ImpactAlpha, October 1 – Bangladesh-based SOLshare launched in 2015 with an off-grid solar model that allows groups of households to share energy generated from their rooftop panels. Impact Investment Exchange led the company’s $1.7 million Series A round through its venture fund, IIX Growth Fund. Innogy New Ventures and Portuguese utility firm EDP also participated in the round.

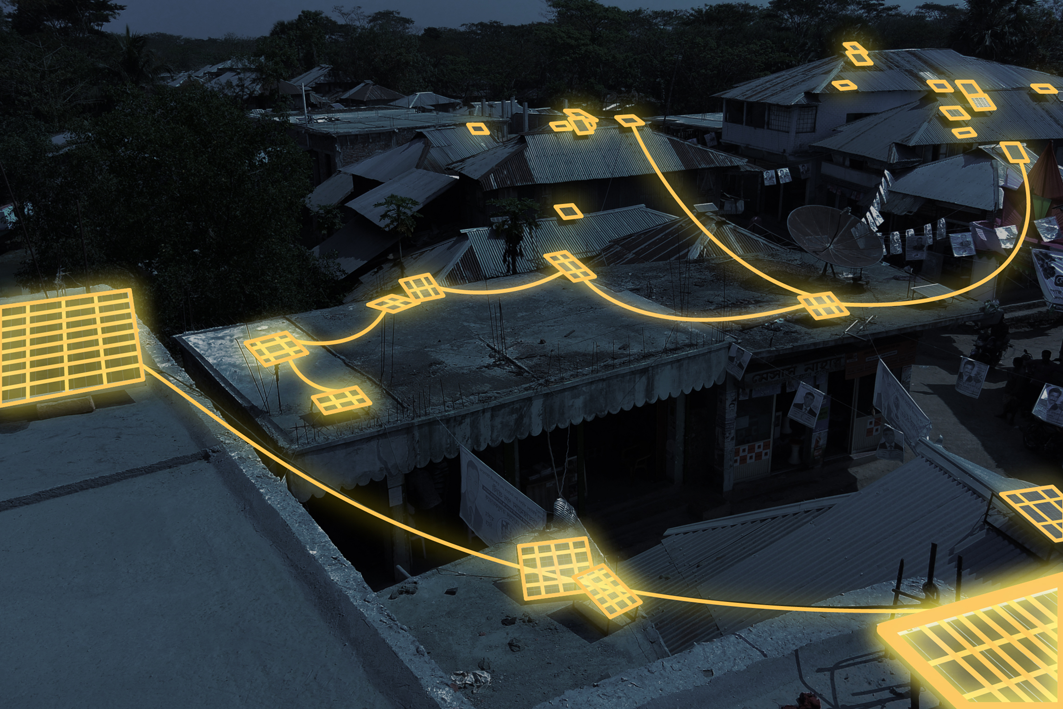

SOLshare effectively allows villages to create decentralized solar-based minigrids. The benefits of the system, the company says, is that it expands electrification while providing households new income streams, from energy that they sell back to the grid network, and offers other households “a more flexible, reliable and cheaper electricity service.”

SOLshare hopes to reach 19,000 rural households with the new funding.

IIX, based in Singapore, invested in SOLshare as part of its Growth Fund’s mission to support impact startups in Asia. “Only 19% of the world’s active private equity and venture capital impact funds across the world target the region, with majority of these funds focusing on India,” IIX’s website states. In response, its Growth Fund is targeting impact startups in Bangladesh, Indonesia, the Philippines and Cambodia.

IIX’s Growth Fund has previously invested in Indonesia-based PT Green Enterprises, which makes coconut oil and other coconut products.

Youth, tech and entrepreneurship drive impact investing’s growth in Southeast Asia