A few weeks ago, I was lucky enough to attend the 12th edition of the Latin American Impact Investment Forum, or FLII – its 11th edition in person in beautiful Mérida, Mexico, after the event had to go virtual in 2021.

I first came to FLII in 2014, just as The Global Steering Group for Impact Investment (GSG) started to work on the formation of a global network of National Advisory Boards extending beyond the G7 and Australia, the original members of its predecessor the Social Impact Investment Taskforce that had been established under the UK presidency of the G7 the year before. Soon after that seminal trip where I got to connect with the vibrant Mexican impact community, Mexico became part of our first cohort of 5 non-G7 members.

Over the years I witnessed how the impact conversation (and, most importantly, concrete actions) evolved in the region, from a focus on “what is impact investment?” in the early days, to increasingly sophisticated discussions around “how” socially-minded investors, entrepreneurs, corporates, foundations, asset managers and other ecosystem players could increasingly deploy capital and solutions for impact in the region.

Home grown solutions

This year´s FLII was like no other. The energy doubled, the deals and discussions felt (and were) more mature, creative and idiosyncratic than ever before. It’s as if the sector reaffirmed its growth trajectory from adolescence to adulthood, taking what’s valuable, best practice and interesting from the world, such as strong frameworks to measure, manage and report on impact (delivering greater transparency), but going beyond the linear adoption of (mostly) Anglo-Saxon developments.

Mexico’s fund Viwala, for example, launched a few years back as a local innovation to bridge a financing gap for companies that need flexible capital with lower-tier tickets (e.g. USD hundreds of thousands in debt rather than US$1-2 million in equity). The fund continues to grow and now manages different thematic funds from LGTBQi investment to coral reef conservation (a growing area of interest in the region, focusing on the natural systems of Central America and the Caribbean).

In another exciting development, Chilean company Betterfly, promoting wellbeing by rewarding people´s healthy habits, recently became Latin America´s first B-certified unicorn.

