Impak Battles, an ImpactAlpha series with impak, a Montreal-based impact ratings agency, assesses the positive and negative impact of corporate operations. The agency uses its impak Score rating methodology in a head-to-head assessment of two representative companies. Last edition: Total vs. Neste Oyj. Next up: A comparison of the two European stock exchanges. Face-off!

The past year was a difficult and erratic time for stock exchanges around the globe. The pandemic struck, large-cap stocks in tourism, transportation and food chain plummeted; others resurfaced and soared. In the last month, small investors took a stand, perhaps redefining some market rules.

2020 saw a spectacular increase in sustainable investments, pushing stock exchanges to position themselves in the race for sustainable data (ex. Deutsche Börse acquired ISS and Clarity.AI and London Stock exchange acquired Refinitiv).

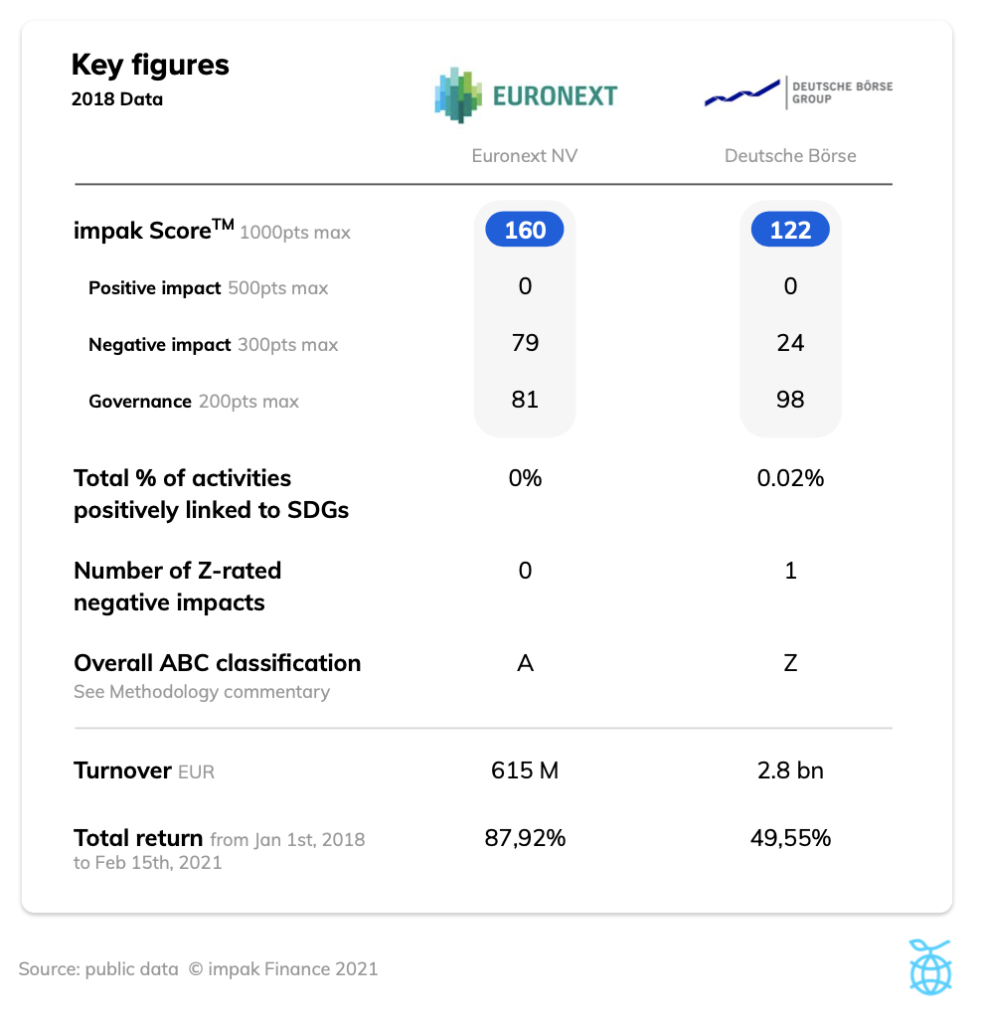

Impak analyzed the 2018 impact statements and Impak scores of Amsterdam-based stock exchange Euronext NV (Euronext) and Frankford-based exchange Deutsche Börse (DBG). The road to transition is still blocks away, though the recent merger and acquisition activity is encouraging. Notable: This is the first time our Impak Battle series presents companies that do not generate any material positive impact.

Data are based on both companies’ 2018 public financial and extra-financial statements, compiled using impak’s rating methodology and aligned with the Impact Management Project framework. The methodology follows the IMP classification: A (act to avoid Harm), B (benefit stakeholders), C (contribute to solutions) and Z (does or may cause harm).

