Greetings, Agents of Impact! Three quick reminders:

Heading for Change. 2X Global’s Suzanne Biegel will share details about Heading for Change, a donor-advised climate + gender fund, on a Zoom call co-hosted by ImpactAssets and ImpactAlpha, today, April 25 at 10am PT / 1pm ET / 6pm BST. (RSVP).

Good green jobs. Join ImpactAlpha and Jobs for the Future on LinkedIn Live to kickoff JFF’s Quality Green Jobs Regional Challenge and a new funding opportunity to support green jobs, Thursday, April 27 at 2pm PT / 5pm ET. (RSVP).

Take our subscriber survey. We want to hear from you how to make impact investing easier with enhanced data and research. Start here.

Featured: Community Finance

In an inflationary environment, are bond buyers still interested in CDFIs? Impact investors in recent years have sought out community development financial institutions as essential capillaries to connect capital to disadvantaged US communities. But rising interest rates have created a mismatch for CDFIs, particularly those using capital markets to finance their activity. The problem: in an inflationary environment, issuing debt at a market rate means “pushing the cost of capital beyond what mission-driven partners and projects can afford,” write Christina Travers and Kathleen Keefe of Local Initiatives Support Corp. in a guest post on ImpactAlpha. CDFIs, many of which are themselves nonprofits, “can only absorb so much of that gap before it becomes untenable,” say Travers and Keefe.

- Impact notes. Starting in 2020, LISC began issuing monthly market-rate Impact Notes, raising $110 million over 18 issuances. Last spring, however, they paused the program. As a result of interest rate hikes, yields had grown beyond what they felt could be responsibly lent to their community partners, which include affordable housing developers, early childhood program operators and community health centers, among others. LISC was concerned that issuing its notes at concessionary rates could send the message that CDFIs were “a better fit for philanthropy than the investment market,” write the authors. That could undo years of work educating investors about the “structure, stability and impacts of CDFI social investments.”

- Unfounded fears. LISC came back to the market in early 2023 with a three-year, ‘AA-’ note at 4%. While the rate was slightly below the 4.4 – 5% offered by comparable fixed-income products, the notes “nonetheless attracted investors, drawn by its investment grade S&P rating and our underlying CDFI mission,” write Travers and Keefe. The note brought in $6.2 million, just above the average volume raised across LISC’s 19 total issuances.

- Flexible finance. The capital is vital in the current economic environment, say Travers and Keefe. Funding generated from such notes is unrestricted, which means it is flexible enough to support interest rate write-downs for LISC’s local partners “who can’t afford to step back and wait for interest rates to moderate.” Only a handful of large CDFIs offer such debt capital. “For those that do, it is capital that we can tailor to the needs we see in the communities we serve.”

- Keep reading, “In an inflationary environment, are bond buyers still interested in CDFIs?,” by Christina Travers and Kathleen Keefe on ImpactAlpha.

Dealflow: E-Mobility

Dollaride scores $500,000 from Elemental Excelerator to electrify urban mobility. Brooklyn-based Dollaride initially launched in 2018 to digitalize New York’s informal network of dollar van drivers and riders (for background, see “Electrifying ‘dollar vans’ to boost livelihoods and cut carbon in New York’s transit deserts”). With a $10 million grant from the New York State Research and Development Authority, or NYSERDA, Dollaride is working to electrify and decarbonize at least 100 dollar vans in Brooklyn and Queens this year. The investment from Elemental, an early-stage climate tech investor and accelerator, will support the electrification of a half-dozen vans and chargers in the Clean Transit Access Program and aims to catalyze an additional $27 million in financing. Elemental’s investment “is catalytic as it’s designed to unlock additional capital that’s already in our pipeline,” Dollaride’s Su Sanni told ImpactAlpha. “The investment is structured to de-risk subsequent investments into the company, which would be made by more traditional debt lenders and project financiers.”

- Catalytic capital. The investment in Dollaride is part of Elemental Excelerator’s infusion of $30 million in catalytic funding for local climate projects. “Our deeper investment in Dollaride is just the start of our deeper investments into scale-up projects,” said Elemental’s Dawn Lippert. “We have a dozen more investments in climate technology to help ensure that underserved communities experience the benefits of technology first, not last.” Seven climate tech startups, including Dollaride, will receive Elemental’s 2023 Infrastructure Prize, which comes with project development, financing and strategy support from Elemental’s policy lab.

- Check it out.

