ImpactAlpha, April 15 – Capitalism is not working well for the majority of Americans because it is producing self-reinforcing spirals up for the haves and down for the have-nots. These conditions pose an existential risk for the U.S.

That’s not socialist Sen. Bernie Sanders speaking. It’s billionaire Ray Dalio, who manages $125 billion as founder of Bridgewater Associates, one of the world’s largest hedge funds. Dalio last week took up the challenge of “Why and How Capitalism Needs to Be Reformed.”

In the latest episode of ImpactAlpha’s Returns on Investment podcast, the roundtable regulars took up the challenge as well, with a provocative discussion of inequality and the age-old tension between capital and labor.

“Is impact investing on the side of capital, or on the side of labor?” asks host Brian Walsh, head of impact for the fintech company Liquidnet.

Walsh pointed to last month’s initial public offering of the ride-hailing company Lyft, which in its public filings makes a claim for environmental benefits but acknowledges as material risks that drivers might gain benefits as regular employees (rather than contractors) or that the company might fail to navigate the shift to autonomous vehicles, which could put many drivers out of work altogether. As Walsh asks, “Can Lyft have its environment impact cake and eat its workers too?”

“We know that down the road, the end-goal is no workers at all,” says Imogen Rose-Smith, an investment fellow with the University of California. “That debate has been taking place in the private market and venture capital. As these companies IPO, it’s shifting to the public markets. It becomes a discussion that public markets have to have: What happens to the future of labor?”

Pension beneficiaries

The question is particularly pointed for pension funds, public and private, which are managed to be able to pay benefits for retired workers – often through investments in companies and private-equity firms seeking to shed jobs, cut benefits and keep wages low. “There’s always been a schizophrenia in how the pension community has viewed the labor market when it comes at it through being an investor,” Rose-Smith says. “Often you’ll see a tensions between people investing the capital and the ultimate pension beneficiaries.”

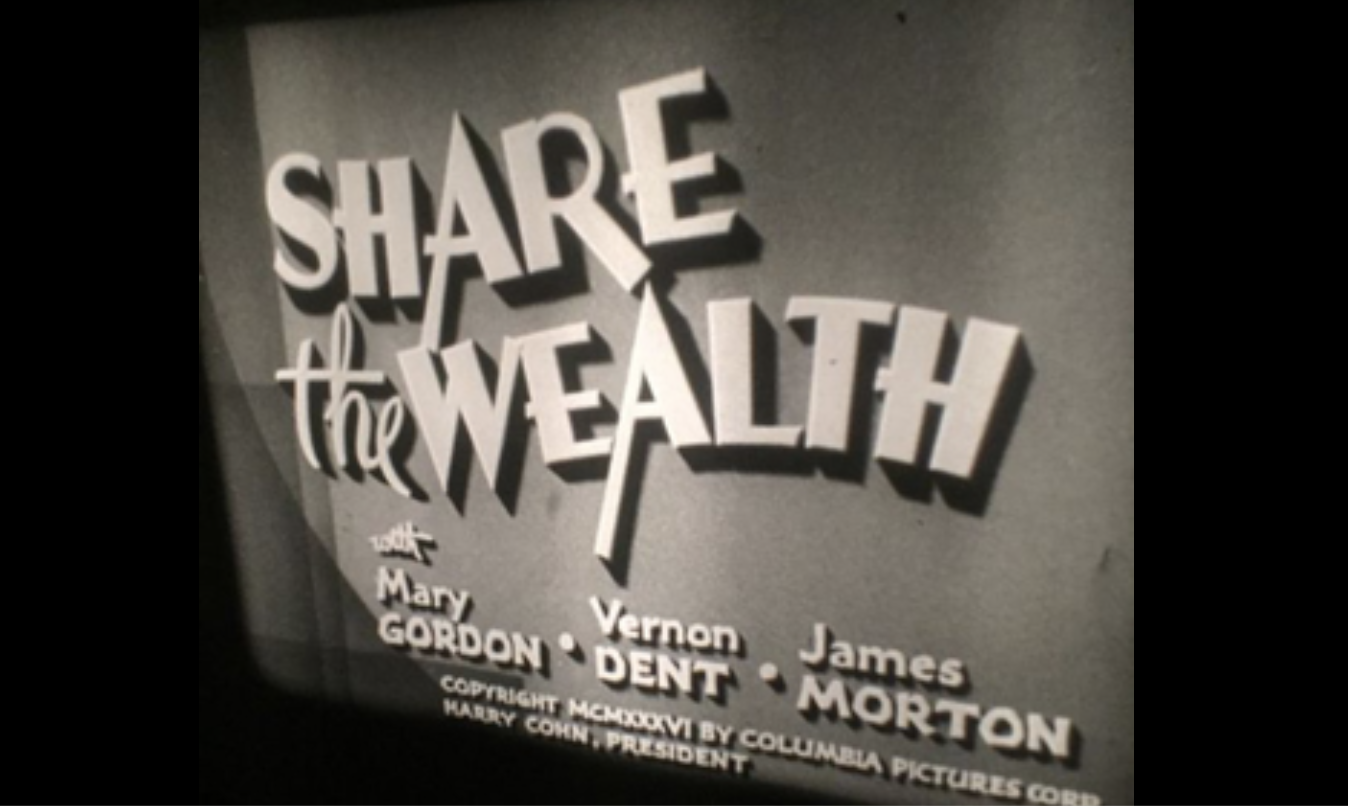

What’s at stake, ImpactAlpha’s David Bank suggests, is nothing less than social contract, and specifically the division of the wealth generated by increases in productivity in the economy. As Dalio documents, “ The share of revenue that has gone to profits has increased relative to the share that has gone to the worker.”

Rising income inequality is increasingly recognized as a systemic risk to the financial markets – Moody’s last year warned that income inequality would likely “weigh on the credit profile” of U.S. government bonds, signaling a potential downgrade that would hurt the economy.

What forces could be mobilized to help drive more wealth to more people as unions historically did but no longer do? Can a citizens’ mobilization drive public policy? Could pension fund managers play a role through their investments?

Future of work

As Lyft’s S-1 filing suggests, the power struggle between battle will be most stark as companies accelerate the automation of production with robots and artificial intelligence. A raft of studies from McKinsey to the World Economic Forum suggest the possibility of a soft landing for workers.

Behind the scenes at Davos this year, however, executives talked privately of draconian workforce reductions. “People are looking to achieve very big numbers,” Infosys’ Mohit Joshi told The New York Times. “Earlier they had incremental, 5 to 10% goals in reducing their work force. Now they’re saying, ‘Why can’t we do it with 1% of the people we have?’”

“The question is whether pension funds want to ride the increased stock prices as a result of those job reductions…..or whether they want to drive, with their shareholder engagement, a different kind of approach that will soften that blow,” Bank says on the podcast. Comprehensive, worker-centric strategies are possible, he said, “but they are not going to get funded on their own without some pressure.”

“It’s better for everybody in the entire marketplace for more people to have more wealth,” he says. “Therefore, let’s get business and financial strategies that drive wealth down the pyramid. That’s an impact investing and ESG imperative for long-term sustainability. And that’s a cool and interesting policy and technology problem for everybody to work on.”

Catch up on all of ImpactAlpha’s Returns on Investment podcasts on iTunes, Spotify, SoundCloudor Stitcher.