantage,” said former vice president and Generation Investment Management co-founder Al Gore. At Davos, Gore will join Muhammad Yunus, the microfinance pioneer who now heads Bangladesh’s interim government, Andrew Forrest of Fortescue, Spanish prime minister Pedro Sánchez, and others to discuss the state of climate and nature investment on the 10th anniversary of the Paris agreement. On Monday, ClimateGPT’s Daniel Erasmus hosted “How AI can help us prosper in a world beyond 1.5 degrees Celsius,” with NatureFinance’s Simon Zadek and others.

- More.

Agents of Impact: Follow the Talent

The Federal Reserve Bank of Boston adds Betty Francisco, CEO of Boston Impact Initiative, to its board of directors… Michael Ras, previously with Counsel Public Affairs, becomes CEO of Employee Ownership Canada… Aaron Hay joins Intermediate Capital Group as sustainability and ESG director… Maureen Bresil, previously head of KL3, joins Katapult Ocean Asia as a Singapore-based associate director.

James Webb, previously with Barry Callebaut Group, joins Oikocedit as its first blended finance specialist… BNP Paribas’ Vanessa Dager will succeed Ana Demel as chair of the board directors of Pro Mujer… The British Columbia Government and Service Employees’ Union seeks a shareholder engagement assistant in Vancouver… Symbiotics is hiring a Latin America and Caribbean-focused investment analyst.

Sarona Asset Management is recruiting a marketing and communications manager… USAA has an opening for a head of belonging and corporate impact in San Antonio, Texas… Project Drawdown is on the hunt for a private sector partnerships director… Align Impact is looking for a catalytic capital director… ResponsAbility is recruiting a senior investment officer of climate finance for Latin America … CrossBoundary is hiring a Latin America and Caribbean-focused investment advisor.

As You Sow will host a webinar on Thursday, Feb. 20 for the release of its “Clean200” report, which features 200 global companies leading the clean energy transition… The Investment Integration Project will host its fourth annual symposium on system-level investing, Tuesday, Apr. 8 in New York… LAVCA, the association for private capital investment in Latin America, published its 2024 list of top and emerging female investors in Latin America.

👉 View (or post) impact investing jobs on ImpactAlpha’s Career Hub.

Thank you for your impact!

– Jan. 21, 2025