Positive impacts

Euronext nv: 0/500 *tie*

Other companies from the face-off series received a positive impact score of 0 because of a negative impact rating of Z (which means it causes or may cause harm). Euronext simply has no material positive. Some of its activities generate positive impacts, but these are not material enough to be considered in the analysis. Those activities include financial literacy engagement and an exchange opening to startups, which will allow cleantech and greentech companies to raise capital.

Deutsche Börse: 0/500 *tie*

Deutsche Börse has one material positive impact linked to Sustainable Goals No. 17: Partnership for the Goals. Just 0.02% of its activities are dedicated to PHINEO’s funding, an initiative to strengthen civil society through advising and connecting stakeholders from the public and private sectors that are dedicated to improving social cohesion and standards. This impact is rated B, in other words, it benefits stakeholders.

Negative impact mitigation

Euronext nv: 79/300 *Winner*

Euronext has six material negative impacts, all rated A (or act to avoid harm). Along with SDGs No. 5: Gender equality; No. 7: Affordable and clean energy; No. 13:Climate action; and No. 16: Peace, justice and strong institutions, No. 17:Partnership for the goals is present twice. One of the related negative impacts is the risk of impacting the financial industry with business discontinuity or data breaches, and the risk of a discontinuity in the trading financial sector impacting the real economy.

The second material negative impact is linked to SDG No. 17 and concerns the risk of issuers transparency on their social and environmental impacts, and the risk of environmental and social negative impacts of products offered (commodity price volatility, climate damage, etc.). Euronext put in place some mitigation measures for these negative impacts, but it does not report any key performance indicators to analyze their effectiveness.

Deutsche Börse: 24/300

Deutsche Börse also has six material negative impacts. One is rated Z (which means it causes or may cause harm). In December 2018, the group was fined in an insider trading case involving its former CEO, raising concerns about more insider trading, fraud and market abuse behaviour.

Clearstream – a subsidiary – is an alleged secondary participant in theCumEx scandal.

Governance

Euronext nv: 81/200

Deutsche Börse: 98/200 *Winner*

Deutsche Börse presents a slightly higher score on impact governance. Our analysis reveals that the main difference between Euronext and Deutsche Börse is at the impact integration level in their governance. In other words, the presence of impact experts in the workforce, impact/corporate social responsibility objectives in key performance indicators and compensation goals demonstrate integration. In this area, Deutsche Börse scores a third of the maximum possible score while Euronext scores closer to zero points.

With regards to the notion of intentionality (if the mission includes an environmental or social issue and a solution), Deutsche Börse scores a few points, while Euronext scores none.

The Winner: Euronext nv (160/1000)

Despite Euronext having no material positive impact and poorly reported mitigation measures, the Amsterdam-based exchange operator is the winner of this battle. Our analysis shows that the main factor benefiting Euronext is the penalty given to Deutsche Börse on its positive impact score because of a Z rating on one of its negative impacts. Next year’s battle may include some surprises because of Deutsche Börse’s recent acquisitions and the potential effect on its positive impact score of mitigation measures regarding its Z-rated impact. In terms of positive impact scoring, Euronext will have to start from scratch.

Specificity of the sector

The stock exchange sector is constantly at risk regarding business ethics, including insider trading, fraud and market abuse behaviour. It also presents a systemic risk regarding data security (ex. potential market discontinuity and data breaches). Both material issues have yet to be properly addressed in most cases. The 2020 sustainable investing explosion brought these issues to the forefront, and the pressure and opportunity it represents for the stock exchange industry is not to be diminished.

Methodological notes

Data are based on both companies’ 2018 public financial and extra-financial statements, compiled using impak’s rating methodology available on www.impakfinance.com, and aligned with the Impact Management Project (IMP) framework.

The methodology follows the IMP classification: A (Act to avoid harm), B (Benefit stakeholders), C (Contribute to solutions), and Z (Does or may cause harm).

It should be said that both companies count a few other potential positive impacts that were not considered because of a lack of information or because they represent less than 0.01% of the companies’ total activities.

Note that according to our methodology, the level of penalties in case of a Z is based on 3 different factors: the type of Z (does cause harm or may cause harm), the repetition of the Z through time and, only in the case of a Z ”does cause harm”, whether or not corrective actions have been implemented.

Two positive impacts can overlap—for example, if the same product is certified Fair Trade AND Organic. The percentages of activities linked to these impacts are therefore not cumulative.

Duration is the timeframe for which the stakeholder experiences the outcome, and Depth is what is defined as the degree of change for the beneficiaries. Both relate to the How Much dimension, one of the 5 dimensions defined by the IMP.

DISCLAIMER:

Information contained in these articles is provided solely for informational purposes and therefore does not constitute advice on or an offer to buy or sell a security. impak Finance is not liable for the induced consequences when third parties use these opinions either to make investment decisions or to make any kind of business transaction. This information is subject to impak Finance’s terms of use and compliance policies.