Greetings, Agents of Impact!

Featured: Carbon Markets

Simple economics driving carbon prices: Soaring demand, limited supply. The crossover has arrived for carbon, the commodity that will increasingly drive the global economy. On Europe’s emissions trading scheme, carbon closed Friday at €96, or $110. Prices have more than doubled since the beginning of 2021 in the two major regional carbon markets in the U.S. and voluntary markets as well. The simple reason: demand for carbon reduction has finally overtaken the supply of carbon reductions from energy efficiency, forest conservation, regenerative agriculture, direct air capture and other ventures and projects. “In the past, when we saw a huge lack of demand and an oversupply of solutions, we were continually trying to push the market, like, ‘Please, here’s a low-carbon solution,’” Rhea Hamilton of General Atlantic’s BeyondNetZero told ImpactAlpha. Now, the opposite is true. “We’re in a supply-constrained world. And the demand is huge.”

- Cost competitive. The carbon crossover is turning the “green premium” into a green discount. Europe’s emissions trading scheme has lowered the premium for “green steel” to less than $300 per car. That can easily be absorbed in the price of a new Mercedes; the German automaker has pledged to use green steel by 2025. A net-zero car “is much better, in fact, on their share price and the value of the company,” says BeyondNetZero’s Emmanuel Lagarrigue. “Most companies will be taking the premium in exchange for being able to say that they’re super green.”

- Playing the market. New carbon markets generally are “long” at launch, to keep prices low and prevent economic disruption, and go “short” as allowances are reduced and demand increases. In Europe, regulators started ratcheting down allowances in 2018, driving the surge in prices over the past two years. The California market, known as the Western Climate Initiative, is on a similar trajectory. “Suddenly we’re at a point where you hit that inflection where supply and demand flips,” says Estabrook Carbon’s Edwin Datson. “People start suddenly realizing not only will there be scarcity this year, but that scarcity will get worse and worse and worse. And then that really drives the prices up.”

- Join tomorrow’s Call: Carbon is $100 a ton. Now what? General Atlantic’s Emmanuel Lagarrigue, Estabrook Carbon’s Edwin Datson, CDP’s Paula DiPerna, ReGen Networks’ Gregory Landua, and Delton Chen of Global Carbon Reward will go beyond carbon credits to fund strategies, deal underwriting, corporate accounting and crypto speculation. How and where is carbon pricing showing up? Share what you’re seeing and we’ll call you up on The Call, tomorrow, Feb. 8, 10am PT / 1pm ET / 6pm London. RSVP today.

Keep reading, “Simple economics driving carbon prices: Soaring demand, limited supply,” by David Bank and Amy Cortese on ImpactAlpha.

