An underdog Super Bowl victory provides an all-too-easy opportunity for metaphors and deep thoughts. C’mon, it’s only been 24 hours –indulge me.

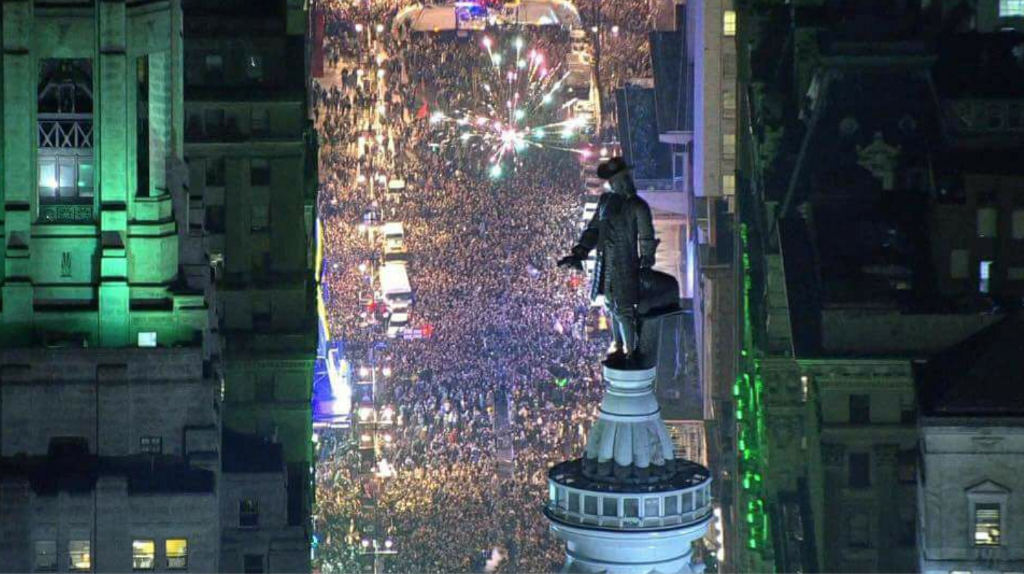

Last night, I joined other happy Philadelphians in the streets to celebrate the Eagles first Super Bowl victory. Philly sports fanatics are having a hard time kicking their rowdy reputation, and last night didn’t help. (Many Eagles, it should be said, are model communitarians).

Perhaps the outpouring represented the city shedding its inferiority complex. The Eagles outperformed opponents’ expectations throughout the season and playoffs. “We’re not a city on the cusp of doing big things anymore,” Philadelphia Inquirer’s Mike Newall wrote overnight. “We’re doing them.”

Reputations can be misleading. The Eagles came into the game with a backup quarterback, Nick Foles, and without a Super Bowl win. The Patriots had arguably the best QB in history in Tom Brady and five previous Super Bowl wins. The Eagles were the underdog, but in the end Foles out-played Brady. Despite the odds, the Eagles turned out to be the better team.

Like many U.S. cities trying to reboot for the 21st-century, Philadelphia also is often under-appreciated and misunderstood. Such biases affect where investments are made. Investors rely on reputations, networks and patterns to build their pipelines and portfolios. Since 2015, Philadelphia-area venture capitalists have raised 11 funds totaling a bit more than $500 million. Boston VCs in the same period hauled in more than $11 billion through 47 funds. “Some might call that a Tom Brady vs. Nick Foles level of disparity,” quipped Pitchbook’s Adam Lewis. Whoops.

Philadelphia rings the bell on a 21st-century revival

Philly revival

Add NFL world champion to the list of small, esteem-boosting, wins that has America’s first capital rising again. Nationally, the city finds itself rising on lists of leading startups cities, tech and social enterprise ecosystem, and fast growing cities for millennials and immigrants. Earlier this month, Philadelphia was short-listed for Amazon’s new headquarters.

“The joyous outpouring of neighbors all over the city (and many suburbs I presume) is a sign of what can happen when we come together,” Margaret Bradley, director of investment partnership at the state-backed Ben Franklin Technology Partners, told ImpactAlpha. Bradley, profiled in our New Revivalists series, runs ImpactPHL Ventures, which is part of the larger civic and economic story unfolding in Philadelphia. As a magnet for venture funds, says Bradley, Philadelphia “may not be the biggest, but we can be a leader; the Eagles represent this beautifully.”

Such investor blind spots, which Village Capital’s Ross Baird wrote a book about, are creating opportunities for investors in underestimated cities across the country, from Philadelphia to Cincinnati, to Nashville, New Orleans and Louisville. In an ImpactAlpha Returns on Investment podcast, Baird said investors who look for companies and entrepreneurs in overlooked geographies and demographics can pay less and achieve equal or greater returns. Funds that invest in the middle of the country, says Baird, do just as well as those on the coasts — and pay roughly half for their stakes in equivalent companies.

“Cities like Philadelphia will rise,” said Steve Case, the founder of AOL, now CEO of venture firm Revolution, who has made investing in overlooked U.S. cities the thesis of his new $150 million Rise of the Rest fund. Case made Philly a stop on his Rise of the Rest bus tour in 2015, selecting Scholly, a scholarship search tool, for a $100,000 investment. “Most people around the country don’t know what’s happening in Philadelphia,” said Case.

Innovation Blind Spot: Ross Baird on bridging the entrepreneurial gaps that divide the U.S.

Hungry birds

Village Capital is working with Bradley and Ben Franklin to boost the participation of African American, Latino and female founders in city’s startup ecosystem. ImpactPHL is teaming up with Good Capital Project on April 26-27 for Total Impact, a conference for financial advisors and family offices interested in impact investing, including local opportunities.

With such efforts, Bradley is sending smoke signals to out-of-town investors. “At Ben Franklin, we are trying to convene capital to make a difference,” she says. “ImpactPHL is trying to shine the light on the many ways that we have opportunity to be a leader in impact investing and in a special kind of civic engagement.”

It so happens that the NFL draft will take place in Philadelphia at the same time as the Total Impact conference on April 27th. That will rekindle Super Bowl fervor as impact investors gather.

The Philadelphia Eagles are Angry Birds no more. Instead, investors will find a city of hungry birds, proud of a Philadelphia on the rise.

Margaret Bradley: Turning Philadelphia institutions into impact investors

Join hundreds of advisors, family offices, and investors at Total Impact in Philadelphia, Apr. 26–27. Good Capital Project and ImpactPHL, with ImpactAlpha, will help you align your portfolio and your social values. Get an early-bird discount when you register before Feb. 23.

- Thanks to Dr. Cecilia M. Cardesa-Lusardi of Trauma Ventures for the headline.

Editor’s note: An earlier version of this post incorrectly stated that the Patriots were tied for the most Super Bowl wins. The Patriots have won the Super Bowl five times, one fewer than the Pittsburgh Steelers, who have won six times, the most of any team.