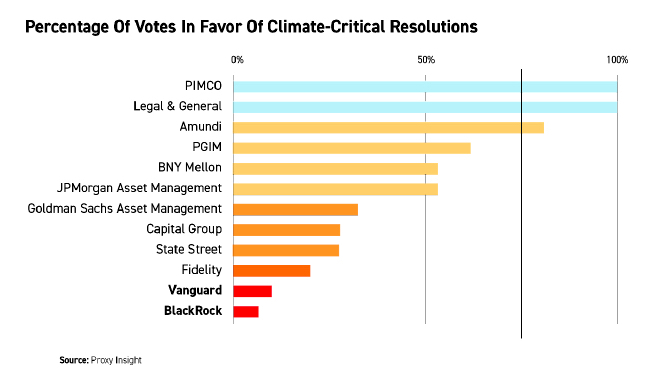

ImpactAlpha, Sept. 22 – Among the world’s dozen largest asset managers, Legal & General and PIMCO were the toughest on corporate management when it came to voting their proxies. The most lax: BlackRock and Vanguard.

“To investors’ portfolios, the systemic risk of climate change is large, material, and undiversifiable,” the corporate accountability group Majority Action says in “Climate in the Boardroom: How Asset Manager Voting Shaped Corporate Climate Action in 2020,” its new analysis of the proxy voting records of asset managers with a collective $27.65 trillion in assets under management. The analysis looks at votes on director elections and executive compensation as well as key climate resolutions at large U.S. companies.

Legal & General Investment Management and PIMCO voted most often against management-proposed directors in the energy, utility, banking and automotive sectors. The two asset managers also supported all of the key climate-related proposals tracked by Majority Action. BlackRock and Vanguard supported just three and four, respectively, of the 36 “climate-critical” resolutions – causing at least 15 to fall short of majority support. In the middle: Amundi, PGIM, BNY Mellon and JPMorgan Asset Management voted in favor of more than half of the climate proposals.

Road block

In his widely read letter to shareholders in January, BlackRock’s Larry Fink vowed to center climate change and hold companies accountable. Yet BlackRock, along with Vanguard, voted against just 1% of company-proposed directors in the energy, utility, banking and automotive sectors, despite their lack of meaningful climate action.

In its own stewardship report released in July, BlackRock said it voted against directors at 53 companies for climate reasons and put another 191 “on watch.” However, most of the directors it voted against were at smaller or non-U.S.-based companies, says Majority Action.

Japanese pension fund pushes asset managers to get tougher on sustainability

BlackRock and Vanguard have served “as a roadblock for global investor action on climate,” the report said. Fidelity and Goldman Sachs Asset Management also mostly sided with management.

Climate Week

The findings generally confirm what veteran governance watchers like GMO’s Jeremy Grantham already knew. Last year, Legal and General won a $50 billion mandate from Japan’s Government Pension Investment Fund partly on the basis of its more aggressive stewardship stance.

Japanese pension fund pushes asset managers to get tougher on sustainability

Majority Action’s report comes at the start of Climate Week NYC and a day before the Securities and Exchange Commission is expected to finalize a controversial rule that would raise hurdles for filing shareholders resolutions.

Investor Say

Separately, Legal & General said it is piloting software from U.K.-based startup Tumelo to enable investors to see what companies are in their pension funds and provide input to LGIM’s stewardship team on issues such as climate change, gender equality, and CEO pay up for proxy votes. The input is “advisory,” but will “influence” the firm’s thinking. The idea is to “help members understand how their investments can align with their principles,” said LGIM’s Emma Douglas in a statement.

Other targets for Tumelo’s “crowdsourced proxy advisory” include large employers and university endowments, cofounder Georgia Stewart told ImpactAlpha. “We’d like to give direct shareholders a voice everywhere.”