Greetings, Agents of Impact!

👋 Join The Call. The next call in ImpactAlpha’s “Muni Impact” series, “How asset allocators are driving racial equity in municipal bonds,” features Harvard’s David Wood, Renaye Manley of the Service Employees International Union, and other Agents of Impact, Wednesday, June 14, at 10am PT / 1pm ET / 6pm London. RSVP today.

Featured: Returns on Inclusion

Expanding impact investing’s electorate, equitably. To challenge a strong incumbent or powerful status quo, start where your opponents are not looking. Insurgent politicians like Alexandria Ocasio-Cortez and Stacey Abrams, for example, engage, enfranchise and empower marginalized communities. Likewise, impact investors seeking to disrupt and transform the financial system must “build a movement that empowers everyone – welcoming and activating those directly impacted communities that are not currently aware or involved with impacting how investments are made,” writes Common Future’s Eric Horvath in a guest post.

- New chapter. Common Future’s Rodney Foxworth, who oversaw the Oakland-based nonprofit’s evolution from grantee to impact investor, is moving on. Foxworth and Common Future colleague Caitlin Morelli are launching Worthmore, an impact investing and venture development firm that will advise investors and help founders develop business models that deliver long-term impact for stakeholders. Worthmore will invest in mission-driven enterprises through a permanent capital pool it is raising. “We’re looking to be deep partners and create value,” Foxworth says. Sandhya Nakhasi, Jennifer Njuguna and Jessica Feingold will lead Common Future as co-CEOs. “The broad goals, vision and mission will stay the same,” Njuguna tells ImpactAlpha.

- Lived experience. For Horvath, expanding impact investing’s talent pool starts in the classroom. Horvath teaches “Capital for good: Finance, investment and social justice,” to racially and socio-economically diverse policy students at The City College of New York. “I designed a class that deliberately accommodates and amplifies their backgrounds so they can honestly see themselves in this field,” he writes. “I invite progressive people of color working in the field to join us in class and translate jargon into relatable components.” Horvath coaches students beyond their fears, he says, “repeatedly emphasizing that not only can they learn to invest for impact, but their unique lived experiences may make them even better” at it.

- Activating talent. Finding deals and delivering outsized returns, both social and financial, rely on differentiation, “which we can improve by thinking about the ‘who’ more expansively,” says Horvath. Frameworks such as Due Diligence 2.0 help investors select managers by going beyond traditional diversity metrics like race and gender. Programs like Mission Driven Finance’s Community Finance Fellowship and Just Economy Institute’s fellowship are expanding the talent pool. “If we do not consider and value applicants’ socio-economic status and lived experience, and lean into ‘creative hires,’” Horvath says, “so much of the potential I see each semester will remain untapped and disenfranchised.”

- Keep reading, “Expanding impact investing’s electorate, equitably,” by Common Future’s Eric Horvath on ImpactAlpha.

