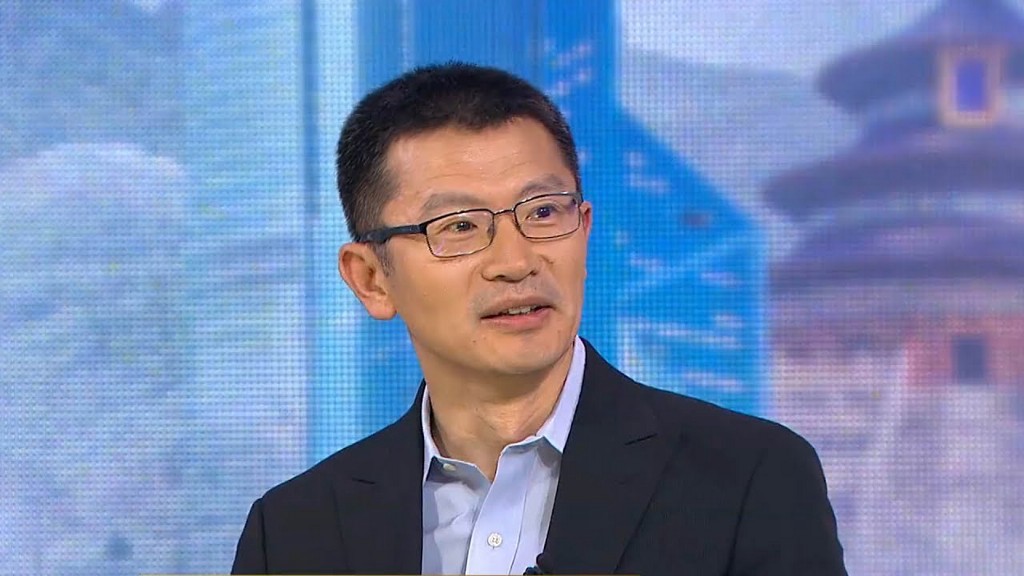

The philosophy behind impact investing isn’t lost on China, but the tendency to over-hype the sector could be. “The Chinese culture traditionally encourages less talk and more action,” says Tao Zhang, founder of Dao Ventures, a China-US consortium that has invested more than $200 million in social and environmental ventures in and outside of China.

Even successful social ventures such as Landwasher, a waterless toilet company that has sold more than 10,000 toilets across China, aren’t sexy enough for typical venture investors. Such investors are “used to dizzying venture valuations especially in the mobile Internet sector,” writes Zhang in Philanthropy Impact.

Other than development banks like International Finance Corp. and the Asian Development Bank, few investors in China identify as impact investors, he says. (Annie Chen’s Hong Kong-based family office, RS Group, is an exception).

Zhang, who previously ran the global New Ventures program of the World Resources Institute, cites the example of Ecofroggy International, which provides recycled stationery products and environmental education for China’s primary school students, but struggled to attract investors at a recent entrepreneurship competition. “The concept of impact investing has yet to sink in with them, which is not uncommon with mainstream venture capitalists in China.”