Greetings, Agents of Impact!

Featured: Institutional Impact

Sustainability is at risk when asset managers are the judge, jury and executors of the ESG agenda. What makes a sustainable investment truly sustainable? And who gets to decide? In her new column on ImpactAlpha, contributing editor Imogen Rose-Smith argues that community members and workers, as well as impact investors, should insist on “community beneficial audits” of money managers that pitch clients on sustainability or ESG. Take Trinitas Partners, an alternative investment firm based in Silicon Valley that specializes in large-scale agriculture investments and proudly claims to practice and support sustainable farm practices. One of the firm’s main projects, through its Pomona Farming subsidiary, is Mahi Pono on the Hawaiian island of Maui, a 41,000-acre plot on an old sugar plantation. In the Hawaiian language, Mahi Pono can be translated as “to cultivate the land responsibly.” Rose-Smith worked with the Hawaii-based ESG consulting firm Responsible Markets on a recent case study that called out Mahi Pono for its water use, lack of transparency, and negative effects on the community of East Maui.

“Allowing the managers to not only monitor, but to define ESG and responsible business practices, risks discrediting sustainable investing,” writes Rose-Smith, a longtime senior writer with Institutional Investor. For example, BlackRock, the world’s largest asset manager, this month announced it had raised nearly $1.8 billion for two new “carbon transition readiness” funds. The U.S. fund includes seven holdings in Carbon Underground’s list of the 200 top owners of coal and oil and gas reserves, including Chevron, ExxonMobil, ConocoPhillips and Diamondback Energy, according to the not-for-profit watchdog As You Sow. It all adds up to an “agency” problem for asset owners who outsource investment decisions, including sustainability strategies, to managers who may have their own agendas. The U.S. Securities and Exchange Commission has signaled the need for uniform standards. For now, “BlackRock is in the driver’s seat when it comes to deciding what constitutes an ESG strategy,” Rose-Smith says. “Leaving it to managers to say what a good ESG investment is leaves a giant opening for doubt.”

Keep reading, “Institutional Impact: Sustainability is at risk when asset managers are the judge, jury and executors of the ESG agenda,” by Imogen Rose-Smith on ImpactAlpha.

Dealflow: Follow the Money

Congruent Ventures raises $175 million for early-stage climate tech. Trillion-dollar green infrastructure plans and corporate net-zero pledges? “Fuel on the fire or, these days, electrons in the battery,” says Congruent’s Abe Yokell. Yokell, with co-founder Joshua Posamentier, blew past the firm’s $125 million target for Congruent Fund II to raise $175 million for pre-seed, seed and Series A rounds of ventures solving climate-related challenges. Congruent’s first early stage climate-tech fund, launched in 2016, invested in 29 companies across energy, food and agriculture, transportation and sustainability. Limited partners in the new fund include Microsoft’s Climate Innovation Fund, UC Investments, affiliates of Prelude Ventures, Three Cairns Group, Grantham Environmental Trust and Surdna Foundation.

- Smart tech. Congruent already has made seven investments from Fund II, including Parallel Systems, a maker of electrified autonomous electric rail cars, and Hippo Harvest, which is using machine learning and robotics to optimize greenhouse growing systems. A dozen of the firm’s three dozen portfolio companies use machine learning or AI.

- More.

