Investors today are grossly overlooking one critical category of volatility: climate change.

When investors seek targeted risk budgets and returns by diversifying portfolios — spreading out risk across different asset/risk classes, geographies, and industries — they ignore the fact that climate change threatens all these variables and our understanding of risk at large.

“Risk” first emerged in 1966, when economist William Sharpe revolutionized the way investors quantified risk and constructed portfolios with the Sharpe ratio, a simple decision-making equation that calculates an investment’s return compared to its risk. Its goal, and genius, is to calculate risk-adjusted returns for portfolios — essentially pricing the mythical “risk.” The number not only serves as a proxy for volatility, but also quantifies this volatility in terms investors understand.

However, investors’ tendency to think of climate change as a “smooth” curve slowly trending upward makes them believe they can continue to hedge their strategies along with it. But what if this long-term smooth, rising curve is actually a series of unpredictable, short-term jagged lines?

Climate exhibits volatility — deviating from the norm in frequencies and magnitudes of different patterns, depending on location. Consider the agriculture sector, where climate is the most significant predictor of the quality and quantity of crop productivity and ultimately yield. If two regions have similar soils, growing conditions, and long-term climate change patterns, could they have wildly different volatility patterns? What would the comparative risk and expected outcomes be between these two regions?

If climate volatility is not measured properly in conjunction with returns, investors could be speeding into the future with a gaping blind spot. We urgently need a new calculation that can take climate risk into account, a climate-Sharpe ratio, for three reasons:

1. Past volatility is not an indicator of future volatility

Consider an investment in pistachios as an asset class. The quality and quantity of the annual yield will determine returns, but they depend upon several factors, including the number of accumulated chill portions (or how many cold hours trees experience over winter to trigger the plant to blossom/set fruit). Accumulated chill portions will likely decrease in certain regions due to warming, and already sharply declined in the Western U.S. from 2012-2017 compared to the decade before.

Hedging portfolios with investments in these specialty crops isn’t a reliable strategy under climate change.

Accumulated chill portion trends in Kettleman and Modesto, California. Source: California Office of Environment Health Assessment.

In a stable environment, past performance would be a relatively reliable predictor of future performance for investing strategies. Traditional Sharpe ratios based on past returns provide no mechanism to take the evolving risk landscape into account.

2. The Sharpe ratio in its current form can’t account for the fat-tailed nature of weather and climate risks

The assumption underlying how the Sharpe ratio measures volatility is that potential gains and losses fall on a bell curve with a normal distribution. However, today, risk distributions rarely follow this pattern. In the example below, Asset B exhibits higher volatility and has more sensitivity to catastrophic climate events than Asset A but are treated the same in the traditional literature of sharpe ratio.

Return profiles from two assets: Simulated using Climate datasets. Source: ClimateAi

Climate-dependent investments can quickly become NPAs when volatility descends. In Europe this past fall, energy costs soared and energy suppliers struggled as several factors converged: mild winds caused lower wind energy output, liquefied natural gas deliveries dropped due to skyrocketing Asian demand, Russian gas supplies declined amid infrastructure outages, and Europe’s carbon policy hiked prices.

As a result, power companies folded. Nine British power suppliers collapsed in September alone, and in October, a large Czech electricity and gas supplier, Bohemia Energys, halted operations, and German gas company, Otima Energie, declared insolvency.

3. Geographic and asset-level diversification doesn’t mean climate diversification

The Sharpe ratio measures portfolio risk-adjusted returns, but cannot account for system-wide risks like climate change. While impacts of climate change are usually felt locally — wildfires raging in Northern California, a hurricane hitting New York City, flooding across a German river basin — in our globalized world and interconnected financial systems, knock-on effects pervade across regions and sectors.

Although traditional portfolio investment decisions must balance risk and reliability, climate change accelerates shifts in nearly every decision-critical factor, from labor to interest rates to commodity prices. Extreme weather causes construction and logistic disruptions, plus property damage and higher energy costs. All these are also tied to resource scarcity and materials shortages.

Investors can’t diversify away from systematic risks. Every region and industry around the globe is exposed to climate risk, although these risks manifest differently.

Climate Sharpe ratio

Relying on traditional Sharpe ratios exposes portfolios to huge systematic risks, especially for climate-sensitive sectors such as agriculture, energy, and capital goods, among others. While the exact formulation of a Climate-Sharpe ratio warrants another op-ed, there is an initial step that portfolio managers can take: to analyze if historical volatility paradigms have shifted in your portfolio by matching them with key climate drivers of volatility and returns for those asset classes — tipping points of volatility.

