ImpactAlpha, March 8 – Africa is transforming. Many investors are interested in the continent’s rapid urbanization and spending power of its larger, more affluent, younger population. They see a continent that may be the only one growing by the end of the century. They see a middle class that has added 13 million households in the past decade and could soon have an annual spending potential of $2.5 trillion. They see a burgeoning workforce projected to represent one-quarter of the global working-age population by 2050.

As women asset managers in Southern Africa, we see a growing, young, ambitious population that wants to do better for themselves and their countries – like the person in a South African slum aspiring to live in a formal house and own a car. We see more of the Black community beginning to lead the emerging middle class. And we see that when you invest in women—from street vendors to business executives—they invest back into their families and communities.

We also see how we shoot ourselves in the foot when we ignore large segments of society, allowing that potential to go untapped and ignored.

As owners of two of the too-few Black women-owned and led private equity firms in South Africa—and across the globe—we see these things because we are all too familiar with being overlooked. Our teams, which consist mostly of Black employees and have majority-female ownership, look different than most established investment teams. This means we also think differently. Our difference in perspective is our strength, allowing us to see and capitalize on opportunities that might otherwise go unnoticed.

To fully harness Africa’s growth potential, we need an investment industry that represents and understands the diverse population that makes up the continent. In this day and age, it doesn’t make sense to have an industry that’s predominantly white and male.

Overlooked opportunities

The economic mainstream still lacks an understanding of Black people, especially Black women in lower-income brackets. It characterizes this significant market segment as “higher risk.” For example, the banking and financial sectors have always prioritized packages and products for people who have already “emerged,” leaving perceived “high-risk” communities in rural areas at the mercy of hard-to-reach brick and mortar establishments.

The digital space and smartphone penetration are changing that, disrupting banking in South Africa and thrusting us towards mobile banking and lower costs. When we smooth out issues in infrastructure and broadband, there will be a population of people hungry for products and who aspire to move into the middle class. This population represents nearly endless financial services opportunities that mainstream investors don’t necessarily think about.

We do.

AIH Capital’s mandate is to invest in South African companies and prioritize sectors with opportunities to improve women’s participation in financial services, industry and technology, while achieving capital appreciation and income growth.

Ditiro focuses specifically on investments in the lower end of the mid-market – South Africa-based businesses that likely get overlooked by most fund managers due to their stage and size, despite having good track records and sustainable earnings. With a bit of strategic input and capital, we aim to help companies in high-potential sectors like healthcare, agri-processing, manufacturing, and infrastructure grow and make a difference for employees, shareholders, suppliers, and customers.

Depth of experience

While we are first-time fund managers, we do not lack expertise. We are all Chartered Accountants and come to the table with decades of experience in private equity, finance and investment. So do the leaders of the eight other women-led funds in the inaugural cohort of the Women Empowerment Mentoring and Incubation Fund Manager Programme (WE>MI) of Southern Africa, an initiative of USAID, MiDA Advisors, and the Southern Africa Private Equity and Venture Capital Association (SAVCA) to increase and strengthen the number of investable women-owned and -led fund managers in the region. It’s a community of like-minded, entrepreneurial women – all astute investors.

Yet despite being experienced investment professionals, we often have to fight harder to prove ourselves. Many young, Black women, especially those who grow up poor, don’t see a prestigious career like Chartered Accountant as a possibility or qualification held by people in their communities. Working in finance and private equity, we’ve all frequently been in situations where we were the only woman or person of color present on a team, in a workplace, in a meeting. We appreciate the responsibility of cultivating diversity in our spheres of influence. It fuels our determination and passion to stay our course and change the industry.

AIH Capital’s controlling shareholder, AWCA Investment Holdings, is entirely owned by more than 50 Black women, many of them Chartered Accountants. A portion of our profits go toward university scholarships, professional mentoring and other programs that introduce more young Black women to the profession.

‘And’ over ‘or’

Being excluded has made us hungry for inclusion, and our investment models leverage this both as a strength and a goal. We know that “and” is better than “or,” and we know how to use this to our advantage by pursuing balance between financial and social returns, progress and profit. Our focus is on achieving the target returns we promise to investors while working with our portfolio companies to improve their approach to environmental, social and governance, or ESG, factors.

This approach allows us to serve as good stewards of capital, especially when it comes to institutional investors. Both funds have received initial commitments from pension funds eager to access new opportunities in private investments and growth markets. The due diligence process affirmed our abilities as credible fund managers with the networks, experience, strategies and teams to execute on our mandates.

We know the people whose money we’re managing—teachers, nurses, people from the communities we grew up in—and the importance of doing so responsibly and with a commitment to produce the returns they require and to use their funds for the greater cause of South Africa.

If the past 24 months have taught us anything, it’s that we need all parts of society to move us forward as a whole. The pandemic has put a global spotlight on extreme inequality and exclusion and their consequences. In our WE>MI cohort, we work alongside women (and men) from different countries, ages, and walks of life, as well as a similarly diverse group of mentors and sponsors who invest their time and expertise in helping unlock the value of diversity and inclusivity in private equity and asset management.

In the words of Nelson Mandela, “Our differences are our strength” – a strength we happily embrace. We need to cultivate this mindset in our field, and we need more people to support and implement it. Bolstered by programs like WE>MI, women-owned and led fund managers will drive diversity and inclusion in the businesses we invest in and the communities they serve. When joined by family offices, foundations, development finance institutions, pension plans, and other investors, our funds can truly transform Africa.

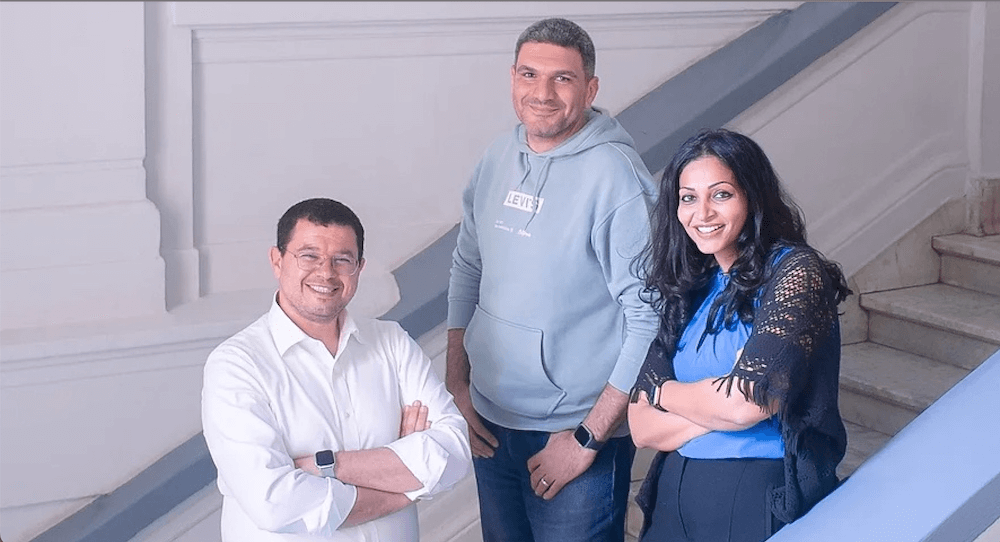

Sindi Mabaso-Koyana and Jesmane Boggenpoel are managing partner at AIH Capital. Madichaba Nhlumayo is founder and partner at Ditiro Capital.