Greetings Agents of Impact!

In today’s Brief:

- A colossal approach to de-extinction tech

- Equipment financing for Colombian businesses

- Big bets on African remittances

- Reprioritizing impact-first strategies

Featured: Impact Tech

Wild and woolly: Colossal Biosciences raises $200 million to revive the mammoth and other lost species. In just a few years, the first woolly mammoths to live in more than 4,000 years may be taking their first tentative steps across the chilly Arctic tundra. If they do, it will be a crowning moment for Colossal Biosciences, the bold-thinking “de-extinction” startup behind the mammoth and other projects intended to rewild long-lost species and restore degraded ecosystems. In addition to mammoths, the Dallas-based biotech company is using gene editing tools and AI to resurrect the Tasmanian tiger and the iconic dodo bird. The research is already spawning technology and insights that could help preserve currently endangered species and keep them from disappearing. “The world is in the middle of the sixth mass extinction event caused by humans,” says Colossal’s Ben Lamm, a serial entrepreneur who founded the company in 2021 with Harvard’s star geneticist George Church. “Conservation works, but not at the speed at which we are changing the ecosystem and eradicating species.”

- Re-engineering nature. Dallas-based Colossal has raised a fresh $200 million from TWG Global, the investment vehicle for Guggenheim Capital’s co-founder Mark Walter. The deal values Colossal at more than $10 billion, just a year after it earned unicorn status with a $150 million Series B round led by Pittsburgh-based United States Innovative Technology Fund. Silicon Valley investor Jim Breyer, biotech venture firm Arch Ventures, “Lord of the Rings” director Peter Jackson, and In-Q-Tel, the venture arm of the CIA, also are investors. In-Q-Tel said Colossal’s research could unlock new capabilities beyond re-wilding species, such as re-engineering wood to improve building materials, sequestering carbon, curing human diseases and enhancing crop species to tolerate climatic changes. “De-extinction and species preservation we think go hand in hand,” Lamm says.

- Technology spinoffs. Colossal’s big pay off may take years, but its investors are spreading their bets. Colossal has spun out two companies, in which its investors get stakes: Form Bio was launched in 2022 to offer computational biology tools and software developed at Colossal to help speed research for human healthcare. The company has raised over $35 million and, Lamm says, has seven-figure annual recurring revenue. Last April, Colossal spun out Breaking, named for its synthetically enhanced microbes that can break down plastics into harmless biomass. The startup raised $10.5 million in seed funding and has several active pilots underway. “We think those are billion dollar-plus businesses,” says Lamm. The company also plans to make money from its advanced genome engineering tools and, eventually, from biodiversity credits.

- Keep reading, “Wild and woolly: Colossal Biosciences raises $200 million to revive the mammoth and other lost species,” by Amy Cortese on ImpactAlpha.

