ImpactAlpha, April 16 – OpenInvest launched in 2015 with the ambitious goal of democratizing impact investing. That turned out harder than expected (see, “Retail platforms for sustainable investing struggle to differentiate themselves – and to attract customers“).

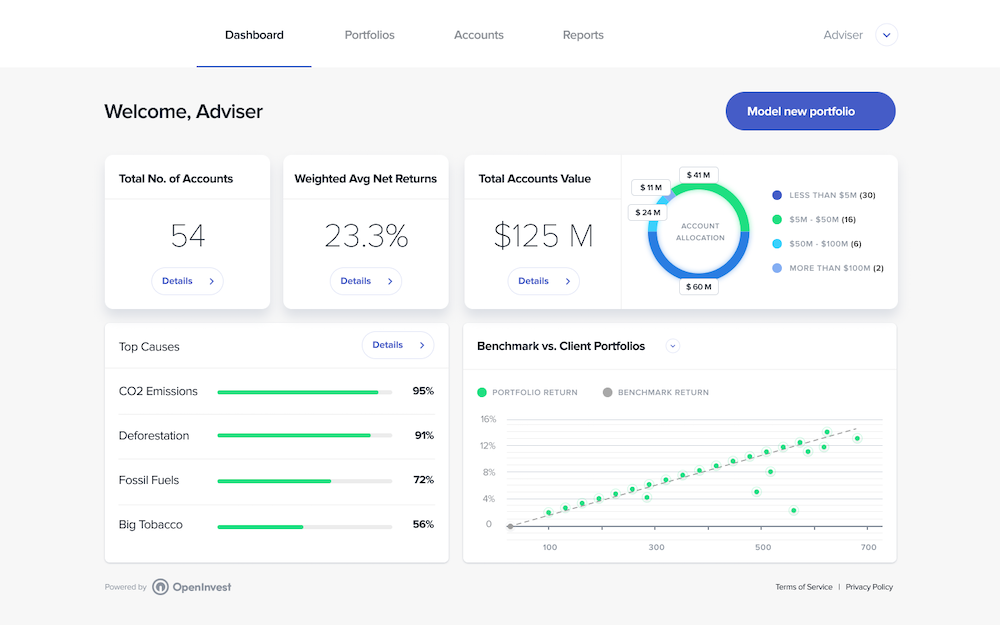

Last year, the robo-advisor pivoted away from its direct-to-consumer approach and toward technology partnerships with wealth advisors, including Resolute Investment Managers, which handles $75 billion in assets.

“Advisors are realizing this is a personal conversation, but optimizing portfolios and managing risk across the many factors that people value is almost an impossible human task,” OpenInvests’s Josh Levin told ImpactAlpha.

It has now raised a $10.5 million Series A round that will help the company launch globally. QED Investors led the round with participation from SystemIQ, Resolute and the venture arm of ABN AMRO.

The current market volatility is driving more capital to responsible strategies (see, “Sustainable investments are growing, and outperforming, in a volatile market”). “This is a time that comes once or twice in a career for an emerging asset manager,” Levin says. “No one changes when the market is going up. It’s when you have volatility that people start looking for new solutions.”