ImpactAlpha, March 14 — Austin, Texas-based B-Corp. Stellar wants to disrupt the poverty cycle through credit-building. It is targeting the 132 million Americans with little to no access to credit to buy a car or a house or pay for college.

“Millions of Americans lack access because the current system is broken,” said Brian Tochman of Trust Ventures, an investor in Stellar, alongside Acrew Capital, Fiat Ventures and Vera Equity.

Inclusive fintech

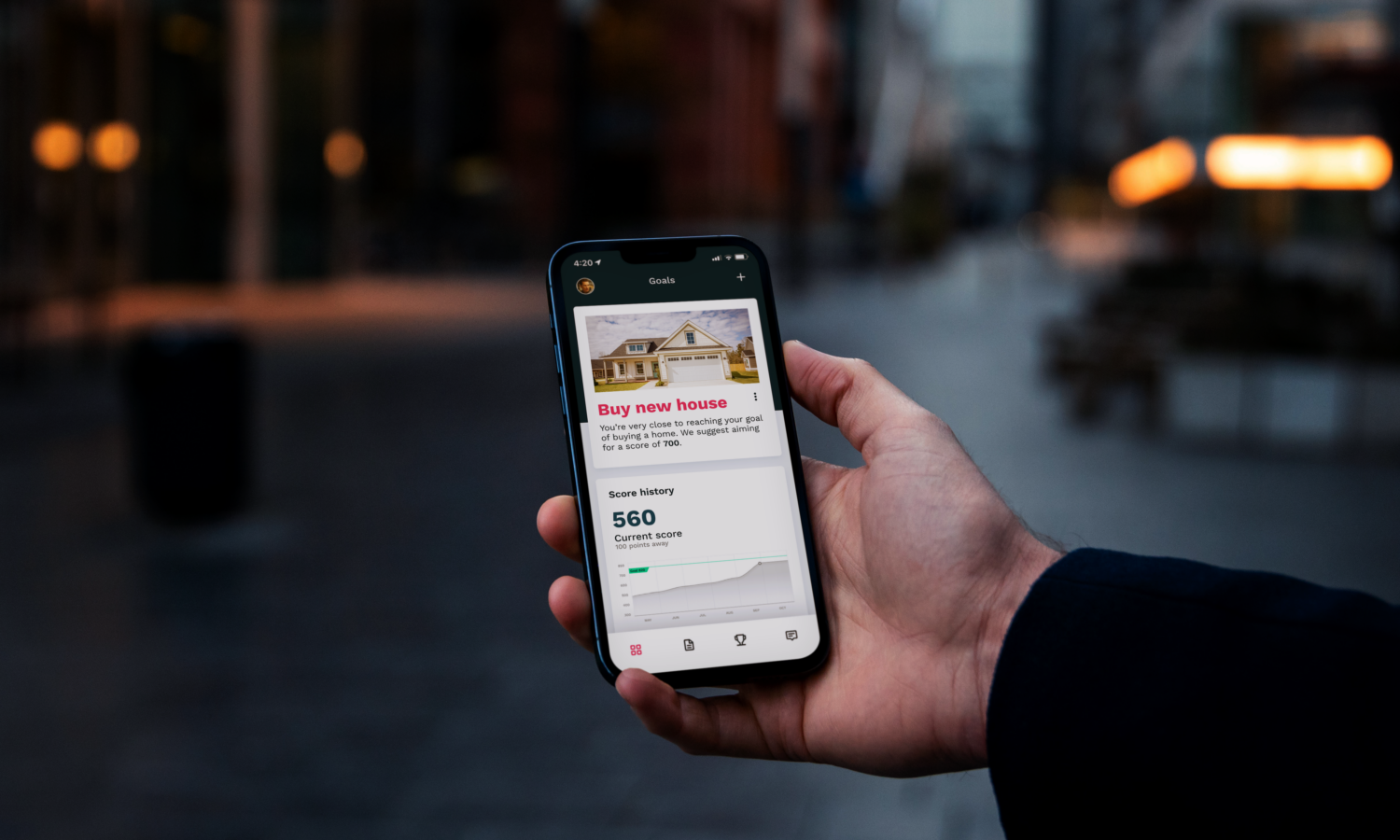

Through Stellar’s subscription-based app, users’ payments for rent, utilities and streaming services help build their credit. Stellar reports monthly payments to major credit bureaus, while rewarding users with cash back for future bill payments.

“We don’t care if users don’t have a credit card or not, we designed the product to give them access to a line of credit,” Stellar’s Lamine Zarrad told ImpactAlpha. “They can almost instantly access thousands of dollars of credit after signing up.”

Small businesses

Zarrad, a former enlisted marine and immigrant, earlier founded Joust, an Austin-based fintech for small businesses and gig workers that was acquired by ZenBusiness in 2020.

Stellar is working on features to provide tools and services to help users launch their own businesses. “Once we figure out the consumer product, the natural expansion for us is to start looking at small businesses,” said Zarrad.