Dealflow: Financial Inclusion

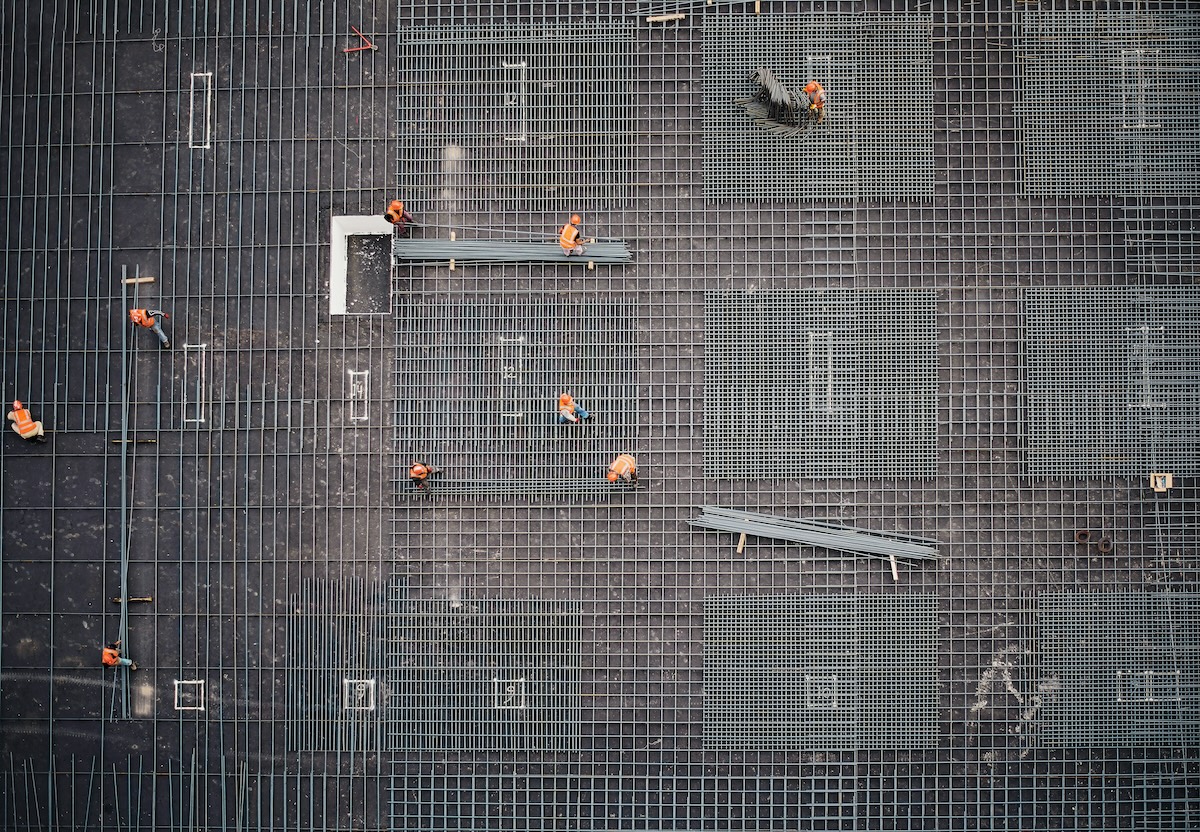

FinMaq raises $29 million in debt and equity to provide equipment financing to Colombia’s small businesses. The Bogota-based fintech venture uses alternative credit-scoring to help informal, micro and small businesses borrow to acquire equipment to boost their livelihoods. FinMaq provides loans in partnership with more than 40 machinery distribution companies. Since launching in 2022, the company has loaned $17 million to about 550 borrowers, 30% of whom had no formal credit history; half are based outside of urban areas. Acumen’s Latin America-focused ALIVE Ventures led the mixed debt and equity round to support the company’s growth in agriculture, construction and healthcare. “The financial solutions provided by the company are reaching a critical segment of the economy, traditionally underserved and challenged by informality,” said ALIVE’s Santiago Álvarez. Venture capital firm 30N Ventures also invested.

- Fintech for impact. The explosion of fintech solutions during the pandemic pushed impact investors toward “productive uses,” in which financing is directly connected to livelihoods, rather than consumption. FinMaq finances, for example, machines for metalworking, packaging, dentistry, and cranes and other construction equipment. FinMaq reports that, for 55% of its clients, the equipment it finances becomes borrowers’ main sources of income. FinMaq says each machine it has financed has supported the creation of two new jobs on average.

- Share this post.

Remittance app LemFi lands $53 million to build financial services for African immigrants. Canada-based LemFi was founded in 2021 to give the country’s growing population of African immigrants quick and affordable ways to send money back home. Traditional remittance channels like banks charge excessive fees fees to send even small amounts. “We were told remittances had already been solved. But for too many people, it is still too slow, cumbersome and expensive,” said LemFi’s Ridwan Olalere. LemFi enables free international money transfers and competitive exchange rates from Europe, the US and Canada to banks and mobile wallets in Senegal, Kenya, India and other emerging market economies.

- African diaspora. Remittances from Africans living abroad were estimated at more than $100 billion last year. LemFi says it handles more than $1 billion in monthly transactions. London-based venture capital firm Highland Europe led LemFi’s Series B round. Previous investors Left Lane Capital, Palm Drive Capital and Y-Combinator also joined the round.

- Betting on remittances. Investors are active in tech-enabled international money transfer and payment platforms. Tanzania’s Nala raised $40 million last year to support global expansion. London-based TerraPay secured $75 million from the International Finance Corp., ILX and other investors to expand in Africa. Zepz, founded by a Somali refugee, landed $267 million from LeapFrog Investments. HUB2 in Côte d’Ivoire raised $8.5 million to simplify remittances in French-speaking West Africa.

- Share this post.