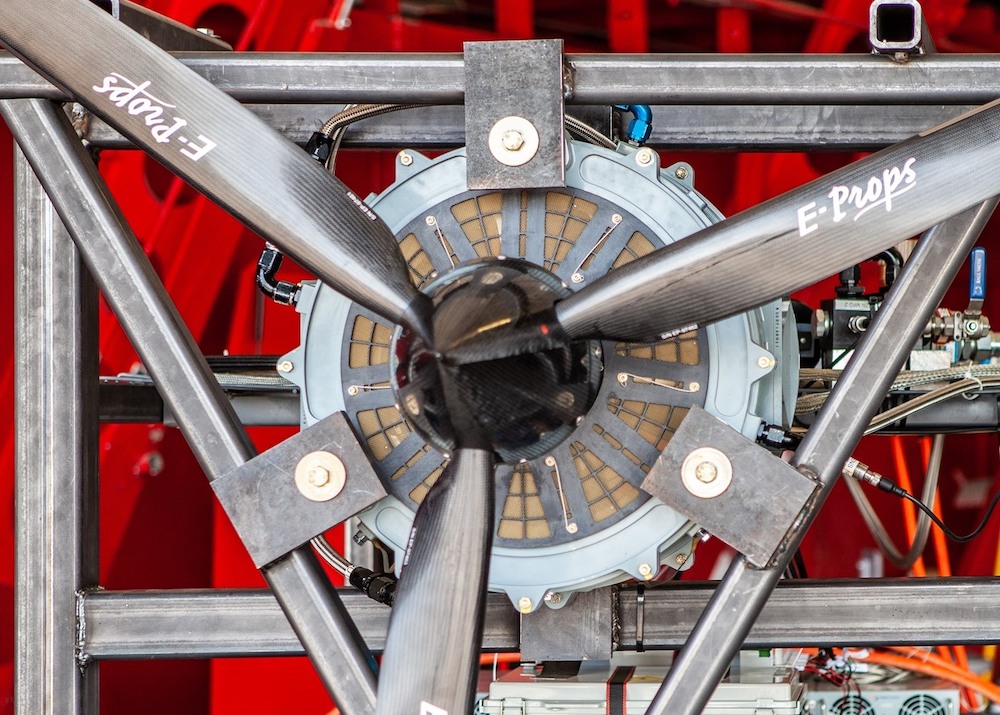

Universal Hydrogen scores $20.5 million to green commercial aircraft. The Los Angeles-based company is developing hydrogen-based powertrains to retrofit commercial aircraft. “Hydrogen is today the only viable fuel for getting to true zero emissions in commercial aviation,” said Universal Hydrogen’s Paul Eremenko. The company’s goal is to “de-risk” the greener fuel source to spur commercial developers like Airbus and Boeing to build hydrogen-powered planes within the next decade. Venture capital firm Playground Global led the Series A round. Airbus Ventures, JetBlue Technology Ventures, Toyota AI Ventures and others participated.

- Green flights. California-based ZeroAvia, is building similar hydrogen-based aircraft technology to Universal Hydrogen (see, “ZeroAvia aims to decarbonize air travel with hydrogen-powered engines“). Both companies are focused on decarbonizing regional flights of 500-700 miles within three to five years, and longer-haul flights in a decade.

- Take off.

Dealflow overflow. Other investment news crossing our desks:

- The U.S. International Development Finance Corp. invests $25 million in WaterEquity’s Global Access Fund, the first tranche of a planned $100 million debt investment, through government-guaranteed “certificates of participation.”

- Cisco’s philanthropic arm plans to disburse $100 million in grants and impact investments to early-stage climate technologies.

- Elder-care tech venture Aloe Care Health Systems raises $5 million from City Light, Laerdal, the Springbank Collective and Drumbeat Ventures.

- Kenya’s Ecobodaa joins a growing crop of startups raising early funding to accelerate e-mobility in emerging markets (see, “Vietnamese e-motorbike venture Dat Bike secures $2.6 million”).

Signals: Ahead of the Curve

LEAF Coalition will pay for success in protecting tropical forests. A global coalition of governments and corporations will pool funds to keep tropical forests intact. The Lowering Emissions by Accelerating Forest Finance, or LEAF Coalition, announced at U.S. President Joe Biden’s climate summit last week, aims to mobilize at least $1 billion to pay countries and states to protect their forests. The LEAF Coalition will pay $10 per ton of carbon avoided. At $1 billion, the coalition could finance the avoidance of 100 million tons of carbon, equivalent to the annual emissions of nearly 22 million passenger cars. To pre-empt charges of greenwashing, countries will be paid based on their performance over five years. Joining forces: the U.S., U.K. and Norwegian governments and nine corporations, including Amazon, Unilever, Salesforce and Nestle. The nonprofit Emergent Forest Finance Accelerator will coordinate the coalition and verify results with satellites.

- Nature-based solutions. Protecting tropical forests is a low-hanging fruit for climate action. Key development: valuing, and paying for, the ecosystem services forests provide. Despite the pandemic, demand for soy, palm oil, timber and grazing lands increased deforestation by 12% last year, harming the climate, biodiversity and indigenous communities.

- More.

Agents of Impact: Follow the Talent

Thea Lee is stepping down as president of the Economic Policy Institute to join the U.S. Biden-Harris administration… Generate Capital is hiring a vice president/principal for its investment team and more than a dozen other roles… The Department of Energy is recruiting a director for its federal energy management program in Washington, D.C… Republic seeks a senior director in New York… Acumen is hiring an associate director of agriculture investments in New York… Social Capital Partners is looking for an associate/senior associate of investments and director of communications in Toronto.

Thank you for your impact.

– Apr. 26, 2021