Greetings, Agents of Impact!

Featured: ImpactAlpha Original

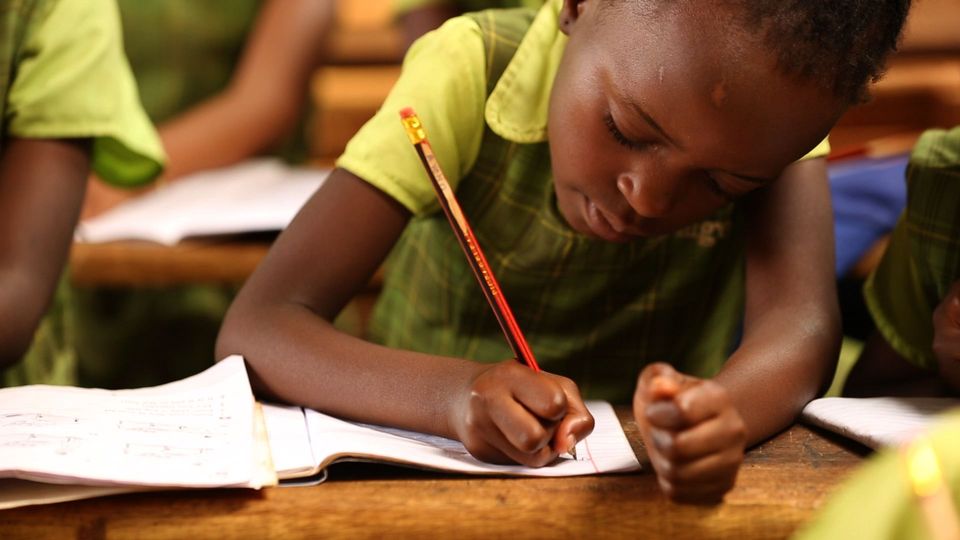

What if… the redesign of education put racial and social equity at its core? The upending of this school year has made almost every parent, willingly or not, a participant in the radical transformation of education. Some of the most far-reaching proposals for reinventing elementary, middle and high schools, however, run into a well-founded objection: while all that might be fine for relatively affluent, largely white families, what about lower-income students of color for whom already gaping educational achievement gaps have only been exacerbated by the COVID disruption? Imaginable Futures, the $200 million edtech portfolio spun out of Omidyar Network earlier this year, took up the challenge with the help of design firm IDEO. Such design thinking, captured in Learning Reimagined: Radical Thinking for Equitable Futures, could help parents and educators globally think through, “What if, at this moment of disruption, our systems of learning could be redesigned to eliminate the inequities that are embedded in our schools and our communities?”

“I do not fantasize that remote learning will ever be as good as being in school,” Imaginable Futures’ Amy Klement told ImpactAlpha. “But I’m hopeful that we can do things in new and different ways such that when we come back to school, school can be even better.” In Africa, Bridge International Academies partnered with government agencies to create lessons broadcast over radio and WhatsApp channels for quizzes and practice. Vedantu, an online tutoring platform, is making qualified tutors available and affordable, even in India’s smaller cities (see, “Vedantu closes $100 million in India’s red hot edtech market“). “They have gone gangbusters during this time because it’s incredibly affordable,” says Klement. In the U.S., the nonprofit Khan Academy has seen skyrocketing demand since schools closed in the spring and has responded with resources for teachers, districts and parents, as well as kids. “I am convinced that this innovation isn’t going anywhere when our schools reopen,” Klement says, “and that this is a good thing for students everywhere going forward.”

Keep reading, “What if… the redesign of education put racial and social equity at its core?” by David Bank on ImpactAlpha.

- New tools. Schmidt Futures’ Futures Forum on Learning is offering $2 million in rewards for education technologies to accelerate recovery from COVID-related learning loss for students in grades K-12.

Dealflow: Follow the Money

Daimler joins Europe’s green bond parade. The German automaker issued a €1 billion ($1.2 billion), 10-year bond to transition to clean cars. Daimler’s bond follows a €500 million issuance from Spain’s Banco de Sabadell last week.

- Green Europe. Germany and Sweden both floated their first sovereign green bonds last week. Germany raised €6.5 billion with its 10-year note, while Sweden issued a bond for 20 billion crowns ($2.3 billion). Germany and Sweden’s moves are aligned with a broader E.U.-strategy to sell both green and social bonds to support the block’s economic recovery while financing a sustainable transition. The E.U. is looking to issue up to €750 billion in such bonds, a move that would nearly double the green bond market.