Dealflow overflow. Investment news crossing our desks:

- Raven Indigenous Capital Partners invested in Indigenous-led FetchGoat, a software developer that helps businesses manage logistics and deliveries. “They strive to create employment opportunities for Native Americans in the logistics and supply chain industry – an area where representation has historically been lacking,” the Raven team wrote on LinkedIn. (Raven Indigenous Capital Partners)

- Belgium’s Capricorn Partners raised €51 million ($52.6 million) in a first close for its second health tech fund, which invests in early and growth-stage companies driving access to personalized and value-based healthcare in Europe. (Capricorn Partners)

- Oxford Cancer Analytics snagged $11 million in Series A equity, led by Toronto-based impact fund manager Cross-Border Impact Ventures, to commercialize its liquid-biopsy blood tests for early cancer detection. (Oxford Cancer Analytics)

- EQT, through its EQT Transition Infrastructure fund, acquired Scale Microgrids, a New Jersey-headquartered company that builds, finances and owns distributed energy assets for data center owners, universities, hospitals and other clients. (EQT)

- World Vision’s VisionFund raised $10 million through a bond issuance to extend credit to women and other underbanked groups in 25 emerging markets. (Symbiotics)

Impact Voices: Catalytic Capital

Standing up for impact-first capital at Open Road Impact. How effective has impact investing actually been at creating meaningful, enduring change? “I have come to believe that what we’re currently doing is either not working, or it’s not enough,” Open Road Impact’s Caroline Bressan writes in a guest post on ImpactApha. Open Road, which for more than a decade has helped bridge social enterprises through “unexpected OMG moments,” is changing its for-profit status to embrace the promise of philanthropy. “We recognize that we can achieve far greater impact as a nonprofit and do more to further our mission of unsticking capital,” Bressan writes. “To be clear, we are not going to change our focus to grant allocations. On the contrary, we are going to double down on our strategy to invest in for-profit enterprises.”

- Impact-first for all. Bressan says the pursuit of mainstream credibility and market-rate returns has led investors to neglect “additionality,” the unique social or environmental benefit an investment brings. “We realized early on that there is a tension between impact and risk and that we could not chase the highest returns if we wanted to maximize impact,” she explains. “But we have grown to realize that we don’t want to only invest in the lowest risk deals because that would not be meeting the impact goals of our investors.” Switching to a nonprofit, she says, allows Open Road to invest in more challenging opportunities without being constrained by expectations of market-rate returns.

- Impact-first allocations. “All impact investors, foundations, individuals, multifamily offices should have an impact-first allocation,” Bressan tells ImpactAlpha. With smart portfolio construction that includes impact-first allocations, she says, investors can achieve their return expectations and multiply the impact of their capital. “The idea is to make the impact-first pie bigger instead of relying on small carveouts from a philanthropic portfolio.” By embracing its non-profit status, Bressan writes, Open Road aims to help the industry “restore the role of highly catalytic impact-first strategies to their rightful place in the impact ecosystem.”

- Keep reading, “Standing up for impact-first capital at Open Road Impact,” by Open Road Impact’s Caroline Bressan on ImpactAlpha.

Agents of Impact: Follow the Talent

Project Frame invites investors to take part in its annual climate investment survey. The survey is open through Tuesday, Jan. 21… Narina Mnatsakanian, former head of impact investing at UBS Asset Management, joins Regeneration.VC as partner and chief impact officer… US SIF appoints Jennifer Coombs, previously with Ethos ESG, as head of content and development… New York-based energy transition investment firm Captona adds Brydne Slattery, previously with Onyx Renewable Partners, as general counsel… Sara Blenkhorn steps down as interim managing director of Social Venture Network.

The Rockefeller Foundation welcomes Lyana Latorre as vice president of program strategy for the Latin America and Caribbean region… Spearmint Energy recruits Michael Weinstein, previously with SunPower Corporation, as senior vice president and head of investor relations… Impact Seed adds Heidi Mippy of Curtin University in Australia as a board member… Nicolle Richards, previously with Gary Community Ventures, joins Climate United as a senior investment officer… Cambridge Associates promotes Justin Fligstein to senior investment associate…

Renat Heuberger, part-time chairman of MPower Ventures, launches sustainable investment firm Terra Impact Ventures… VentureESG is on the hunt for a research fellow focused on responsible and impactful AI… NYU School of Law’s Grunin Center for Law and Social Entrepreneurship seeks a program associate in New York… Propeller Ventures is hiring an operations leader in Boston… Longevity Partners is recruiting a climate and policy analyst in London… The World Economic Forum is looking for a sustainable finance specialist in New York.

Shaw Trust seeks an impact investment manager… The Schmidt Family Foundation has an opening for an impact investing portfolio manager in San Francisco… Colorado’s Employee Ownership Office is looking for a program manager in Denver… CrossBoundary is on the hunt for a natural capital MBA associate… CataCap has an opening for an impact investing business development and client manager… The Global Impact Investing Network will convene impact investing leaders in San Francisco for its West Coast impact forum and impact investor training, Apr. 15-16… The CDFI Coalition will host its 2025 CDFI Institute in Washington, DC, March 13-14.

👉 View (or post) impact investing jobs on ImpactAlpha’s Career Hub.

Thank you for your impact!

– Jan. 15, 2025