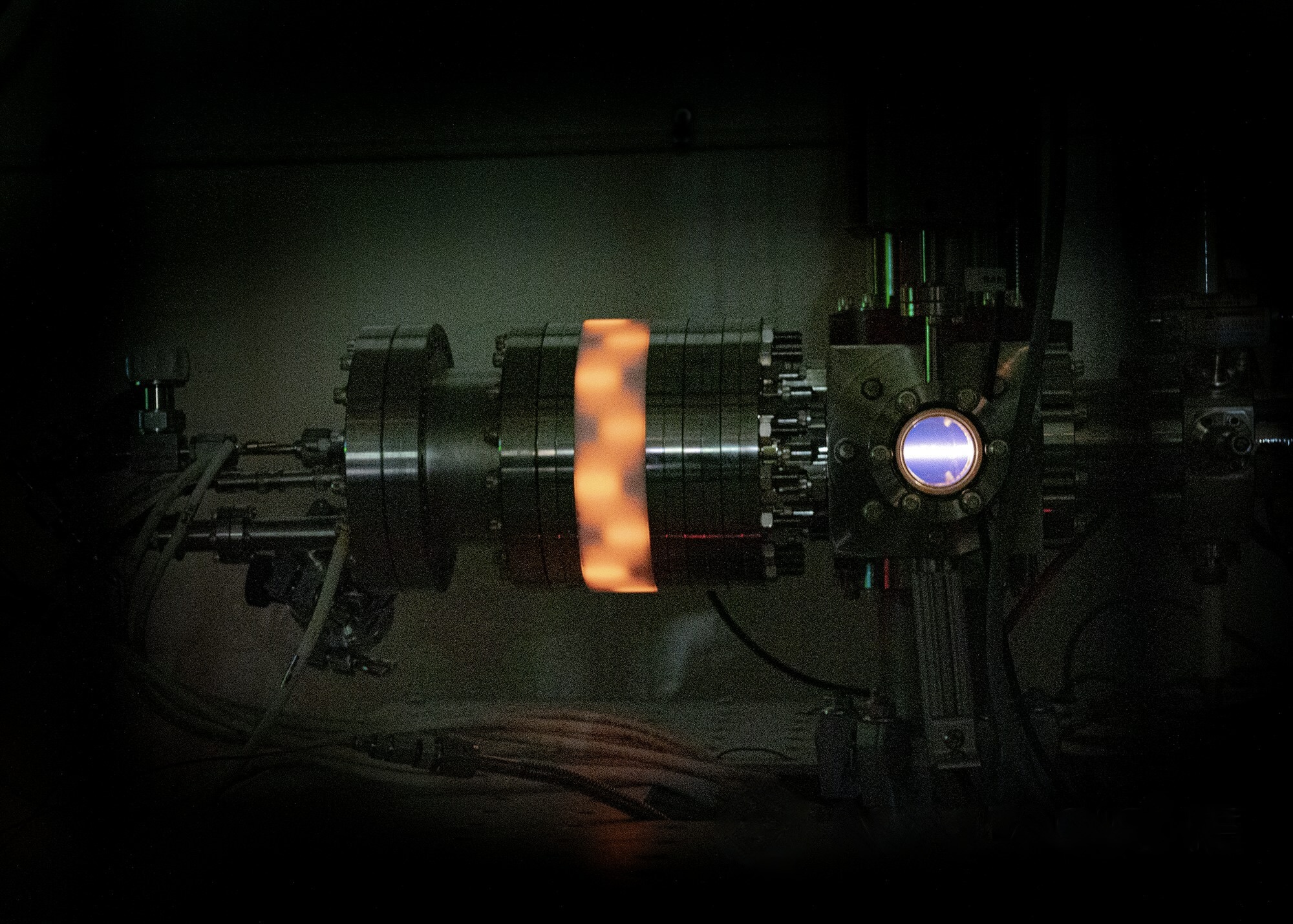

Avalanche Energy raises $40 million to build modular fusion micro-reactors. Fusion energy, considered the holy grail of clean energy, could be a scalable, zero-carbon source of power that avoids many of the drawbacks of other energy sources. Seattle-based Avalanche is building modular fusion micro-reactors that cost tens of millions of dollars, not billions, and are small enough to fit on a desk. Avalanche says one of its two prototypes recently operated at 200 kilovolts, a key milestone.

- Rapid testing. The company will use the Series A funding to “scale up to run more tests at a faster pace,” said Avalanche’s Robin Langtry. Avalanche aims to reach 300 kilovolts in the next six to 12 months. Chris Sacca’s Lowercarbon Capital led the round, with participation from Founders Fund, Toyota Ventures, Grantham Foundation, MCJ Collective and the Climate Capital Syndicate (Prime Impact Fund led the company’s 2021 seed round). If successful, Avalanche’s small reactors have “the potential to be stacked for endless power applications,” said Toyota’s Lisa Coca.

- Fusion energy race. The Lawrence Livermore National Laboratory late last year achieved a net energy gain in a fusion reaction, a breakthrough 70-plus years in the making (see, “‘Net energy’ breakthrough fuels the race to commercialize fusion power”). Commercial fusion startups have raised billions to build demonstration plants and prove their technology, but have yet to create net energy.

- Share this post.

