ImpactAlpha, October 5 – Latin America’s annual small business financing gap stood at $1 trillion even before the COVID crisis.

Now, the pandemic is exacerbating the capital gap and threatening to reverse recent advances in income and gender equality, economic growth, and employment.

With 10% of the global population, the region has logged 25% of all COVID cases. As businesses have been forced to stop or slow operations over the past six months, 60% of capital providers in the region think their portfolio companies will need more than $300,000 apiece, mostly in working capital, to weather continued disruptions and rebound from the crisis, according to a new survey of Latin America’s local capital providers by the Collaboration for Frontier Finance (a sponsor of ImpactAlpha’s Capital on the Frontier series).

“The pandemic has exacerbated the need for capital for almost all businesses in the ecosystem,” said Raúl Pomares of Sonen Capital, which sponsored the survey of the new operating environment.

The collaborative polled 90 capital providers supporting Latin America’s small business ecosystem with a total of $3.5 billion in assets under management.

Growth potential

Before the pandemic, more than 60% of the portfolio companies in the capital providers’ portfolios companies were growing revenues by 10% or more each year. Coming out of the pandemic, capital providers are seeking to increase their investments in health care, education and financial services, where the pandemic is accelerating digitization.

The biggest loser: tourism and travel. A June survey of emerging market capital providers by the Collaborative for Frontier Finance found that 94% of capital providers believe their portfolio companies need relief funding—specifically concessionary capital and debt.

Market maturity

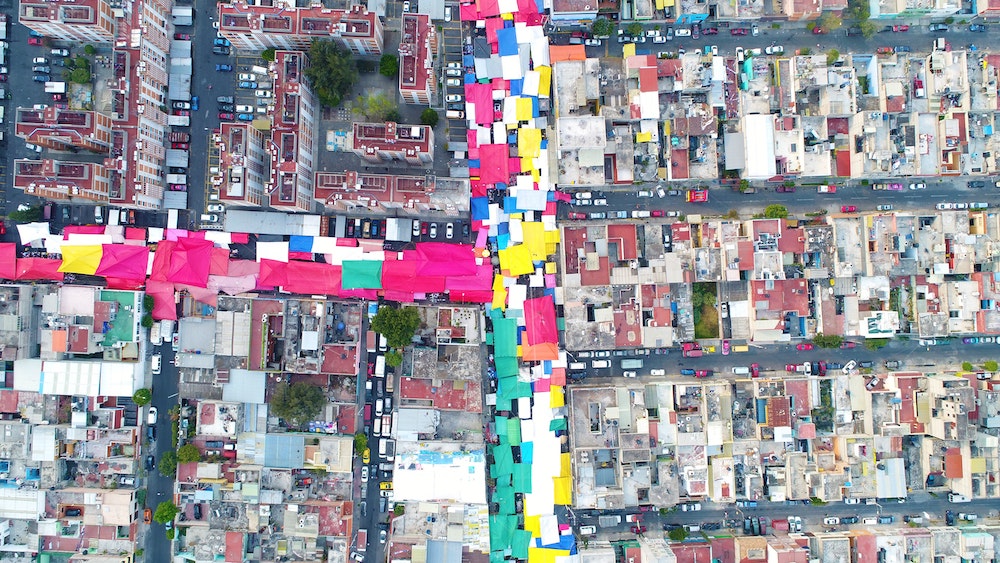

Engagement from local investors committed to local market growth makes Latin America’s market relatively mature compared to Africa’s, for example, CFF’s Drew von Glahn told ImpactAlpha. More than 80% of Latin America’s capital providers are principally based in the region; more than one-quarter have raised their third or fourth funds, including Mexico City-based DILA Capital, which is raising a fourth fund to expand in the region. In June, Corporación Andina de Fomento issued a €700 million, five-year social impact bond to provide COVID economic relief to small and underserved businesses.

Capital mismatch

Most impact capital in Latin America is deployed through traditional closed-end funds that do not always align with businesses’ needs. The recent scan of Latin America’s investment ecosystem by the Aspen Network of Development Entrepreneurs found that 5% of deals, and only 2% of capital, used non-dilutive equity structures, convertible notes and other quasi-equity instruments. Capital providers handling smaller tickets are more likely to offer such alternatives to traditional equity, according to CFF and Sonen.

Ecosystem building

More than 50 organizations that had created Emprendedores Frente al COVID-19 (Entrepreneurs Facing COVID-19) are building an ongoing network to share resources and coordinate support for entrepreneurs (see, “ COVID response spawns network to support Latin American entrepreneurs”).