ImpactAlpha, May 19 – As companies get better at defecting shareholder resolutions, there is one vote they can’t duck: board elections. It’s rare that shareholders can muster enough votes to oust a sitting director, but the effort sends a powerful – and personal – message.

For shareholder activists, Lee Raymond would be a trophy head. Raymond, the former CEO of Exxon and architect of its climate obfuscation, is the target of a shareholder campaign to eject him from JPMorgan’s board, where he has served as lead independent director since 2001. Raymond’s record is “incompatible with climate competent leadership,” says Majority Action, which spearheaded the proposal.

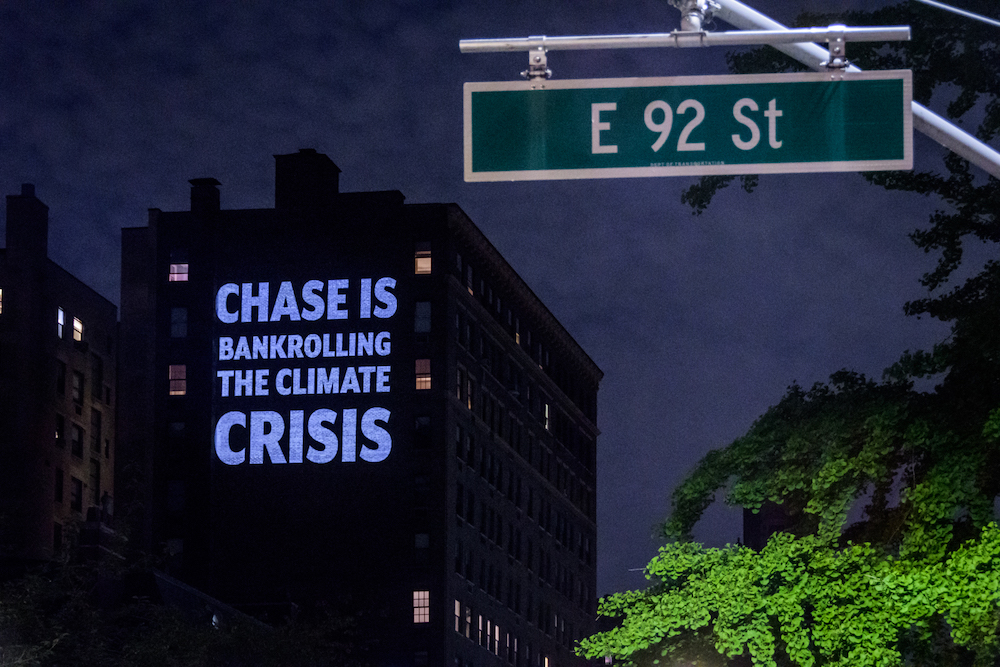

On the eve of the bank’s annual shareholder meeting today, climate activists projected protest signs across the street from JPMorgan chief Jamie Dimon’s Manhattan home.

Momentum

JPMorgan in early May demoted Raymond from his lead director role. Treasurers from 10 states, along with the New York City comptroller and CalPERS, are calling for Raymond’s removal altogether. “As part of a broader plan for the bank to seriously grapple with the risks climate change pose to investors, Raymond should plan to retire from the board entirely,” said Maryland’s Nancy Kopp. Proxy advisor Glass Lewis has thrown its weight behind the proposal.

Climate action

Shareholders are also asking the world’s largest financier of fossil fuels to align its lending with the Paris Agreement and address reputational risk stemming from its financing of Arctic and the Canadian oil sands projects. A fourth proposal seeks to split the roles of chairman and CEO held by Dimon.

‘Stewardship’ under scrutiny as shareholder season gets started

Exxon exits?

Raymond’s former company is facing heat, too. Legal & General Investment Management, the UK’s largest asset manager, announced it would vote against the re-election of Exxon’s chairman and CEO Darren Woods at Exxon’s May 27 general meeting. The Church of England and the New York State Common Retirement Fund are urging shareholders to boot the oil giant’s entire board.