Dealflow: Low-Carbon Transition

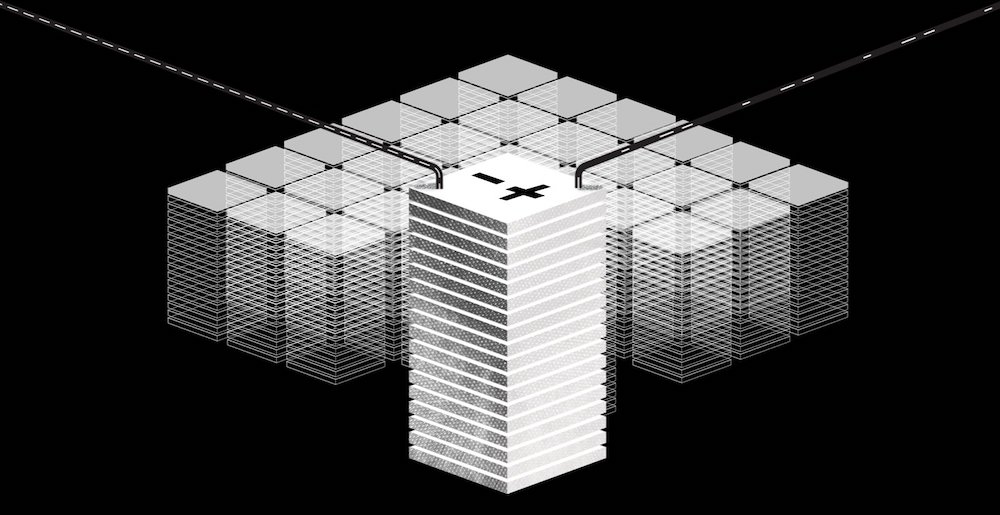

Verdox raises $80 million to commercialize electric carbon-capture technology. Direct air capture technology that can remove billions of tons of carbon from the atmosphere may be critical to keeping global warming below two degrees Celsius. Current carbon capture solutions, however, are expensive and energy intensive. Woburn, Mass.-based Verdox’s method, developed by a group of MIT professors, uses a super-battery that absorbs carbon or a stream of waste gas from the air as it charges, and releases pure CO2 as the battery discharges. The pure CO2 can then be used for other purposes. The company says the process is cheaper and more efficient than other direct air capture methods. “Verdox’s technology has the potential to capture carbon from any industrial source or the air – and at up to 70% relative energy savings,” said Verdox’s Brian Baynes.

- Direct air capture. Other companies pursuing direct air capture of carbon include Vancouver-based Carbon Engineering and Zurich-based Climeworks. “The high energy efficiency and scalability of Verdox’s technology could enable the company to play a major role in addressing the carbon removal challenge,” said Carmichael Roberts of Breakthrough Energy Ventures, which made the investment with Lowercarbon Capital and Prelude Ventures.

- Check it out.

Israel’s Agritask raises $26 million for sensor data for farmers. The Tel Aviv-based agriculture analytics company uses a network of connected sensors, weather stations and satellite imagery to give farmers and insurers insight into soil and crop health. Agritask manages more than 50 different crop types in over 35 countries.

- Risk reduction. Agritask has helped companies like Starbucks and Heineken reduce risks with sustainable farming and sourcing practices. The company also works with insurance companies to expand their products for farmers. Agritask can “play a key role in securing the future of food production and impacting the lives of millions of farmers,” said Constantin Liechtenstein of Liechtenstein Group, which led the Series B round with Smart Agro Fund, the InsuResilience Investment Fund and Bridges Israel, the Israel-based sister fund to Bridges Fund Management.

- Share this post.

Dealflow overflow. Other investment news crossing our desks:

- Engine No. 1 secures an anchor commitment from Bay Area advisory firm Jordan Park to launch an exchange-traded fund to invest in companies advancing the energy transition.

- Insurance tech startup Casava scores $4 million in pre-seed funding for affordable income protection and health insurance in Nigeria.

- Also in Nigeria, Rwanda Innovation Fund backs MAX to expand its ride-hailing platform and financial services to East Africa’s drivers.

- Eco-friendly online grocer Zero Grocery raises $11.8 million in seed financing to deliver groceries using plastic-free packaging.

Agents of Impact: Follow the Talent

Harris Komishane, ex- of Fidelity Investments, joins Invest Green as senior advisor and principal… Tikehau Capital appoints Alexander Bell, ex- of Caisse de Dépôt et Placement du Québec, as head of the North American private equity climate practice, and Cristian Norambuena, ex- of New York City Comptroller’s Office, as director of the practice… Jeffrey Cohen, ex- of the Sustainability Accounting Standards Board Foundation, joins Oak Hill Advisors as head of ESG and corporate sustainability.

Michael Chitwood, ex- of World Vision USA, joins Opportunity International as chief philanthropy officer… Tanya Beja, ex- of Blue Marble Microinsurance, joins AlleyCorp Social Impact as partner… Coalition for Green Capital names William J. Barber III, son of Rev. Dr. William J. Barber II, as chief consultant for environmental justice and equity… Blackstone Charitable Foundation is hiring a director of finance and operations in New York… New Markets Support Company is looking for an impact manager and an impact analyst.

Thank you for your impact.

– Feb. 7, 2022