This post is sponsored by Cornerstone Capital Group. Join a webinar with Cornerstone Capital’s Katherine Pease and Craig Metrick, “The Access Impact Framework: Enabling investors to measure the alignment of the portfolios to the issues that matter most to them,” Monday, May 20 at 1 pm ET. Register today.

The financial return of investment dollars is easy to track consistently across asset classes, time frames and investment styles, using a variety of internationally agreed standards and methods. Metrics abound for the measurement of financial performance.

When it comes to measuring the impact of investments on society, however, there is a dearth of useful information. The lack of consistent, broadly applicable measurement standards makes it challenging to understand how investment dollars benefit, or harm, our world.

As a firm dedicated to serving sustainable and impact investors, at Cornerstone Capital Group we have found data provided by firms such as MSCI and Sustainalytics to be useful at a “micro” level. One can use data on greenhouse gas emissions by specific companies, for example, to assess some of the positive or negative contributions that a company makes to climate change.

But this data, as useful as it is, fails to paint a holistic picture of how investments support the broader themes our clients tend to care about – gender and racial equity, the health of our oceans and waterways, or the imperative to address climate change. Data points alone cannot adequately address the interconnected, systemic nature of these critical issues. The ability to provide a high-level, nuanced, data-driven understanding of impact is key to enhancing our clients’ understanding of the impact of their investments, and to steering their capital toward opportunities that align with their goals. As advisors to total portfolios we need a framework that is applicable across asset classes, styles and approaches to impact investing.

Access to resources

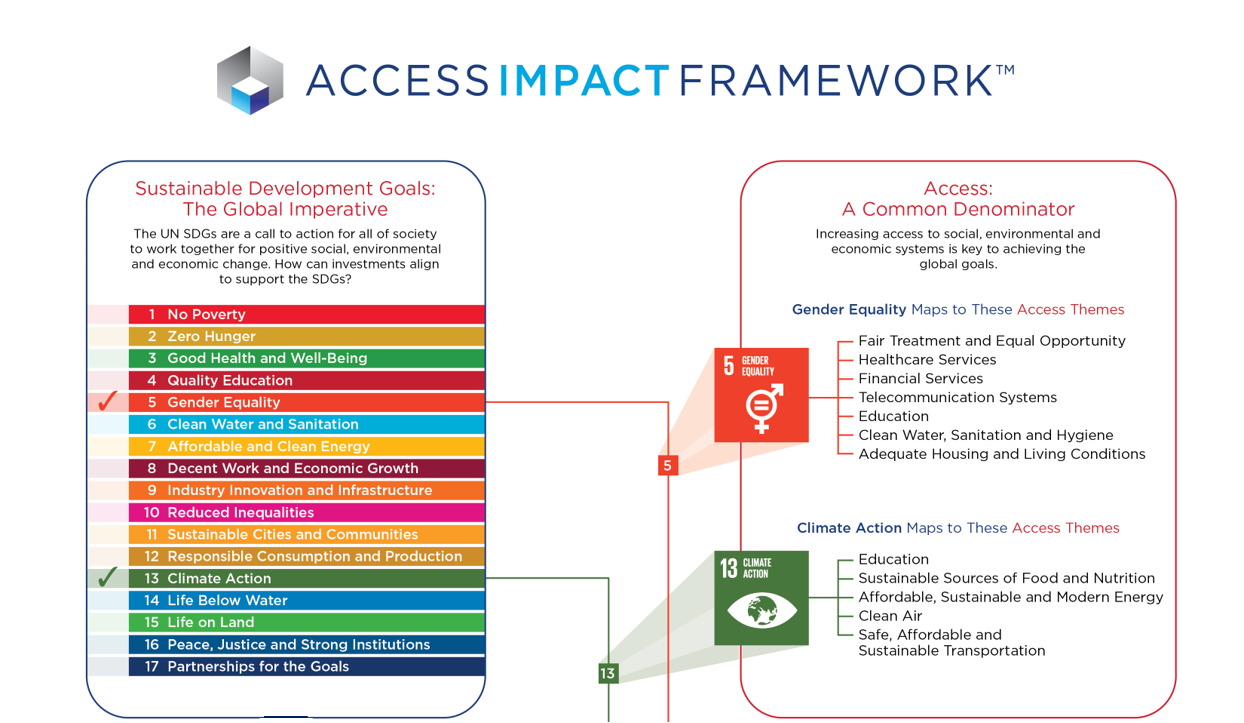

After reviewing the landscape of existing frameworks, we set out to create a new structure that would capture the complex, interconnected nature of the impact that results from investments. We chose the United Nations Sustainable Development Goals, or SDGs, as the overarching structure for our effort. The 17 goals are broadly understood and accepted to represent the key social and environmental imperatives of our time. The SDGs are the result of years of research, dialogue and consensus-building among the 193 UN member states and a host of non-governmental organizations, or NGOs.

On their own, however, the SDGs are insufficient for measuring the impact of investments. They’re intentionally broad and aspirational. Each SDG is underpinned by a number of detailed targets and indicators that are helpful metrics of success. But most of the targets and indicators reflect interventions typically employed by governments and NGOs, not private sector actors. They do not naturally translate into the type of framework that is needed by investors (and investment advisors) to understand the impacts of investments across asset classes and themes.

The Access Impact FrameworkTM bridges the gap between the Sustainable Development Goals and available granular metrics on specific environmental, social, and governance issues by aligning them with the concept of access to the natural, human and economic resources that will create a more regenerative and inclusive world. As outlined in the framework, access is a key common denominator underpinning the SDGs, one that can more readily translate to investment activities.

Our goal in creating the Access Impact Framework is to provide Cornerstone Capital Group clients with a means to gauge the impact of their investments in relation to the SDGs. Our clients invest through fund managers and strategies that we select based on their financial and impact goals. Thus, it is important not only to look at the nature of those investments, but also at the investment managers themselves: their operations, stakeholder policies, and engagement with portfolio investments in core themes found in the SDGs, such as a commitment to gender equity and the environment.

We are excited to share this new framework and look forward to continuing to work with our clients and partners to build greater understanding of the social and environmental impacts of investments across industries and asset classes.

Katherine Pease is head of impact strategy and Craig Metrick is head of institutional consulting at Cornerstone Capital Group.