Sign up for ImpactAlpha Latin America to follow the people and money powering Latin America and the Caribbean’s impact economy.

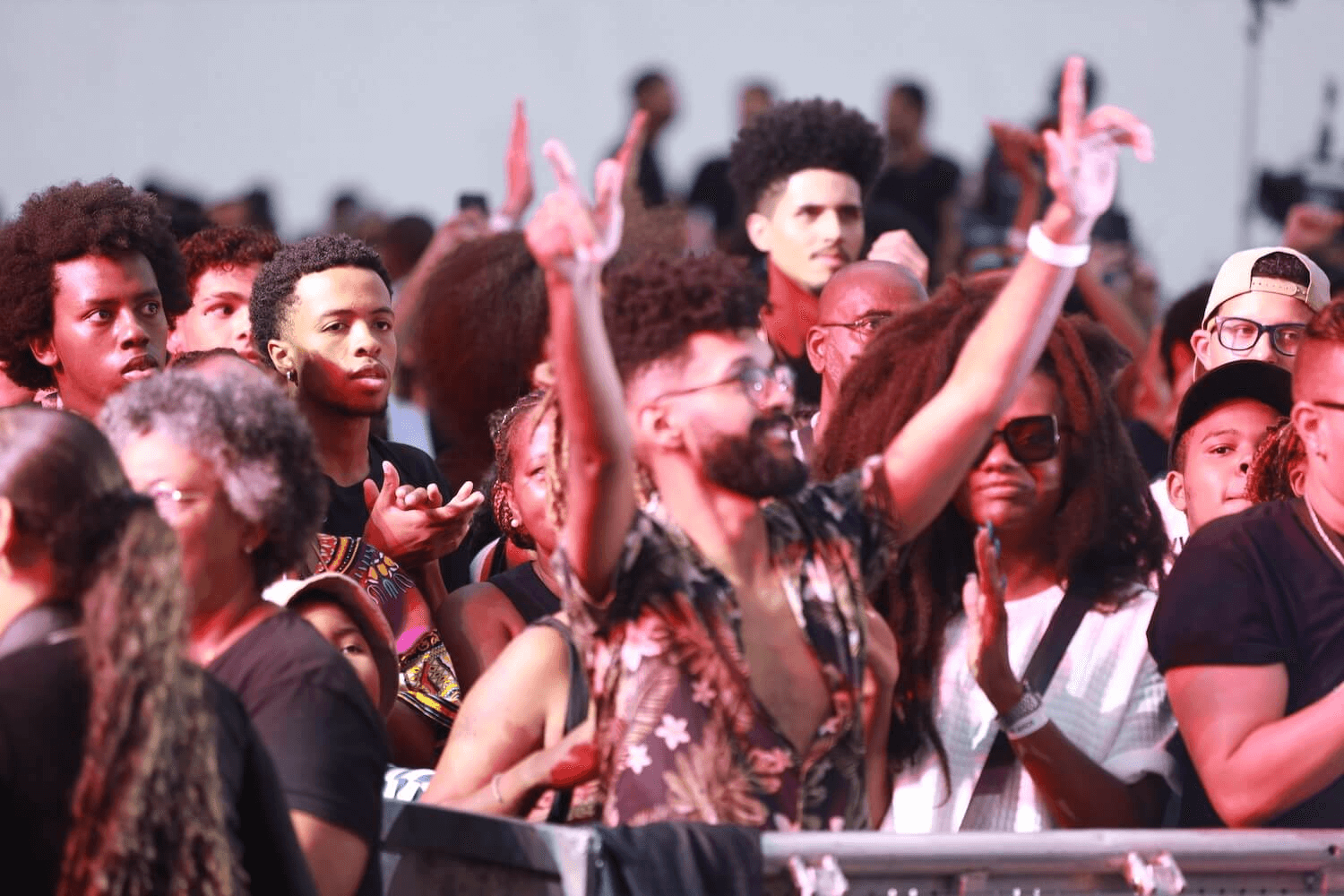

In May, thousands of visitors will descend on São Paulo for the Feira Preta festival, the largest Black cultural and entrepreneurship event in Latin America. Founder Adriana Barbosa has over two decades grown Feira Preta, or Black Fair, into a platform that has helped plug more than 10,000 Black and Indigenous creative entrepreneurs into the Brazilian economy.

Barbosa’s Pretahub supports entrepreneurs to produce and distribute their work with accelerators, physical spaces and financing. In turn, Barbosa, an Ashoka fellow, has helped companies recognize the purchasing power of Black consumers.

Brazil’s Black community “is an economically active population,” Barbosa told ImpactAlpha at the Latin America Impact investing Forum last month (video). Investments in Brazil’s African descendents “would produce much more wealth,” she says.

Investment incentives

Growth in Latin America’s largest country has largely stagnated in recent years, in part due to persistent inequality. The half of the population that identifies as Black has long faced barriers to credit, education and the formal economy.

Investment in Brazil’s Black entrepreneurs, and thousands of impact businesses throughout the country, stands to get a boost from Brazil’s new National Impact Economy Strategy, or Enimpacto. The coordinated policy aims to address inequalities and environmental challenges, and boost impact investing in the country from $11 billion to $120 billion over 10 years with blended finance, investment incentives and more inclusive procurement.

“We are committed to building a better world, a more inclusive world,” Lucas Ramalho Maciel, who heads “new economies” in the Brazilian ministry behind Enimpacto, told ImpactAlpha at FLII (video). “Investing in Brazil is investing to combat inequalities.”

In a follow up interview, Maciel said that inclusion is a cross cutting component of the national strategy, to ensure “the representation of race, gender, region, territory, traditional communities, peripheral communities, LGBTQIA+ population, as well as other historically oppressed population groups and communities in social vulnerability.”

Black entrepreneurship, he says, is “supported in an even broader context, which seeks to promote racial equality as well as diversity and social inclusion in all its dimensions.”

Brazil will extend its social and environmental agenda through its G20 presidency, says Ramalho, where it aims to work with other countries to develop their own national impact strategies. Next year, Brazil will host COP30 in Belém, Pará.

Impact economy

Pipe.Social and Quintessa have mapped over 1,000 impact businesses in Brazil. That almost certainly undercounts businesses in Brazil’s majority-Black northeast. Almost 60 organizations, including Artemisia, NesST, and Din4mo, now support Brazil’s impact businesses, according to Guia 2.5, a survey conducted by Quintessa.

In São Paulo, Estímulo has used blended finance to turn a COVID relief fund into a small business lender that has provided more than $40 million to more than 3,400 businesses.

“The impact economy in Brazil is rising,” Estímulo’s Lucas Conrado told ImpactAlpha as FLII (video). “The financial sector is increasingly interested in innovative financing structures with the social sector.”

Estimulo uses a credit guarantee fund backed by loan receivables that allows the nonprofit to own subordinated quotas funded through philanthropy and raise private capital on the senior quotas. The structure allows senior investors to come in at competitive rates while the subordinated debt protects them from default.

Funds like Potencia Ventures, with offices in São Paulo and Portland, see a tech opportunity in Brazil’s impact economy. Potencia earlier this month backed Brasília-based fintech Trampay, which provides a “safety net” of financial services to mostly unbanked gig workers, a vast majority of whom are Black.

The long-time investor in Brazil and other emerging market countries is going all in Brazil and Latin America. “The future of work involves generating solutions for social problems,” Potencia’s Itali Collini told ImpactAlpha at FLII (video). “It is a region full of creative, resourceful founders that can do a lot with little input.”