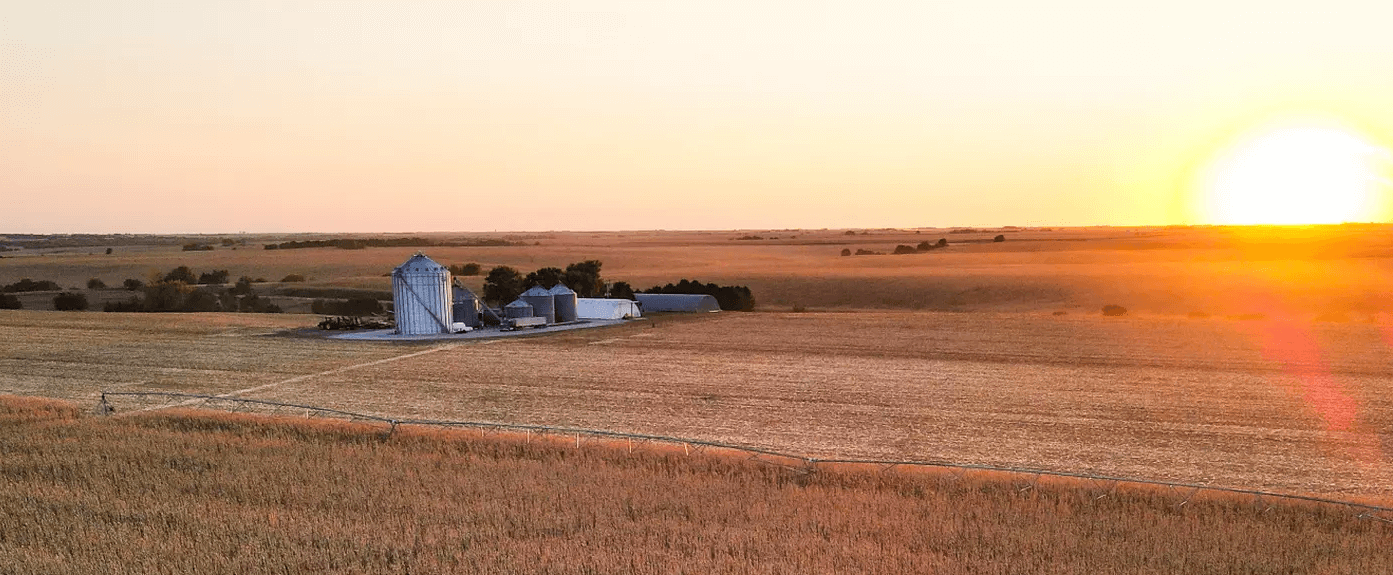

Dealflow: Carbon Tech

Charm Industrial secures $100 million after inking corporate carbon purchase agreements. San Francisco-based Charm prevents the release of carbon dioxide by converting agricultural and agroforestry waste into bio-oil and sequestering it underground. Companies can buy the carbon credits. Charm says its bio-oil improves soil nutrition more than if the biomass waste were left to decompose on its own. Its process has been reviewed by Carbon Direct and EcoEngineers. The company reports sequestering more than 6,000 tons of CO2 through its pyrolyzer, which cleanly burns biomass. Charm’s $100 million Series B round, led by General Catalyst, with backing from Lowercarbon Capital, Thrive Capital and others, will help the company expand its Colorado facility and build a fleet of mobile pyrolyzers.

- Ramping up. Last month, Charm inked offtake agreements for 140,000 tons of CO2 with JPMorgan Chase and the Frontier consortium, whose members include Stripe, Alphabet, Meta, Autodesk, and H&M. Frontier is planning new offtake agreements with companies implementing biomass carbon removal and storage, or BiCRS, which “has the potential to reach climate-relevant scale in the medium term,” the consortium said. Charm said the offtake agreements enable the company to “move meaningfully faster than we’d otherwise be able to, accelerating essentially all aspects of our technology and operations.”

- Check it out.

UK-based OXCCU secures $22.7 million to commercialize sustainable aviation fuel. Climate-friendly policy, advance purchase agreements and capital for climate technologies are accelerating demand for sustainable aviation fuel. Many such fuels are expensive and airlines “continue to face a significant supply shortage,” said United Airlines’ Michael Leskinen. London-based OXCCU reduces costs by combining captured carbon dioxide with renewably-sourced green hydrogen. OXCCU’s fuel “has the potential to resolve our problem by using CO2 as a feedstock to produce fuel,” said Leskinen.

- Corporate VC. Clean Energy Ventures led the round, with participation from the University of Oxford, Aramco Ventures, Braavos Capital, Doral Energy-Tech Ventures and others. United Airlines invested through its sustainable flight fund, a $100 million venture fund for scaling the supply of sustainable aviation fuel.

- Share this post.

Meltdown at Bitwise leaves employees, cities and investors in limbo. The Fresno, Calif.-based upskilling company and social venture darling fired its co-founder CEOs Jake Soberal and Irma Olguin Jr., days after they furloughed the company’s 900 employees amid a cash crunch. Earlier this year, Bitwise Industries raised $80 million to take its model for upskilling low-income residents for high-growth tech jobs to Chicago, with participation from investors including Kapor Capital, Motley Fool, Citi Impact Fund and Goldman Sachs Asset Management. “We have continued to double down round after round, and the skeptics have been proved wrong round after round,” Kapor Capital’s Mitch Kapor told ImpactAlpha shortly after the raise. Kapor Capital declined to comment. In an email to employees, interim CEO Ollen Douglass said “the picture the company presented consistently orally and in presentations was not an accurate picture of the company’s financial health.”

- Local fallout. The office of Fresno mayor Jerry Dyer said Bitwise violated California’s Worker Adjustment and Retraining, or WARN, Act by failing to give employees 60 days notice of the furlough.

- Share this story.

Dealflow overflow. Other news crossing our desks:

- LeapFrog Investments raised $200 million from AIA Insurance in Hong Kong. The firm said it is seeing growing interest from investors in Asia. (Financial Times)

- South African telehealth venture Kena Health raised $2 million from insurance company Old Mutual and US-based Tofino Capital. (BizCommunity)

- Netherlands-based Supersola secured €1 million ($1.1 million) to make portable solar panels equipped with electrical sockets in which appliances can be directly plugged and powered. (Solar Magazine)

- Chile-based Impacta VC led a $700,000 equity round for Mexico’s Airbag, which aims to improve road safety with software that monitors and rates truck drivers’ driving behaviors and rewards them for safe practices. (LatamList)

Agents of Impact: Follow the Talent

Menterra Ventures seeks an impact investment analyst in Bangalore… Palladium has several openings in London and New York, including a financial inclusion director and capital advisory analysts and associates… The SCAN Foundation is recruiting an impact investing director in Long Beach, Calif.

Illumen Capital is hiring a vice president of investor relations in Oakland… New York State Insurance Fund is looking for a senior ESG and sustainability lead… The Families and Workers Fund seeks a remote program director and a program manager.

Applications are open for Dream Climate Tech Launchpad, Village Capital’s new fellowship program with Dream.org that focuses on early-stage Black and Latinx climate tech founders serving communities most impacted by climate change… Next Cubed is accepting applications for its HBCU Founders Accelerator Fall 2023 cohort.

Thank you for your impact.

– June 7, 2023