- Corporate issues. Earlier this year, Royal Schiphol Group, which operates Amsterdam’s airport, issued a €750 million green bond to finance infrastructure upgrades and “clean transportation.” The bonds will also boost liquidity amid the COVID induced travel slowdown, the company acknowledged. Finland’s Evli Bank launched a dedicated fund to invest in European corporate green bonds. Says Evli’s Juhamatti Pukka, “Success in environmental and sustainability issues has a significant effect on long-term credit quality.” Triodos Bank is launching a similar fund, available to U.K. retail investors.

- Check it out.

Farmers Business Network spins off GRO Network to track agricultural carbon. The new venture from the California-based agtech company is tracking the carbon footprint of grains to help regenerative farms get premium pricing for sustainably grown crops and connect with buyers like Unilever and biorefinery Poet. “The end result of this shared effort is to both accelerate the adoption of regenerative practices and give [farmers] the opportunity to maximize profit potential,” the company writes.

- Regenerative ag shakeup. Indigo Agriculture is shaking up its leadership after raising $360 million last month to expand its Terraton Initiative, which pays farmers for carbon they sequester in their soil. CEO David Perry has stepped down and is being replaced by Flagship Pioneering’s Ron Hovsepian.

- Read on.

Solar developer Lightsource closes $20 million for California project. The capital will finance the development of Wildflower Solar, a 16.5-megawatt solar farm near Sacramento. Sacramento Municipal Utility District, a community-owned nonprofit utility, has signed on to purchase the farm’s generated power.

Signals: Ahead of the Curve

Smart subsidies for Africa’s high risk, low return smallholder finance market. In well-functioning capital markets, expected returns on investment match the risk. In the fragmented agricultural markets of sub-Saharan Africa, risk in lending to small and midsize enterprises is perceived to be twice as high as other sectors, while returns are 4-5% lower. Aceli Africa and Dalberg, which analyzed more than 9,000 transactions totaling $3.7 billion from 31 lenders, found the mismatch is creating an annual $65 billion financing gap for small farmers that translates to fewer jobs and reduced food security and inclusive development across the continent. A financing model from Aceli is looking to turn tens of millions of dollars in donor capital into hundreds of millions in lending by mitigating risks and boosting the returns for lenders to the least-served and most impactful African agribusinesses. “We’re providing a subsidy to the lender so that they can earn an acceptable return to serve these businesses,” Brian Milder, who left Root Capital to start Aceli, told ImpactAlpha. ”The cost of that subsidy in the short term is a fraction of the direct impact that’s created.”

- Catalytic capital. To make high-impact agribusinesses more attractive to lenders, Aceli will provide lenders with a first-loss cushion of 2-8% for loans to borrowers that meet targets for gender inclusion, food security and nutrition, or climate resilience. The vehicle will also compensate lenders for the lower revenues and higher costs of originating loans to new, high-impact borrowers. “We’re using the data to calibrate the optimal amount of subsidy that’s required,” says Milder. Nine global social lenders and another 15 East African banks and nonfinancial institutions that have applied to participate.

- Market building. “If you go to Detroit, or the Mississippi Delta, and you see JPMorgan, or community development finance institutions lending there, they’re not doing it on a commercial basis,” says Milder. The Community Reinvestment Act and other various state and federal incentives make it possible for lenders to earn a return. “We’re trying to develop an analogous model for lending to agricultural SMEs in East Africa.”

- Farmer financiers. Last month, a coalition of philanthropic investors stepped up to lend $20 million in subordinated debt to smallholder lender One Acre Fund with the goal reducing investment risk for institutional investors. USAID is providing the bulk of the capital for Aceli at launch. Other smaller donors include Good Energies Foundation, Mulago Foundation and IKEA Foundation. MacArthur Foundation, Ceniarth and Omidyar Network, the U.K.’s DFID and USAID were among Aceli’s design stage funders.

- Share this post.

Agents of Impact: Follow the Talent

Beeck Center’s Jennifer Collins joins LISC as head of enterprise operations… Global Impact Investing Network seeks a director of finance and operations in New York… The Washington Area Community Investment Fund is looking for a development manager in Washington, D.C… Tideline has an opening for an impact investing analyst in New York, San Francisco or London.

The Global Impact Tech Alliance is hosting “From Cleantech to Climate Tech” with Dan Goldman of Clean Energy Ventures, Top Tier Impact’s Alessandra Sollberger, SJF Ventures’ Dave Kirkpatrick and Lubomila Jordanova of Greentech Alliance, Wednesday, Sept. 16… India Impact Investors Council is hosting “India Impact Investing Week – Prabhav 2020” from Oct. 5-9. ImpactAlpha subscribers get 35% off registration with code P20-IMPALPHA.

Thank you for reading.

–Sept. 8, 2020