ImpactAlpha, August 13 – Venture capital firm S2G Ventures invests in sustainable agrifood technology. It’s now expanding into ocean health and sustainable seafood.

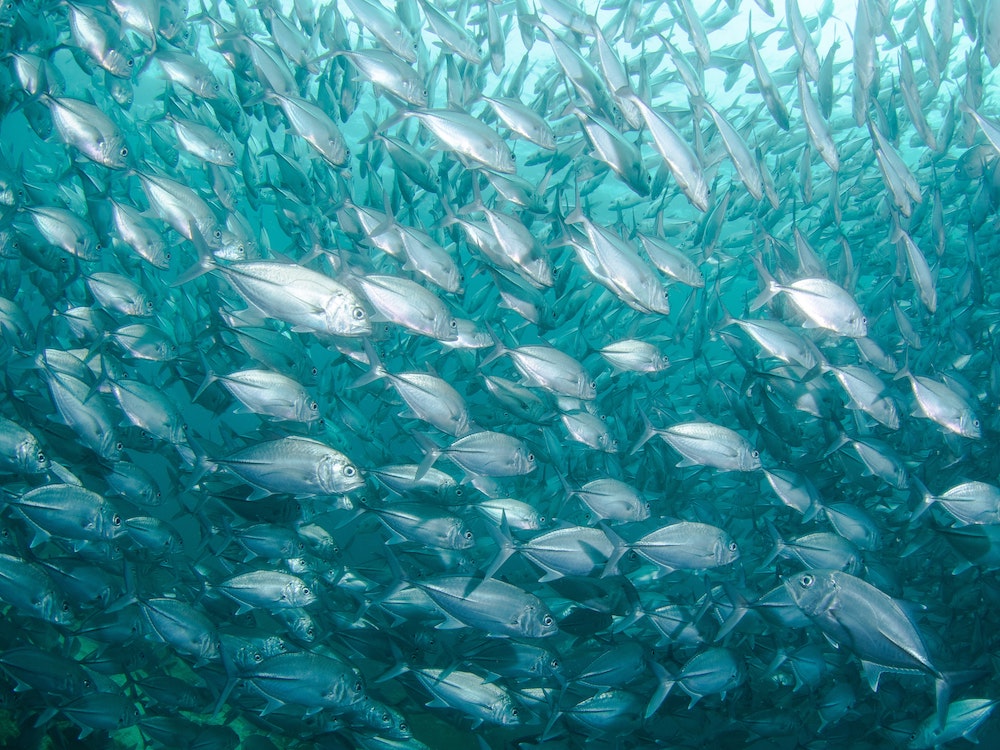

Oceans provide a critical food source for billions of people and are crucial link in tackling climate change. S2G’s Oceans and Seafood fund will back early- and growth-stage startups developing science and technology around alternative proteins, aquaculture and supply chain innovation, traceability and transparency, algae and seaweed, ecosystem services, and ocean health.

The firm has recruited Kate Danaher, previously with RSF Social Finance, and Larsen Mettler, from Silver Bay Seafoods, as the fund’s managing directors.

Food system gap

S2G’s portfolio includes companies like Beyond Meat, sweetgreen, Apeel Sciences and Greenlight Biosciences. With only one seafood investment—FishPeople—S2G recognized that it was missing opportunities.

“The ocean is part of the food system for many people on this planet, and it is also, like land based agriculture, in dire straits for a lot of reasons,” Danaher told ImpactAlpha. “The sector has been so basic and under-invested in, entrepreneurs really need help to build their businesses, not only with capital but also wraparound services and support.”

A handful of other investors back oceans and seafood technologies, including Netherlands-based aquaculture fund Aqua-Spark, aquaculture accelerator Hatch, and other agrifood investors like SOSV, Alimentos Ventures and Eco.business Fund.

Dive into ImpactAlpha’s full coverage of Financing Fish.