ImpactAlpha, August 23 – Agriculture is the foundation of daily life in most of the world. The food and agriculture sector provides livelihoods for 2.5 billion people and contributed $3.3 trillion to the global economy in 2018. It accounts for 4% of global GDP — and up to 26% of GDP in some of the world’s least developed countries — according to the World Bank.

However, this bedrock of society is also surprisingly delicate, with the Covid-19 pandemic, extreme weather and geopolitical conflicts deepening already existing cracks.

Sustainable agriculture is key to strengthening existing systems and achieving Sustainable Development Goals such as ending poverty, achieving zero hunger and meeting climate targets. Although the worldwide market value of sustainable agriculture products reached an estimated $872 billion in 2020, it remains underinvested, with an annual financing gap of $260 billion. Just 2% of total activity in private equity is focused on sustainable agriculture.

It’s clear sustainable agriculture presents a huge opportunity for investors—but where do we start?

Research shows that giving women equal access to agricultural resources would increase production and reduce the number of hungry people worldwide by up to 150 million. But while much research focuses on women at the bottom of the economic pyramid, we believe investing in the women at the top of the pyramid is our best bet, as empowering them will have ripple effects all the way down.

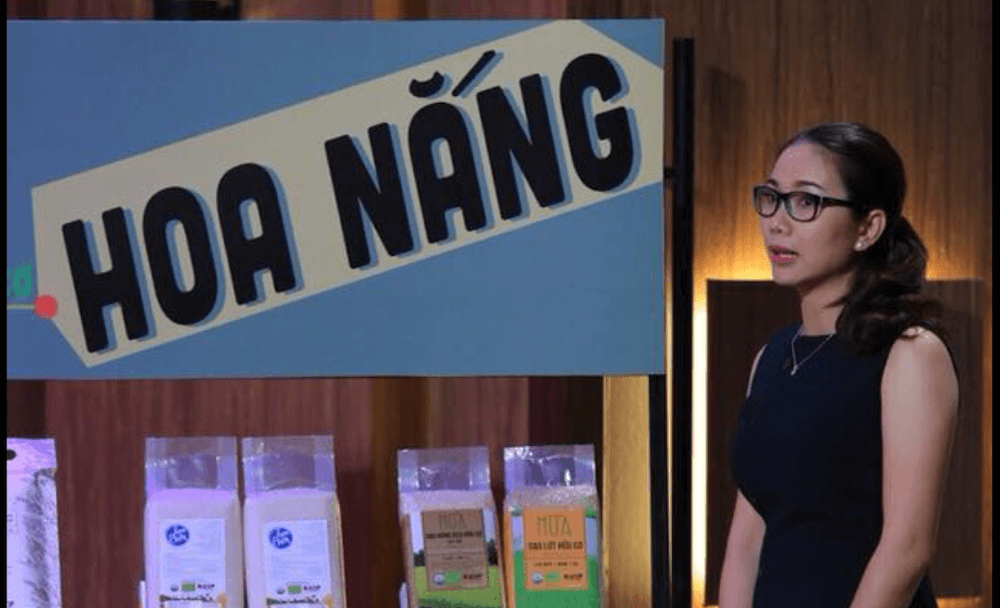

Our experience investing in Hoa Nang Organic, an organic rice company in Vietnam, is a case in point.

Investing in growth

In September 2021, we met Dang Thi Truong An, the CEO of Hoa Nang Organic. Before she founded the company, An worked for another agricultural value-chain company where she became increasingly interested in improving sustainability. She convinced leadership to allow her to pilot a project focused on environmentally-friendly practices, but it was such a large company that her initiative remained a small part of what they did. So, she decided to leave and start her own agricultural business with sustainability at the forefront (a rarity in Vietnam) and her leading it as its CEO.

As a woman CEO in the agricultural sector, An is an outlier. While women make up 43% of the agricultural workforce and produce the majority of food in developing countries, they hold only 14% of management positions and receive only 7% of agricultural investment.

When our fund met with dozens of agricultural companies last year, about half of them were women-run. However, we found that most of the time, women had a smaller share or voice compared with their male co-founders or were relegated to the COO (rather than CEO) role, lessening their visibility in the business and limiting their impact.

The whole idea of the Beacon Fund, which provides fit-for-purpose financing to women-led and women-owned businesses in Southeast Asia, is to meet the specific needs of those female founders. Launched on the Patamar Capital platform in 2020, the fund has since raised more than $20 million, including multi-million-dollar commitments from the Visa Foundation and the Sasakawa Peace Foundation. The fund also incorporates a blended finance structure, with USAID providing $1 million in funding through the INVEST initiative to build in a first-loss layer.

Our near-term goal is to grow to a $100 million fund.

Women-led businesses face significant challenges, regardless of their field. Women are often constrained by domestic and caregiving responsibilities, are less likely to have necessary collateral for bank accounts or loans, they lack the same networks, and face enormous biases and double standards when seeking investment. Women in agriculture have even higher hurdles to overcome, having to deal with the power dynamics of being “double minority” in male-dominated business and agriculture.

They are also navigating a system that was not built for them. Traditional venture capital and private equity funds generally target the same type of opportunities, focusing their efforts on unicorns and exponential growth companies, and ultimately leaving many promising businesses without the support they need.

Empowering women

We knew there was an opportunity to make investment work for women-led businesses, rather than the other way around.

Earlier this year we announced that Hoa Nang would be the Beacon Fund’s second-ever investment. From the beginning, we were impressed with An’s capabilities; despite being a rare woman CEO in sustainable agriculture, and the even more nascent organic farming sector in Vietnam, she has seen the company through a remarkable growth trajectory. We were struck by the company’s commitment to upholding organic standards and their commitment to gender equality under her leadership, both on their team (70% are women) and among the farmers they work with (about 50%).

Hoa Nang is a great example of how a company can consider gender in various aspects of its work — not just checking the box of female leadership. It demonstrates how a gender lens factors into all aspects of the business, from looking closely at the customer base and their preferences, to supply chains, to building talent within the company. An, for instance, is very focused on building the next generation of female leaders, giving them room to grow, expanding their skill sets, and sending them for training and English programs.

We are already seeing the fruits of this investment for Hoa Nang, beyond the dollar value. First, it gave An and her team the confidence to find alternative sources of funding, as the management team knows it has the track record and prestige to seek additional investments. It has opened conversations with additional funders, including DFIs, government support programs and other foreign capital that previously seemed out of reach. With Beacon Fund’s investment, they were able to deliver a significant and growing order from a corporate client that will be crucial to the company’s continued growth and expansion into new product lines.

Perhaps most importantly, An shared that she sees the investment as a validation of Hoa Nang’s values, which has been meaningful on both a personal and professional level. On our side, we see partnerships like this as a proof of concept that we can make the investment system work better for women-led businesses, even in a difficult sector like agriculture.

An’s experience shows how investing in the women at the top of the pyramid could be a key part of the solution—and demonstrates how the investment community can get us there, one Hoa Nang at a time.

Shuyin Tang is the co-founder and CEO of Beacon Fund. Yen Do is Beacon’s investment manager.