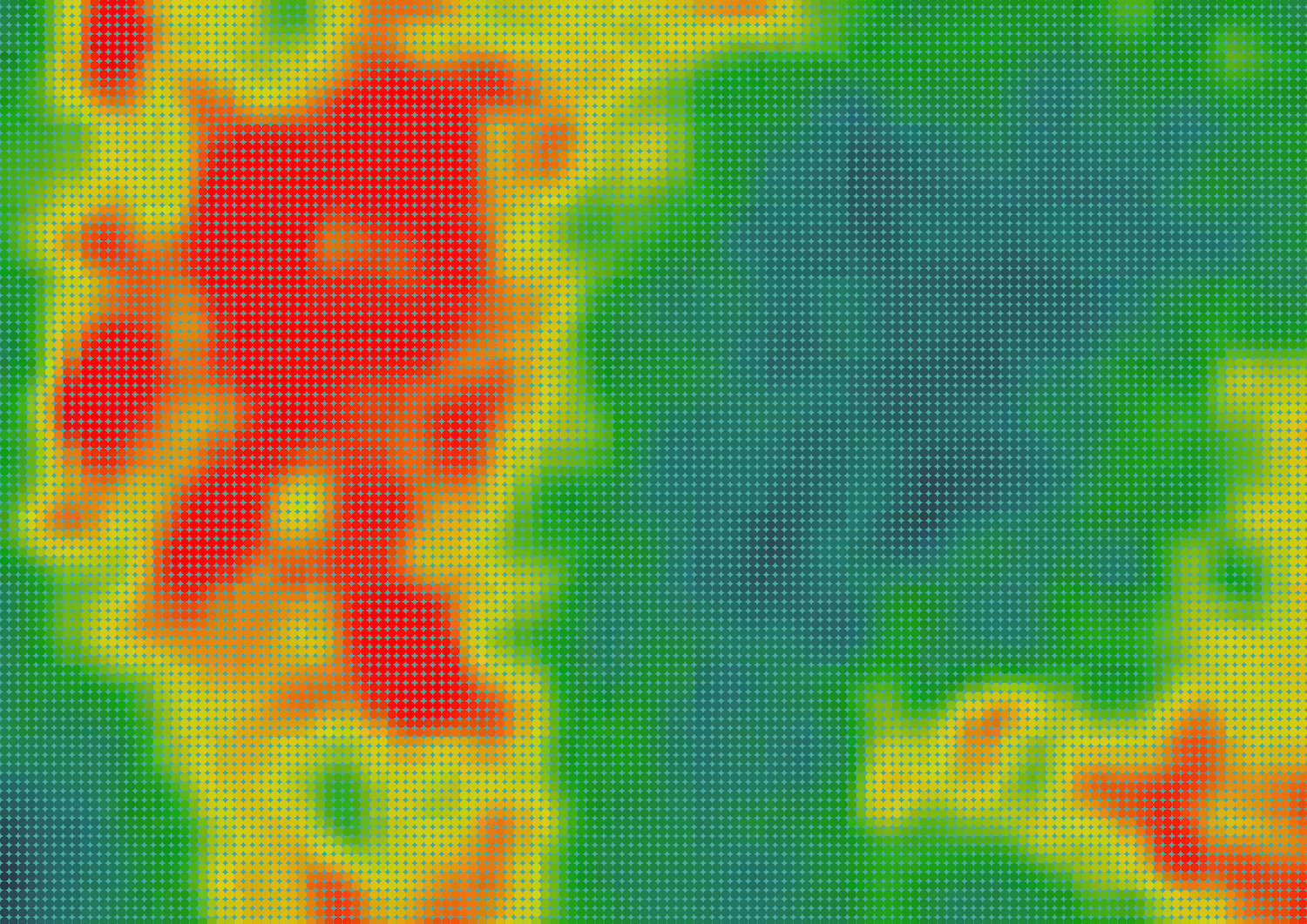

Coffee portfolios are a great example. Heat risk during coffee beans’ ripening season has explained their yields/quality globally over the years. In the example below, the tipping points for heat risk for coffee have already occurred across most of the coffee-growing regions in Brazil.

Tipping point for heat Stress in Coffee Source: ClimateAi

The next step is to evaluate climate-adjusted returns and climate-adjusted volatility for these assets — which will be discussed in detail in the next op-ed. A new climate-Sharpe ratio will provide crucial insight for investors and decide the winners and losers of the coming decades as climate change and its impacts accelerate.

Himanshu Gupta is CEO and co-founder of ClimateAI. Dave Chen is CEO and chairman of Equilibrium.