Dealflow overflow. Other investment news crossing our desks:

- Canada’s Braya Renewable Fuels secured a $300 million preferred equity investment from Energy Capital Partners to produce renewable fuel for the aviation industry and heavy-duty transportation. (Braya Renewable Fuels)

- BTG Pactual’s Timberland Investment Group will receive $50 million in debt from the U.S. Development Finance Corp. to protect and restore forests in Brazil, Uruguay and Chile. (Businesswire)

- Paris-based Woodoo raised $31 million, most of which is equity funding led by Lowercarbon Capital and One Creation, to make low-carbon and wood-based materials to replace glass, leather and steel. (TechCrunch)

- San Carlos, Calif.-based Ebb Carbon raised $20 million in Series A funding to enhance and speed up the ocean’s natural ability to capture and permanently store carbon from the atmosphere. (Businesswire)

- French mobility venture Kate scored $7.6 million from individual investors to make small electric vehicles. (TechCrunch)

Six Short Signals: What We’re Reading

Impact exits. Bangalore-based Unitus Capital, which backs ventures serving low-income populations in Asia, has helped investors exit 53 investments from 30 companies with a 43% median internal rate of return and cash-on-cash return of 4.4x (Unitus Capital).

Impact exits. Bangalore-based Unitus Capital, which backs ventures serving low-income populations in Asia, has helped investors exit 53 investments from 30 companies with a 43% median internal rate of return and cash-on-cash return of 4.4x (Unitus Capital).

Investing in the creator economy. The $100 billion “creator” economy of platforms, products and services for independent content creators is ripe for impact investment to ensure the related economic benefits are shared equitably and sustainably. (Upstart Co-Lab)

Investing in the creator economy. The $100 billion “creator” economy of platforms, products and services for independent content creators is ripe for impact investment to ensure the related economic benefits are shared equitably and sustainably. (Upstart Co-Lab)

Trillion-dollar bank. To meet goals for global poverty reduction and climate action, the International Bank for Reconstruction and Development, the lending arm of the World Bank, should triple its sustainable annual lending to around $100 billion per year, with a total loan exposure of $1 trillion by 2030. (Brookings Institution)

Trillion-dollar bank. To meet goals for global poverty reduction and climate action, the International Bank for Reconstruction and Development, the lending arm of the World Bank, should triple its sustainable annual lending to around $100 billion per year, with a total loan exposure of $1 trillion by 2030. (Brookings Institution)

IRA after eight months. Since the policy became law last August, companies and investors have announced 41 major new projects, more than $44 billion in announced capital investment and an estimated 32,000 new jobs. In March: Ford announced a 500,000 per year EV target for Blue Oval, Tenn. In Ohio, Lordstown and Foxconn resumed pilot production. (Jay Turner / Charged)

IRA after eight months. Since the policy became law last August, companies and investors have announced 41 major new projects, more than $44 billion in announced capital investment and an estimated 32,000 new jobs. In March: Ford announced a 500,000 per year EV target for Blue Oval, Tenn. In Ohio, Lordstown and Foxconn resumed pilot production. (Jay Turner / Charged)

Virus hunters. A new coalition, CLIMADE, brings together big names in public health to address climate-amplified diseases in Africa and Latin America. (Bloomberg)

Virus hunters. A new coalition, CLIMADE, brings together big names in public health to address climate-amplified diseases in Africa and Latin America. (Bloomberg)

Scaling biodiversity credit markets. Natural capital accounting, nature-related risk disclosure and tax incentives for setting nature targets are among policy options needed to give supply- and demand-side market actors the confidence to scale their investments in biodiversity. (Taskforce on Nature Markets)

Scaling biodiversity credit markets. Natural capital accounting, nature-related risk disclosure and tax incentives for setting nature targets are among policy options needed to give supply- and demand-side market actors the confidence to scale their investments in biodiversity. (Taskforce on Nature Markets)

Agents of Impact: Follow the Talent

Don’t miss these upcoming ImpactAlpha partner events:

- May 1-2: ImpactPHL’s Total Impact in Philadelphia (use code IMPACTALPHA for $500 off)

- May 1-5: AVCA Annual Conference (Cairo)

- May 16-18: ReFED Food Waste Solutions Summit (St. Louis)

Turner Impact Capital hires Gary Rodney, former managing director of affordable housing at Tishman Speyer, as managing director of multifamily housing initiatives… Schroders seeks a sustainable credit analyst in Frankfurt… The Global Impact Investing Network is hiring a director of the operating principles for impact management in New York.

The Santa Fe Community Foundation is recruiting a controller in New Mexico… OpenInvest has an opening for a remote fixed income ESG associate… Seedstars is on the hunt for a remote impact data manager… Sunwealth is looking for a project development associate in Cambridge… Symbiotics seeks a temporary portfolio manager in Switzerland.

The Venture Capital Alliance, made up of 21 venture firms in the U.S. and Europe including S2G Ventures, Energy Impact Partners and Fifth Wall, launched today to support the global net-zero transition by 2050, both within their respective firms and in their roles as investors and advisors to their portfolio companies.

Thank you for your impact.

– April 25, 2023