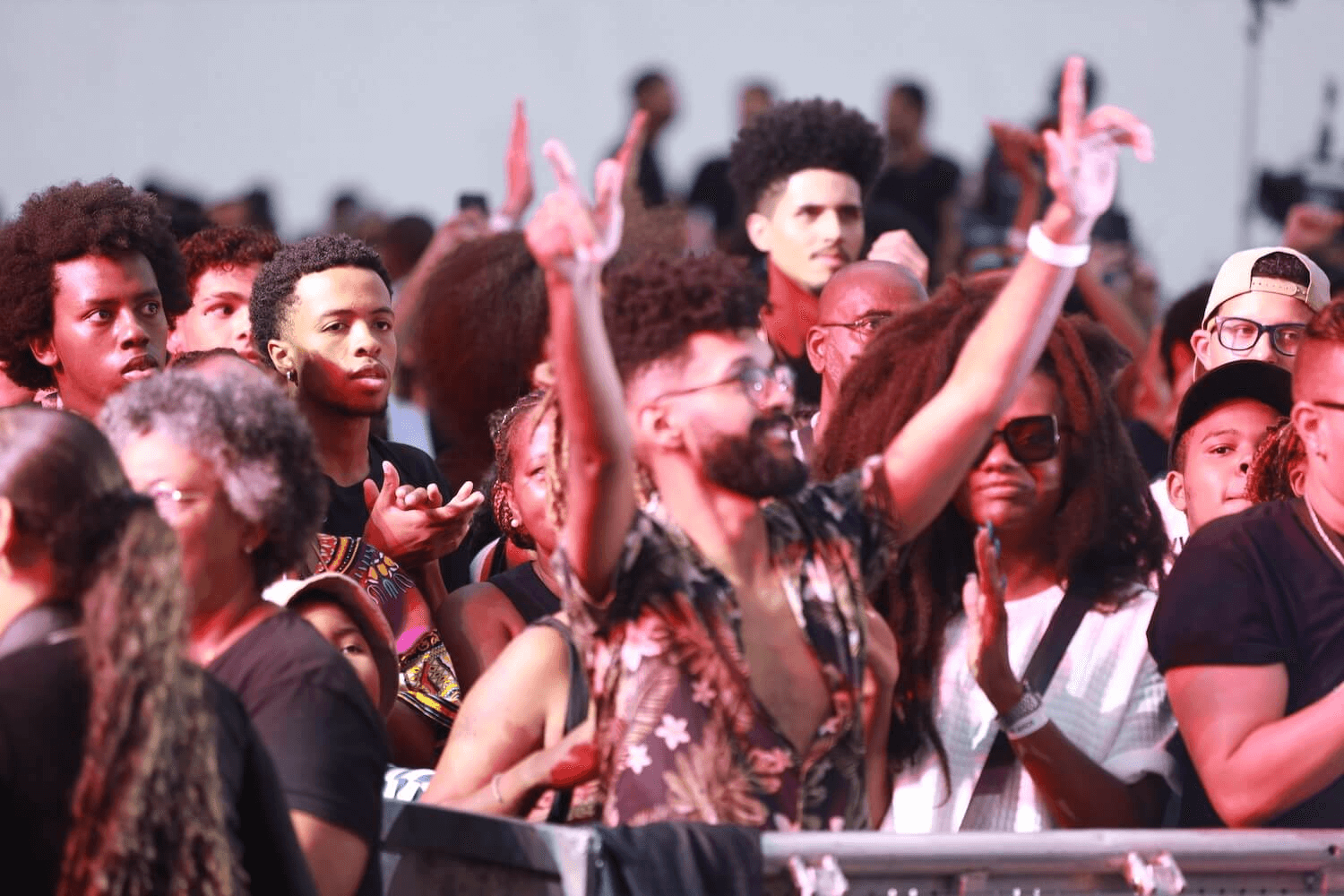

This year´s FLII also had record attendance, reaching over 700 participants, from 400 or so originally anticipated by the organizers. People not only showed up in masses from over 30 countries, but were more eager than ever before to connect, exchange, learn from each other, partner, innovate, and get things done.

Getting to scale

Despite the energy and inspiration, I also left Merida conscious of two challenges facing the impact sector to deliver solutions at scale to help tackle the mounting social and environmental challenges in the region, with impact evolving from being something “interesting” and “hype” to becoming a true driver of much needed systemic change in our economies.

First, Latin America´s impact community needs to be increasingly conscious that 2030, which may have seemed a distant goal at the first FLII in 2011, is now only eight years away. The delivery of the SDGs and a just transition to net-zero that leaves no people and places behind will require scale, integrity and speed in capital deployment. The smart millions of dollars currently deployed to deliver positive sustainability outcomes will need to turn into billions, if not trillions, and this will need bolder solutions and yet greater multi-stakeholder cooperation in the region.

Closely linked to the last point, the sector also can and has to do more to meaningfully engage governments across all of Latin America to help drive change at scale, no matter how much mistrust there may be between administrations in the region and the private sector impact players. It is simply naïve to assume we will drive a revolution without speaking truth to power, strategically influencing government action, and steering regulation in a virtuous manner. If the 700+ FLII participants had been asked where they wanted to be in the coming years, I would safely assume no one would have said in or working closely with government, transforming the public sector from the inside. As long as we continue to perceive the public sector solely as an obstacle, a self-imposed limitation will remain in place, driving us away from our ambitious objectives.

We at the GSG are committed to continuing to work with our partners across Latin America, including our National Advisory Boards in Mexico, Brazil, Argentina, Uruguay, Colombia, Central America and Chile and our sister organizations and partners, including Sistema B, LatImpacto, The Impact and the UNDP country offices, to break the deadlock and drive systemic change.

The work of the Impact Taskforce (ITF), led by the GSG from 2021, can be an important leverage point, as witnessed during the dedicated sessions at FLII and our ongoing work with NABs in several countries to interpret, prioritise and drive the main ITF recommendations to local contexts, specifically looking to increase impact transparency and mobilise impact capital at scale.

It´s time to deliver in Latin America. Let us work together, more closely than ever.

Sebastien Welisiejko is chief policy officer at The Global Steering Group for Impact Investment.