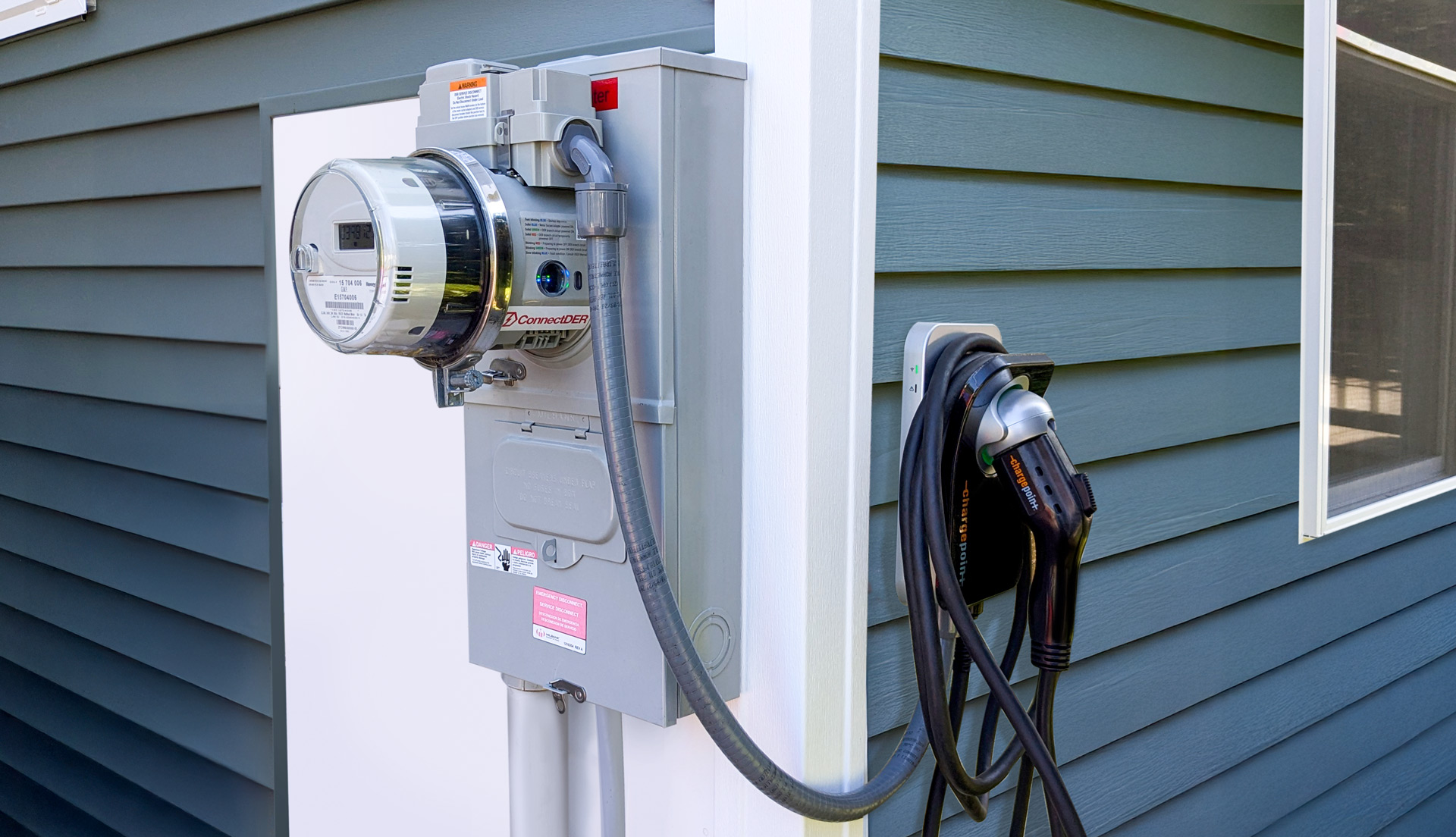

Decarbonization Partners, the joint venture between BlackRock and Singaporean sovereign wealth fund Temasek, has backed its latest climate solutions venture: ConnectDER, a Philadelphia-based smart metering company. The partners joined with MassMutual Ventures to inject $35 million into ConnectDER. Existing investors Avista Development, Clean Energy Ventures, Energy Innovation Capital, Evergy Ventures, LG Technology Ventures and Zoma Capital also participated in the Series D funding round.

ConnectDER’s smart meters support electrification and energy efficiency in residential properties by making it easier to integrate solar panels, batteries and other electricity sources into their homes. The funding will help the company launch Its latest product, IslandDER, which connects with utility grids but also allows “islanding” of distributed energy resources like batteries and EVs in case of an outage.

The new product “enables homes to disconnect and reconnect from the grid enabling customers to harness stored energy from solar plus battery systems or EVs providing innovative backup power and resilience to market,” ConnectDER’s Ivo Steklac said.

It is “an elegant solution that solves a major adoption pain point for customers, enabling and accelerating affordable home electrification in North America,” said Decarbonization Partners’ Meghan Sharp.

Decarbonization Partners was launched in 2022 with $600 million from BlackRock and Temasek. In April, it raised $1.4 billion for its first fund from investors including Allstate, BBVA, Mizuho Bank, MUFG Bank, and TotalEnergies.