Meeting the needs of emerging middle-class consumers in the developing world will spawn some very large businesses.

Meeting the needs of emerging middle-class consumers in the developing world will spawn some very large businesses.

D.light design, for one, has an ambitious goal: Reach 100 million people by 2020 with its inexpensive solar-powered lanterns. That could be dismissed as just another marketing claim if the company weren’t already more than one-quarter of the way to that goal, and already becoming profitable.

Investors are interested. D.ight closed $11 million in new financing in February, including from Draper Fisher Jurvetson, a leading Sand Hill Road VC firm, and Garage Technology Ventures, along with well-known “impact” investors such as Acumen and Omidyar Network. With the closing of its Series C financing d.light has raised about $30 million in investments, and another $10 million in awards and grants.

Some say the company could be one of the first base-of-the-pyramid or “BoP” IPOs to offer shares on a major stock market. D.light is “one of the best examples in the world of how impact investing and a market-based approach can fundamentally transform people’s lives for the better,” says Omidyar Network’s Matt Bannick.

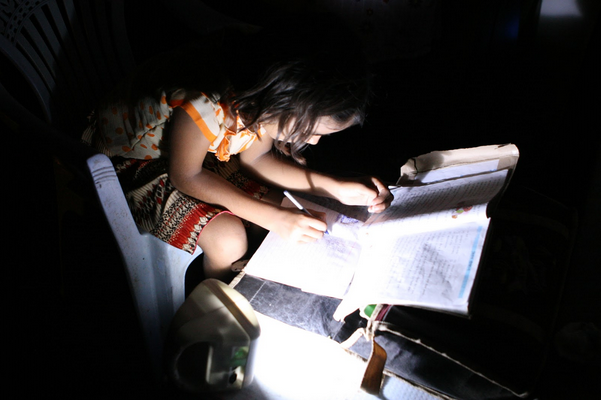

The seven-year-old San Francisco company is a rare example of an impact-driven company executing the high-volume/low-price strategy required for BoP success. Basic solar lighting helps students study longer, small business owners work later and families save money compared to expensive, and dangerous, kerosene lanterns, while reducing indoor air pollution and carbon emissions. Globally, black soot, primarily from kerosene, is a potent contributor to climate change. One feature kerosene can’t match: most higher-end solar lanterns can recharge cell phones.

We are seeing an enormous growth opportunity to provide clean, affordable solar light and power products to the relatively untapped markets of the developing world.Mohanjit Jolly, a managing director, Draper Fisher Jurvetson

The nearly insatiable demand for off-grid energy has attracted other solar lantern makers, including Barefoot Power andGreenlight Planet. Bloomberg Philanthropiesrecently made a $5 million impact investing, it’s first, in Little Sun.

According to D.light’s CEO Donn Tice the company commands approximately 50 percent share in the markets where it operates and has plenty of room to grow — the solar lantern category in total has barely 5 percent consumer penetration.

Distribution is key. A deal with the French oil giant Total to sell D.light’s new S300 (about $30) and S20 (priced in the mid-teens) in its gas stations in countries like Cameroon, Indonesia and the Republic of Congo has boosted shipments from less than 30,000 to more than 500,000 lanterns each month.

D.light make impact reporting a high priority. As of September 30, d.light’s lanterns have generated more than 57 million kilowatt-hours of renewable energy, offsetting 3.2 million tons of carbon dioxide and generating $1.4 billion in energy-related savings, the company says. Because d.light estimates that each light improves the lives of five people, the company claims to have “empowered” more than 40.9 million lives, including more than 10 million school-age children.

PLEASE WAIT WHILE PROCESSING…

D.light co-founders Ned Tozun and Sam Goldman teamed up in 2007 as students in Stanford Prof. James Patell’s’s famed Entrepreneurial Design for Extreme Affordability course. Their simple premise: The falling costs of solar power and LED lights made it possible to provide affordable lighting for the 2 billion of so global consumers who lack access to reliable power.

The alternatives would not seem hard to displace. Centralized electricity grids won’t reach many villages anytime soon, and where they do, are notoriously unreliable. A typical Kenyan family might spend roughly $30 a month, or up to 25 percent of its income, on fuel to provide lighting in evening hours.

To disrupt the market, D.light’s prices had to be low, but cheap — as in shoddy — products had already soured many potential customers. D.light itself suffered a manufacturing problem in 2011 that forced D.light to announce an expensive product recall. Improved quality and warranties have helped allay concerns, the company says.

Financing helps customers realize immediate savings. Eliminating kerosene purchases let customer recoup the price of D.light’s least-expensive products in just a few months. But for its more expensive models, D.light has had to establish financing partnerships, such as with M-Kopa, a mobile pay-as-you-go operator in Kenya. Nonetheless, D.light’s sales to the poorest of the poor have failed to reach targets, requiring new strategies.

“We are trying to create entirely new markets in places where the infrastructure and the institutional context is not fully developed,” says Tice, who became D.light’s CEO in 2011. “It takes more than just capital.”

IMPACTS

Financial

A distribution deal with French oil company Total helped boost monthly production from less than 30,000 to more than 500,000.

Social

D.light says its lamps have generated 43 million kilowatt-hours , offset 2.4 million tons of carbon and generated $995 million in savings.

One of a series of impact profiles produced in conjunction with the Case Foundation’s new publication, “A Short Guide to Impact Investing.” This is an updated version of a post originally published April 23, 2014.