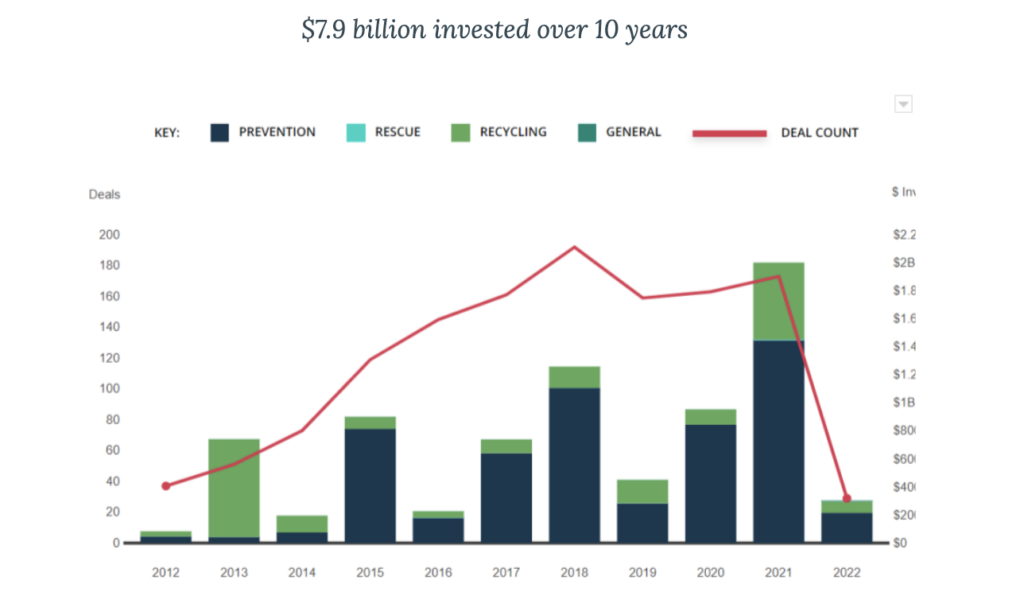

The message received from private funding activity into food waste solutions over the last ten years is clear: Food waste is an established investment sector with multiple demonstrations of financial and impact returns. Data from ReFED’s new Food Waste Capital Tracker shows that private investment into food waste solutions has reached nearly $7.9 billion since 2011 – including a record $2 billion in 2021 alone – as more funders recognize the environmental, economic, and social benefits the space offers.

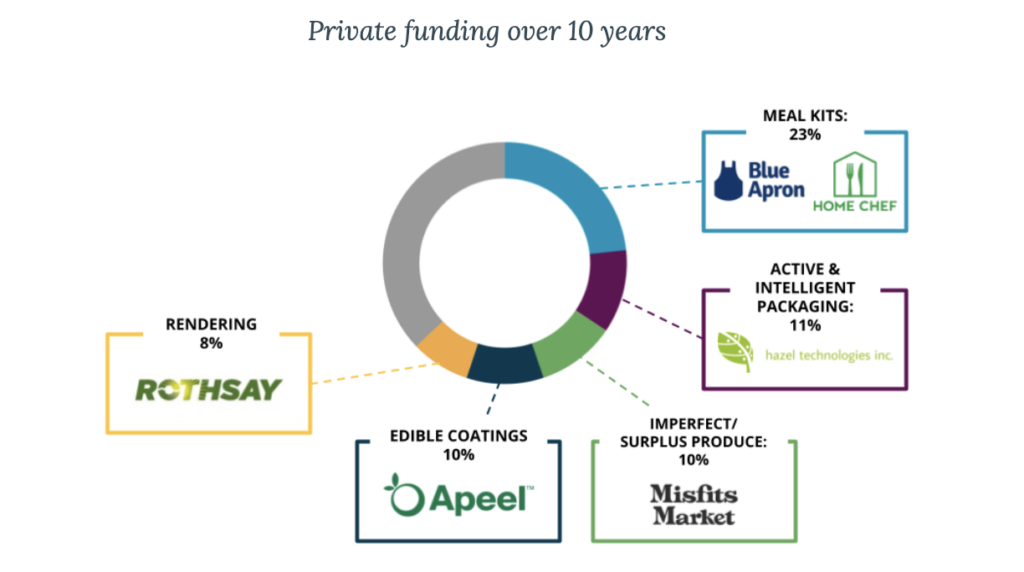

In stark contrast to what we saw back in the early 2010s, when there were only a few types of food waste solution providers receiving funding, it is now easy to point to the likes of Misfits Market, Seebo, and a range of others with funding rounds and valuations that have been on the rise over the past couple of years.

In the mid-2010s, a broader range of food waste business models began to emerge, propelled by a combination of factors like increased media attention, additional research and available data on food waste impacts, and entrepreneurs understanding the potential opportunities. ReFED’s Capital Tracker shows that the inflection point for private U.S. funding for food waste occurred in 2016, as a more diverse set of solutions began to receive funding and new organizations launched.

What makes us optimistic about the continued strength and maturation of the food waste space is what has happened in the past two years. Average private deal size has grown from $2 million – $5 million in the early 2010s to roughly $17 million in 2021, with year-on-year growth in investment into food waste solutions averaging more than 100% over the last two years. While the backdrop to this has been the record-setting overall level of private capital activity (driven by availability) in 2021, which has driven higher valuations, the food waste space has also benefited greatly from climate funders making the connection between food waste reduction and climate change mitigation. Our view is that investor interest in food waste-adjacent themes, such as agtech and regenerative agriculture, is also driving capital into the space.

Investment has not been equally spread across categories but rather has concentrated among specific solution types, where the investor community has been quicker to recognize viable business models. Importantly, this speaks to investors of the opportunity that may lie within many solutions with high impact potential that have not yet attracted the same level of capital.

Where are we going from here? The next wave of solutions on the upswing – enhanced demand planning, upcycling, markdown alert applications, and recyclers converting waste streams into biomaterials – are all starting to see rising deal sizes and increased overall investment, despite the fact that we have generally entered an uncertain time for private capital.

ReFED believes that in the long-term, food waste will continue to attract capital due to a range of factors that are driving continued solution development and adoption, including the growing number of food businesses making public commitments to fight food waste, as well as the implementation of new policies mandating partial or full organic waste bans, like California’s SB1383. And while 2022 has already been marked by geopolitical risks, increasing food prices, supply chain challenges, and the lingering effects from the worst of the COVID-19 pandemic, these factors further highlight the need to build a food system with less waste.

Alejandro Enamorado is capital and innovation manager at ReFED.